Quantum computing itself can be loosely thought of as a new class of supercomputers for certain specialized types of use cases and problems, notably: machine learning, optimization, chemical simulations, and more. Manufacturers are continuing to announce exponential increases in the number of available qubits – the basic unit of processing capacity for these machines. And since the capacity of a quantum computer increases exponentially with each qubit instead of linearly, what does that mean for the future of quantum in the enterprise? We believe that quantum will be a gamechanger for the computing industry – and that IT leaders have the opportunity to take a perspective now, on how they plan to leverage it, while we’re still in the early innings.

Our latest CXO Insight Call explored this topic, and more, with an excellent panel of speakers including:

- Scott Buchholz, Global Lead for Quantum Computing, Deloitte

- Aparna Prabhakar, VP Quantum Partner & Alliances, IBM

- William “whurley” Hurley, Founder & CEO, Strangeworks

A Brief Background on Quantum

To start with, a beginner’s take on quantum is that it essentially represents a different method of computation than what computers use today – which is math (very quickly). Unfortunately, we’re starting to reach the tail-end of what we can do with just math on its own. Quantum represents an opportunity to use physics and quantum mechanics to solve problems instead. Quantum computers are essentially next generation supercomputers – they will be able to perform calculations in hours that might have taken decades. Classical computers scale linearly, but quantum computers use “qubit” (quantum bit) which increases computing power exponentially by 2n (where “n” is the number of qubits). For some classes of problems, quantum computers may be able to compute exact answers instead of providing “best guess” approximations and heuristics.

Organizations working on the hardware have exciting plans to support production systems as soon as the next 3-5 years, and software vendors are working hard to simplify the education and onboarding of new users. These new computers are likely to supplement (not eliminate) today’s computers, in the same way that CPUs compliment GPUs.

Now, while this is all very exciting, progress in the space will come with some real difficulties. For one, solving a problem with physics is quite different from solving a problem with math. This is important because as quantum gains increasing capability, industry will need to think about where and how this might be useful to leverage.

There’s a classic problem in mathematics known as The Steiner Tree Problem, where, if given an arbitrary number of points – one must try and connect them using the minimum amount of materials. A practical use case here would be a road between cities – how could an engineer ensure that the county is using the shortest amount of road? Chances are, if you try and intuit the answer, you will probably be wrong. There’s a huge amount of math you can actually do to solve this, and the answer is unintuitive.

So you can work using math to solve problems like this one, or you can actually do this with a children’s setup. You can take a board, put four nails into it, cover it in a bucket of soapy water, turn it upside down, and the soap film will show you the exact answer. Nature also likes to minimize! This is using physics to solve a problem instead of math. Physics gives the answer almost instantaneously. But using physics is hard because you have to formulate the problem in a way that physics is able to solve. And it turns out that’s what’s so hard about quantum computers. How do you formulate the problem? How do you put the nails in the board and think of using soap film?

Where Could Quantum Be Applied in the Future?

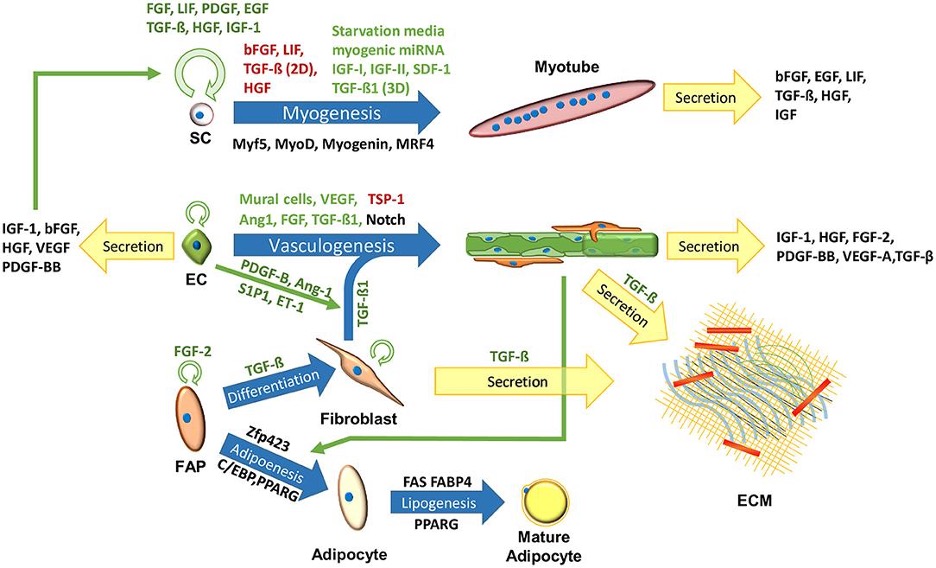

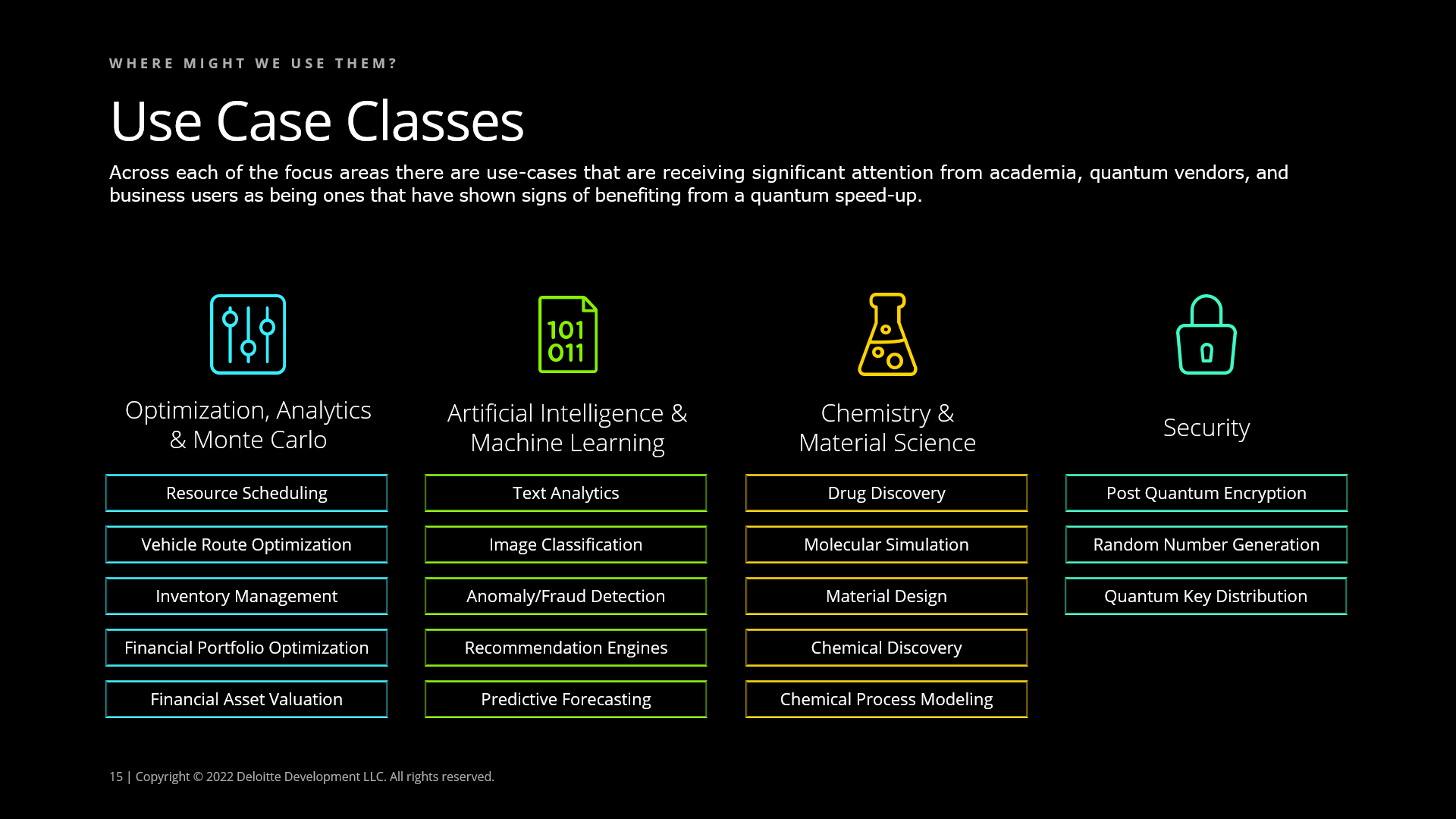

When we think about what we might use these physics problems for, or how we might use quantum computers in the future, there are four big categories people are currently looking at (and many other smaller ones):

Credit: Deloitte

These categories can span industries ranging from aerospace and automotive, to financial services, to healthcare and life sciences. Today, there’s actually a narrow quantum advantage that can be found in the area of optimization – depending on where you’re looking and what sorts of problems you have. There’s a possibility you can do better logistics and routing, better feature selection in ML, which wasn’t possible even a few years ago. And although the advantage is narrow today, it will continue to grow over time – we have 60 years of classical techniques behind us that we spent optimizing math. Imagine where we’ll be with quantum in another 60.

Why Now?

This is the biggest step in computing since the outset of computing – but when will it actually fall into place? How can businesses fund and approach the topic? What is the future of research computing and where does this fall within your org? Where is the funding going?

To start with, over 30B dollars in funding has now been invested in quantum – but the trend is more important. Pessimists used to say that large advances are 20 years out, now 5-10. Realists are preparing today. If you’re going to get people prepared to do this in your org, it takes a good chunk of time just to get them to proficiency. So if you see your org wanting to do quantum in the next five years, you need people working on these new machines already.

The acceleration curve is dramatically changing – and that includes the funding. From 2000-2013 there was almost no funding, but starting in 2014-2015 there has been a drastic increase, which led to where we are today. In 2021 alone there was over 3.2B invested by venture capital and private equity, a billion in Q4. There used to be no publicly traded quantum companies but now we have Rigetti, D-Wave Systems, and many others.

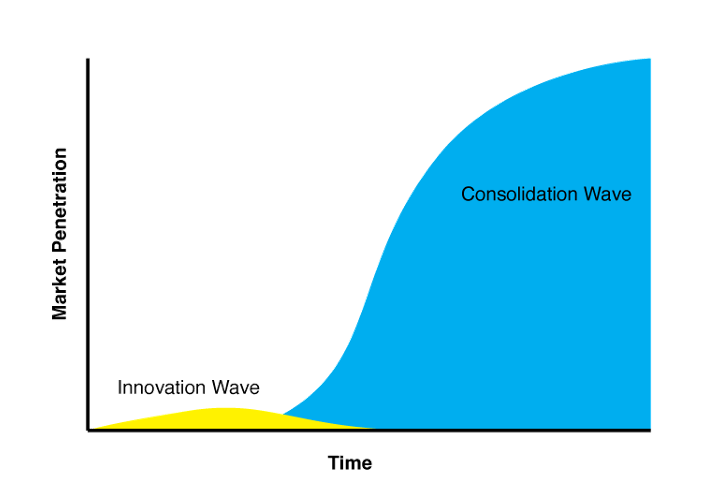

So is it the time to invest? Sure, but how do you determine what that investment is? There are still no stellar use cases, but there are incremental ones. Some you can do today, others tomorrow. Right now, practical breakthroughs in quantum machines are ultimately what has driven these investments. Unlike with classical computers, with quantum computers, you can get to a few hundred qubits and start using them to solve fundamental physics problems. So the ramp is going to look more like a step function than this gradual increase. 2023 is going to look like 1963, in 1959 Jack Kilby invented the integrated circuit. By 1963, it had gotten a bit more popular, and it ultimately led to modern computers that we use today. 2023, based on IBM’s roadmap, could look a lot like that inflection point in 1963.

10 years ago there were only a handful of quantum computing startups, now there are over 800, there were only 4 masters programs and now there are 37 – just tons of new patents and new technologies coming out of all this – it’s a really interesting time.

As an enterprise if you haven’t already started down this path – you might want to start thinking about it, otherwise you could wind up being too late. Like was mentioned above, this won’t be a gradual increase: some players will become kings of the hill. Governments around the world are seeing the importance of this (China has invested $15B), but industry is being slow to follow.

A Brief History of IBM Quantum

This is the first time in the history that the field of computing has branched. When we look back, we say there is quantum and classical. This is huge as it changes what it means to compute (or quantum is wrong). Breaking the 100-qubit barrier has placed us into uncharted territory – we’re crossing the boundary of what is possible today. Given the fast pace at which quantum computing technology and the exploration of its applications to use cases are accelerating, IBM considers this to be the Quantum Decade. A relatively small investment in quantum readiness today could deliver immense returns in the future.

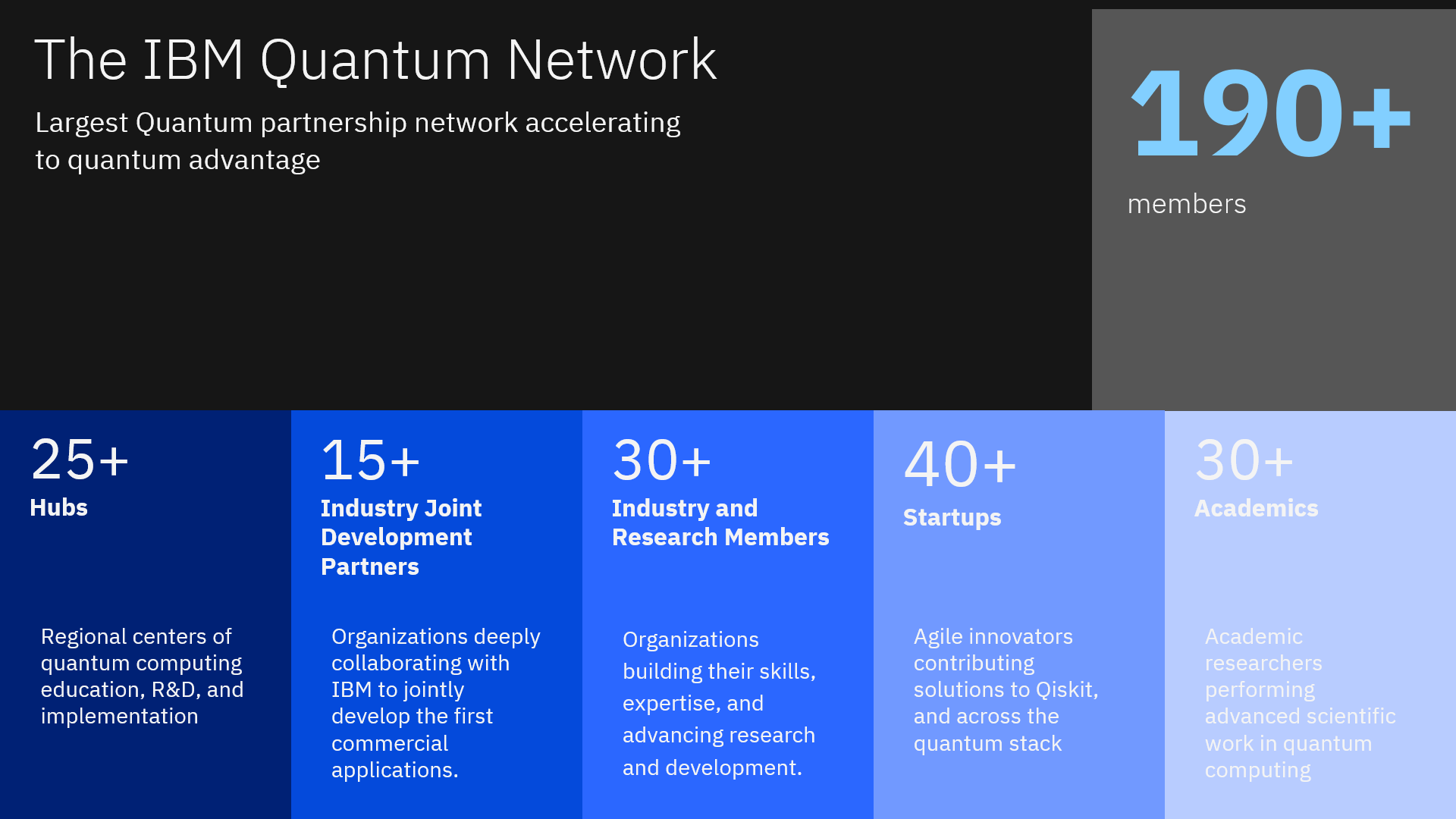

In May 2016, IBM set out with the goal of putting quantum in the hands of everyone – with the first 5 qubit machines displayed in public for everyone to use and touch. In 2017, as they were already seeing a lot of traction and interest, they launched their quantum network to bring together an ecosystem focused on advancing quantum computing. Today, IBM has a fleet of over 20 quantum systems, with around 410,000 users, 190 network members, and 3.5B daily executions (1.3T lifetime executions).

From day one, for IBM, it has always been about adoption. There must be enough people working on quantum computing in a democratized fashion to really engage the community and generate exponential growth.

The key to remember is that quantum isn’t just a technology or a tool – it’s a strategic industry – and there’s a whole workflow that goes with this:

- Research and Development – Advance fundamental quantum research and technology

- Workforce and Enablement – Drive quantum research and quantum industry

- Quantum Services and Infrastructure – Provide quantum computing as a tool

- Industry and Economic Development – Bring the innovation enabled by quantum to impact society

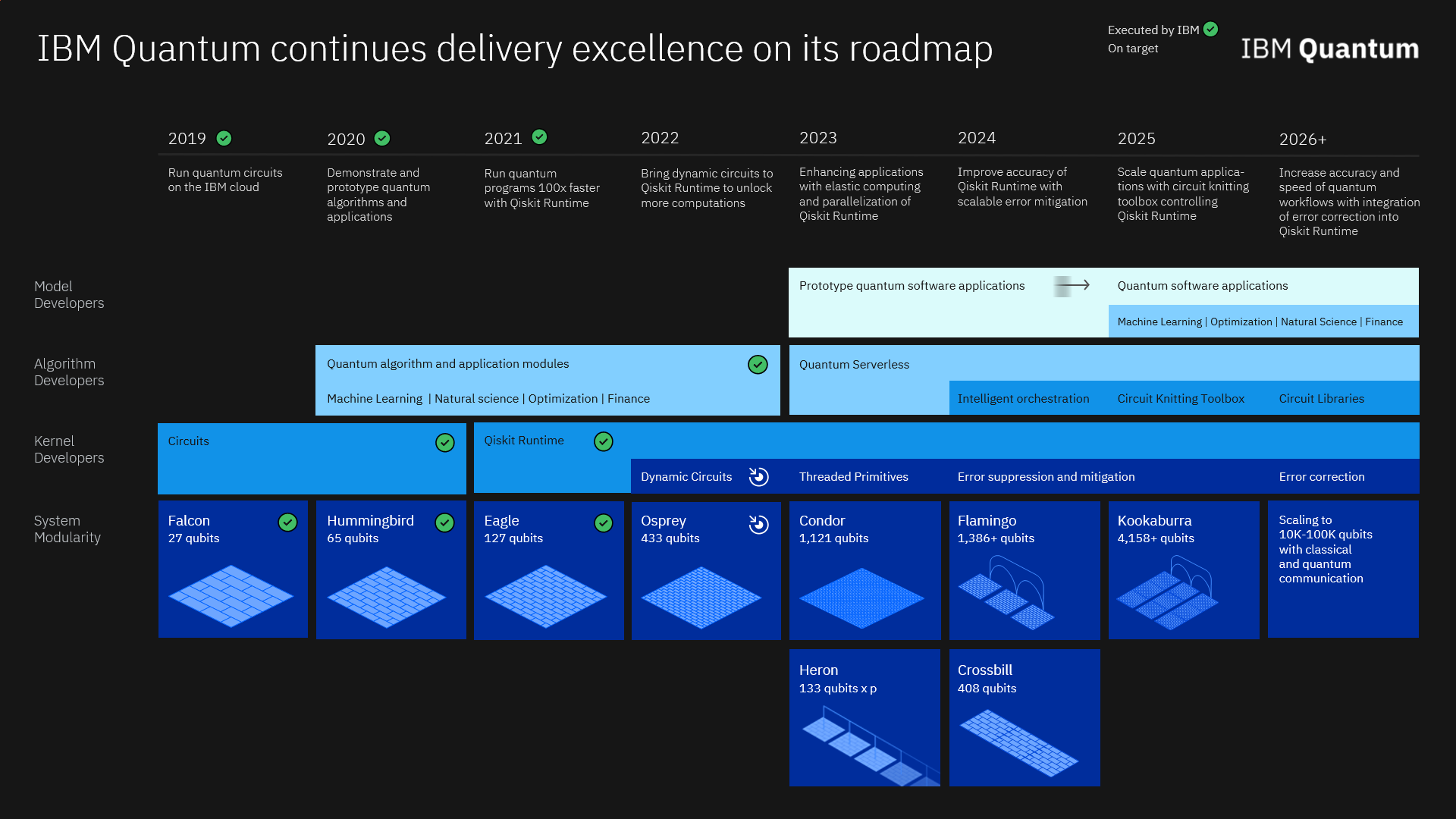

Credit: IBM Quantum

IBM introduced the first quantum computing roadmap in 2018 and enhanced it further in 2022, expanding the boundaries on both hardware and software. They are pushing the limits on hardware processors and are introducing scalable architecture which allows tens of thousands of qubits, with lower errors and faster speeds.

The classical communications on hardware enable IBM to bring the same classical concepts in high performance computing (e.g. threaded primitives, error mitigation techniques) to quantum computing.

Furthermore, IBM wants to enable access to different kinds of infrastructures by combining different types of classical resources (CPU clusters, GPU clusters) with quantum and make that accessible with very simple code constructs (quantum serverless).

Today, IBM has four offerings (free, pay as you go, premium, and consulting services for enterprise readiness) and many others will likely emerge as well. People should begin to learn, use, and think about quantum via the open plan, which is free.

IBM has made a strategic decision to work with their partners and industry experts to find applications that are difficult to solve classically but which can be tackled with quantum circuits. Today they have over 190 members/industry partners and 40+ startups, and no one can truly imagine what quantum will ultimately be capable of. In 1963, would we be talking about the internet or autonomous vehicles? IBM is working with these 190+ partners to explore & accelerate quantum and across a range of different industries and applications.

Credit: IBM Quantum

Getting Started

In terms of evaluating whether or not quantum is right for a specific use case – think about this from both a technical and a business lens. What is the size of your problem? What about the compute time? Does the problem statement that you have serve better with an annealer? On the business side: will this give you a competitive advantage in the market? Is it worth it in terms of resources? Can you do this with a fractional team or should you wait?

One way to approach team building is to take somebody who is already an expert in the domain and have them actually teach and bring the rest of the team along. How do you formulate a problem differently? How do you interact with the abstraction layers created to date? How do you think a little differently about atomic interactions? It’s a shift in mindset and it just takes time. A lot of free learning is available for teams out there today, we list some of it in the free resources at the bottom.

Another issue will be creating the right mindset for an organization to start thinking bigger and more fundamentally about problems that have never been solved before. There are certain problems you can solve brilliantly fast but economically make no sense.

Consider that there are usually three types of thinkers in orgs: the practical standpoint, the visionary standpoint, and the people who have to actually implement things from a process standpoint into workflow. Today, this is something that is mostly falling into the innovation office or the office of the CTO, and not enough people looking at it in terms of practical implications. The communities today are physicists here and developers there, not communities of business leaders. This is a paradox when it comes to people looking at the implementation. Every org has different levels of risk tolerance and how much they’re willing to innovate. So ultimately, this will be case by case at each org:

- What are the problems?

- What is the value of the problems?

- How do you scope those problems and put them into the physics perspective of quantum?

This becomes one of those journeys of a thousand steps – people want to jump to the final answer, and unfortunately, in most cases it’s a journey that you have to go on. People can give you ideas on where to look for problems in the abstract – but wheels will turn – and things will occur to people. People will realize those kinds of things will be doable?

A global CIO can start investigating the big questions:

- How is the business model being reshaped by quantum?

- Where does quantum actually supercharge some existing AI and classical workflows?

- What is a killer app that is currently applicable in their industry?

- What is the best way to start deepening their org’s capability?

Once the big picture is formulated – talent will need to be nurtured to educate internal stakeholders. Have people do quantum as a side project, on Friday afternoons (you don’t need to ask the CFO for budget straightaway!). Poll your developers and see who is already excited about this topic – you might be surprised. And partnerships will be needed with other deep tech and quantum resources. And there are many different ways to do that: start with free quantum resources, or you can start with paid resources from the ecosystem. So, think about the big questions (formulating the problems will be the toughest challenge), have a point of view, nurture the talent, then tap into the ecosystem to start the journey. You don’t need millions of dollars to get started in quantum – you need time more than anything. You can’t make a developer or material sciences person, and hook them up to quantum overnight (it can take as many as 12-24 months to train a new hire) – but you can start today. We have gone from 17 qubits to a thousand in the last few years. The acceleration of these technologies will catch a number of orgs across the world off-guard.

Integrating Quantum with the Modern Tech Stack

As we look towards offerings for quantum from cloud providers like Microsoft, there is hybrid compute available where classical code and quantum code are mixed to allow each to do what they do best. And this new hybrid approach is exactly right: businesses are going to have classical quantum orchestration – so when workflows are considered, there will be certain things that are perfect for quantum, and others that have to be computed classically. IBM’s roadmap includes something called quantum serverless – with the goal being to let developers divide their workflow into these two categories.

Quantum’s Impact on Security

Many fear that there will be a number of bad actors that plan to leverage quantum. And companies have to consider a twofold problem: First, will they introduce new vulnerabilities themselves via quantum? And second, will bad actors use quantum to launch cyberattacks? It’s important to start thinking about these things now from a cyber perspective.

Will and others urge a more relaxed approach: the reality is that security is an ever-evolving dance between threat and remediation. Tech moves on, things get broken, and it’s not a bad thing. Most people have the idea that quantum computers will come along and all encryption will end overnight. But, you can’t just break everyone’s keys all at once. It will happen at a gradual pace that is slow enough for proper responses and remediation to take place. Bad actors will want to break info on an atomic bomb first, not your bank account. Consider the stack rank of threats.

One thing to consider though is that bad actors will probably start to take a “save now, decrypt later,” approach – so having some plans in place can’t hurt. But this is more of a preparedness issue (vs. technology).

The Future of Computing

Quantum is the next evolution of computers – but it won’t just be quantum, it will be all kinds of exotics computers. So maybe you’ll have quantum, maybe neuromorphic, DNA-based storage, a return to some analog compute – all kinds of things are coming down the pipeline. This is why CIOs and CTOs should start preparing today since quantum is just the tip of the spear. And so, this blended hybrid model won’t just be classical quantum – it will include other things that are already emerging, or are yet to emerge. Because ultimately, you want to make sure you are adequately using resources – so you take Shore’s Algorithm, which has five steps, and you can write an iPhone app that does 4 of the 5 steps of Shore’s model so blindingly fast, that it would be a waste of money and resources to do that on a quantum computer.

Furthermore, quantum computers can’t store data – there is no quantum memory. So everything is going to have to be a hybrid model. Using a quantum algorithm on a GPU is a fine way to dip your toe into that world – but you can access pay as you go very effectively at IBM and with others. Take a blended approach to get better informed. A machine of over 1000 qubits coming out next year is a real machine, a real device.

Educational Resources

A business leader’s guide to quantum technology | Deloitte Insights

Preparing the trusted internet for the age of quantum computing | Deloitte Insights

Quantum chemistry – quantum computing’s killer app | Deloitte Insights

Quantum computing potential ethical risks | Deloitte Insights

The Quantum Decade | IBM Institute for Business Value

IBM Quantum Client Case Studies

Strangeworks Syndicate