Mayfield Partner Arvind Gupta recently appeared on “Move Fast and Fix the Planet,” a new podcast about climate and sustainability entrepreneurship from STVP – the Stanford Engineering Entrepreneurship Center. Listen to the episode where he discusses his mission to invest in science-based companies that could change history with Professor Mike Lepech, or read the full transcript below:

Arvind Gupta: We don’t innovate until there’s pressure to innovate. Problems don’t get solved, because they exist. Problems get solved, because there’s a reason to solve it. And so now there is pressure to solve problems that we haven’t really bothered to try to solve. And we’re seeing new technologies that are able to solve it with great unit economics that is not philanthropies, that they’re actually businesses. And so, what gives me hope is I do believe capitalism is going to be able to solve climate change and reverse climate change for humanity.

Michael Lepech: Hi, and welcome to the Move Fast and Fix the Planet. I’m your host, Michael Lepech, Professor of Civil and Environmental Engineering at Stanford. I’m also an associate faculty director of STVP, the Stanford Engineering Entrepreneurship Center, where we empower aspiring entrepreneurs to become global citizens who create and scale responsible innovations. Of course, one of the biggest global challenges we face is climate change and the sustainability of our planet. In each episode of this podcast, we’ll talk to a different expert about entrepreneurship in climate and sustainability, and what’s different about it, if anything, from entrepreneurship in other spaces.

On today’s show, I’m thrilled to welcome Arvind Gupta. Arvind is a partner at Mayfield, focusing on investments in human and planetary health, where his mission is to invest in science-based companies that could change history. He’s also the founder of IndieBio, a development program for biotech startups trying to solve major world problems. Prior to founding IndieBio, he was design director at IDEO in Shanghai. Arvind is also the author of Decoding the World: A Roadmap for the Questioner, a firsthand account of the science that’s shaping our future. He was honored with the F50 Global Award for Impact in HealthTech Innovation and is a frequent speaker at TechCrunch Disrupt, Slush, TEDx and Future Food Tech. Arvind received his BS in genetic engineering from the University of California, Santa Barbara, and holds eight patents. Welcome, Arvind.

Arvind Gupta: Thank you so much for having me. I really appreciate it.

Michael Lepech: Yeah, this is a lot of fun to have you here today. I want to dive right in, and you’ve been a pioneer in investing in science-based companies that look to tackle some of the world’s most pressing challenges. You’ve looked at reinventing the food system, to combating climate change, to a host of other really tough problems. How did you first get involved in human and planetary health? And maybe if even before that, you can discuss a little bit about what does planetary health mean to you?

Arvind Gupta: Yeah, thank you. Thanks for that question. It was a long and winding road to get to today, and I’ll share some of that with you guys, because it is interesting and there are some lessons that I’ve drawn from it. But to address your second question first, planetary health just refers to the idea that our planet has health, just like human health. People, we think of our own bodies and we get sick, we take medicine, we heal ourselves. Our planet also gets sick, and we have been making it sick. And there are ways we need to give it medicine to make it better and make it better for everyone, because when the planet gets sick, people die and a lot of people die. It’s projected over the next 50 years, more people will die from climate change related activities than all diseases combined. So, that’s a significant impact.

Also, as the planet gets sicker, what’s going to happen is our resources become much, much more scarce. And with scarcity, prices get driven up. Inflation goes up, as everyone talking about today, and that causes prices to rise and it increases inequality. So, planetary health is linked to two of the biggest problems that I see in the next 50 years, which is climate related deaths and rising inequality. Those are big problems to tackle, but the good news is human ingenuity and capitalism, combined with opportunity, can solve these problems in a way that we’ve never seen before.

Michael Lepech: I really like the way that you started with grounding this in the environmental health of our planetary ecosystems, but then interestingly, and I didn’t necessarily see it going this way, you use the economic piece to then connect it over to equity and inequality. And that brings together that triple bottom line that we often think about when we talk about sustainability. And it also relates it very closely to the topic for this podcast, which of course is a capitalism investing venture type topic. And so, I really appreciate the way that you were able to weave all of that together. So how did you get into this?

Arvind Gupta: Yeah, well, it’s an interesting question. I didn’t grow up knowing what venture capital was. I didn’t grow up knowing what entrepreneurship was. My dad’s a professor at UCLA, my mom’s an accountant. They’re immigrants from India. I’m first generation, grew up in Los Angeles, and it was in Van Nuys, which isn’t the world’s best neighborhood. And so, this idea of going out on your own and building a world changing company was completely foreign to me until just recently, really in the last decade or two, last 10 years. And so I grew up thinking, “Okay, I’m going to be a scientist.” And so I went to school at UC, Santa Barbara. I studied genetic engineering, got interested in economics through thinking about how DNA self-assembles and economics is basically the self-assembly of society. And so, thought there was overlap there.

Michael Lepech: Wow, that’s a very interesting jump there from saying that, “We were studying the genetics of DNA and the assembly,” and then you connected that to, “Wow, I think this is a lot like economics.” I just want to recognize that. That’s an interesting jump that I don’t know everyone would make.

Arvind Gupta: Yeah. No, thank you. So the way DNA coils itself, this is in 1992, ’93, ’94, it was a lot less known about genetics back then. And so in thinking about; how does miles and miles of DNA filament pack itself down into inside a tiny little cell, in a nucleus of a cell, and then unpack and get read to drive the instructions and then refold back up to… It’s fascinating to think about that. And so for me, just thinking about what are all the things that create this self-assembly, it just naturally led me… I don’t know. My curiosity led me there. And then I remember my first economics class, I was hooked. It was macroeconomics, introduction to macroeconomics. And the first lines of the class, the professor said, “Human desire is unlimited. And because of that, we have the study of economics, because economics is a study of scarcity.”

And I think that stuck with me in a way that I still to this day think about. And it drives the way I think about investing in planetary health, because I do take that to be a fundamental truth, a truth as much as gravity. And so, if we think about that and then look at the economic system we have, capitalism, capitalism will always deliver what the consumer wants always. Always.

Michael Lepech: I guess the equilibrium of economic theory is in itself a self-assembling construct and that equilibrium that we achieve in markets, whether they’re micro or macro in scale, I can absolutely, now that you’re discussing it, see how you would make that jump. So you’re studying genetic engineering, and then what next?

Arvind Gupta: So what next? Yeah, we could continue on tangents for several hours. So basically, genetic engineering I saw was extremely powerful, even in the mid-’90s. When you think of it at a high level, the ability to reprogram life, it’s just obvious that it’s going to be powerful beyond belief. The issue was back then, it was really a set of protocols. It was not a technology yet. It was restriction enzymes and random walks. And the things that we were doing were extremely basic by today’s standards and what would take me a week or a month of prep, now you do overnight and by mail, by mail order. And so I thought to myself, “Okay, well, I don’t know really, I don’t want to be a doctor, and I certainly don’t want to be a bench scientist. I know this is very powerful, but what else can I do with my mind?”

And so I go back to economics and I say, “Well, okay, if there’s a lot of different variables, all that are changing at the same time, maybe I can try to predict how those variables play out and make a bet on it. Where could I do that? The stock market.” So I moved to San Francisco and stood on the steps of the Pacific Stock Exchange. And everyone that came out, I asked, Hey, could I get you some coffee or something? Just give me a job.” And one guy was like, “Yeah, I’ll give you a job and you can get my coffee and check my trades.” So I got on the floor. There I started to learn what was going on. I asked a lot of questions, and a small trading firm backed me to be a market maker in the Microsoft pit. That’s where I learned making money without creating value leads you to a life of consumption as a way of measuring yourself.

Michael Lepech: Interesting. I’d also like to point out someone took a chance on you.

Arvind Gupta: Oh, many people over and over again in life have taken chances on me.

Michael Lepech: Yeah. And so now, I think ultimately we’ll get to you as a venture investor where your job is in some extent taking a chance on people, but I think that’s an interesting point in life when you think about the people who took a chance on you.

Arvind Gupta: Yeah, I can name… You’ll hear in my story crucial moments where I would certainly not be where I am today if it wasn’t for a number of people that believed in me. And so, because my life goes in a way that it wasn’t a straight line, and so therefore, when you go in a different direction, someone has to take a chance on you, because you’re not obvious. So anyway, I got on the floor, started trading, realized that this wasn’t the life that I envisioned for myself, and I knew I could do it, I knew I could make money from trading and options, market making. So I said, “Okay, well, let’s run the experiment. If I do nothing, whatever it is I do, when I do nothing, if I can make a living doing that, then I’m on vacation for the rest of my life.”

So, I decided to run the experiment, close my positions down, walked out the floor, and that’s when I learned basically to find the art side of my life. I started reading a lot of the classics. I basically lived in Moe’s Books in Berkeley. And I started to write poetry, things like that, make my own furniture out of driftwood. And a friend of mine, who I was teaching how to bass jump, I was a bass jumper at the time, and a big wall climber. He was like, “Oh, you should be a designer.” And I was like, “What’s that?” And he’s like, “It’s solving problems with science and art and blend it together.” And I’d never heard of design ever in my life. I was like, “You could make a living?” And he was like, “Yeah.” And so I enrolled in a master’s program at SF State. That was another person that took a chance on me. I had no background in art and Stefano… I was, “Hey, how could I be a designer? All these kids know how to draw and all this stuff.” And he’s like, “It’s not about drawing. It’s about life experiences and using that to solve problems. It’s about the ideas, that matters far more.” And I said, “Oh, okay.”

So that gave me the courage to even try. And then the head of the program took a chance on me that here’s a guy with no portfolio, no nothing, “Yeah, sure, come in.” So, two years in, I had a student show and a global lead of industrial design from IDEO, a guy named Paul Bradley, saw my work and he said, “Hey, you should come and work with IDEO.” And I said, “Okay,” so he was another guy that took a chance on me.

Michael Lepech: He’s coming from the IDEO office in Palo Alto, I imagine?

Arvind Gupta: Correct, with David Kelley, Tim Brown, the people that you know at the d.school for Stanford. And so that’s where I started really understanding. So design was formative for me, because fundamentally I’m still a designer. And what that means is I look at the world through the lens of finding problems and problems are far more important than solutions to me, because problems are persistent. You never just solve a problem. It’s funny, right? Humanity has the same set of fundamental problems that it did a million years ago, or even 200,000 years ago as homo sapiens. And we just solve it with different technologies. And human connection is the same fundamental problem. Now we have TikTok and Tinder and all these apps, Instagram.

Michael Lepech: Zoom.

Arvind Gupta: Zoom, we have… But the connection hasn’t been solved. It’s not like, “Okay, we can move on from that.” I’m hoping climate change is different. I actually hope we can solve that and move on from it. And I think we can, we’ll get to that in a bit. But problems are really… I always said as a design director, the better the problem, the better the product. And so you might as well spend your time honing and refining your problem. And that includes all the constraints around your problem, because the more that you find the constraints, the more your product design is itself in the right way. And if a designer is spending too much time trying to design, they haven’t found the actual problems they’re trying to solve, and their solution is going to suck. Their design is just not going to be something that resonates with people, because it’s too much of the hand of the designer and not the hand of the problem.

So from there, I always thought; what else can design do? How do we find more constraints? I started building businesses through product, as we started expanding what design could do at IDEO with business design and things like that. And I was doing a lot of the technology products and designs to the Samsung Galaxy Curve. I did a project with LG where the design brief was; design a $500 million business. And we did that with McKinsey. So I learned all these tools, and that’s when I was in Shanghai, my wife had this idea for a fitness startup when we were walking around in Xi’an. She built it, launched it three months later, and it was being used very quickly all over the world, thousands of people. She was getting emails from people saying, “Hey, you changed my life, because you helped me get started on my fitness journey.” And I was like, “Man, I’ve designed all this stuff, I’ve won all these awards, but no one’s ever emailed me that I changed their life.” It was a remarkable experience for me.

And so we were coming back to the Bay Area, and my friends had left and become early stage employees at Square and other startups. And this is 2013. And I met this guy named Shaun O’Sullivan who was running basically a family office, but he had this idea to start these accelerators that are vertically focused. And he had one in Shenzhen called HAX, and it was a hardware accelerator, first of its kind. And I saw that, and I thought always back to genetic engineering, I never lost my love of science. I kept up with papers, so I knew the advancements that were happening in the field, and I was thinking about blending them in with design the whole time. And I wrote a paper actually in the Journal of Commercial Biotechnology in 2011 that you could look up that asked the question; what happens if you mix design thinking with scientific method, and you can actually speed up R&D?

So, I saw this thing that Shaun was doing as an idea, as a test bed for what design and investing in early stage biotechnology could do. I thought, “Okay, well, what would a vertical accelerator for biotechnology, synthetic biology and genetic engineering look like? And what can we do with it?” Well, when you reprogram life, you make it more efficient. What’s the most pressing problem of our time that I could spend the next 50 years of my life working on? Climate change, disease. These are the things that are persistent don’t go away and expertise in that can continue over time. So I basically said, “Shaun, look…” He was saying, “Hey…” I gave a talk at HAX, and he was like, “I think you should be a VC.” And as I thought about it, I thought, “Okay, yeah, you’re right. We could do something like this and reinvent what financing early stage biotech companies look like.” And all of these postdocs were coming free. And there’s a phrase called the postdocalypse, where postdocs basically don’t have jobs to go to, because professors aren’t retiring and there’s more postdocs than positions available.

So, I saw this stock of human talent, real talent, it takes a lot of talent to be a postdoc, and they’d had no options. But if you give them a chance to work really hard and work on a hard problem, I bet they could solve it. So I proposed that to Sean. Sean agreed. So I joined SOSV, as a partner, and built IndieBio here in San Francisco in the Bay Area. And that was the simple premise, but no one really believed it at the time, because one biotech had to be expensive, and I was proposing financing it for a 100K, which is laughable, literally laughable. It’s naive to me even today to think about that, and that postdocs could be entrepreneurs, laughable. No one believed that. And that biotech had to be only for drug making, which you could make things cheaper and more efficiently. So, why wouldn’t you have economic value there?

So anyway, those things turned out to be true, and IndieBio took off, and we funded companies like Memphis Meats, now, Upside Foods, the first cell based meat company, Clara Foods, now EVERY Company, egg whites without chickens, a host of agricultural companies and a couple dozen therapeutics companies. The combined market cap is north of $5-$6 billion today. And about three years ago, I realized after building a New York office, I really wanted to work with fewer founders deeper. And I hired Po Bronson who I wrote a book with, and I knew he was more than capable of growing IndieBio and keeping its true north. So I thought to myself, “Well, why don’t I learn how to help these companies grow all the way to maturity and join Mayfield as a general partner in order to do that?”

Michael Lepech: Because 100,000 doesn’t get you very far.

Arvind Gupta: No, but the ecosystem of follow on financing does.

Michael Lepech: That’s exactly right.

Arvind Gupta: That’s right. And so, well over a billion dollars have been raised by IndieBio companies. But I was just spread really thin, and I worked very closely with every single company that moved through IndieBio for the first 10 batches. Every single company I worked with on a personal basis for four and a half months, and then stayed with them afterwards. As too many founders, you just don’t have time, so now I’m focused much, more focused, and selective in the problems that I’m working on. So yeah, that takes me to today.

Michael Lepech: Yeah. Wow. Well, so that leads me to my next question, which with regard to having a front seat to seeing the evolution of startups in this space by being such a force in IndieBio and then now being able to do rounds of follow on at Mayfield, do you think that investing in the climate and sustainability startup space is different than other sectors, whether it’s tech or medtech, or any other vertical for that matter?

Arvind Gupta: Yeah, it’s very different. The fundamental physics of business are always going to be the same, but the companies in planetary health often have different business physics, because of their sectors. In other words, software typically has very low manufacturing costs.

Michael Lepech: High margin.

Arvind Gupta: Copy, paste. So that generally leads to high margin. Now, that’s not always true, because oftentimes these companies spend a lot of money on marketing, on distribution. With the recent AI companies, manufacturing costs have actually gone up, because you do have to pay to train models or do API token calls. So, some of that’s changed. But basically, planetary health companies oftentimes are physical products, and so therefore you have very different gross margin structures, fundamentally.

Michael Lepech: Capital intensity is very different.

Arvind Gupta: Much higher capital intensity. Oftentimes, scale is the one thing that gets you to positive unit economics, which means $200 million might need to go into the company prior to seeing any real profit margins. You might see revenues before, but you’re paying through the nose for them. So, those need to be very respected, and you need to design businesses that could survive that kind of growth. So, through the valley of death, which is you have to get through that capital intensity in order to get to positive unit margins. And that’s typically called the valley of death. So, it is different that way, but it’s not different in the entrepreneurial pluck that’s required, the animal spirits that are required to find customers, land them, deliver to them, and have them order more. All of that is required. That’s the same.

Michael Lepech: Yeah, the business of business is still business-

Arvind Gupta: Correct.

Michael Lepech: … as they say. But that brings up an interesting question, and I know this is an odd question to pose to a venture capitalist. Is venture capital the right funding mechanism for these types of companies?

Arvind Gupta: Yeah, it’s a great question. I’m glad you ask it. There is no one universal tool. And so, a lot of these companies have different business physics, which lend itself to different rates of return. There are vast amounts of capital seeking different rates of return. So venture seeks extremely high rates of returns, the highest on the planet, the highest on the planet that I know about, and therefore only certain business physics will match that.

Now, for physical products, that means a very, very high total addressable market. So, $50 billion total addressable market, or more, preferably a lot more than that. So there aren’t many categories that have that high a TAM, which you could then make up for a lower gross margin in revenue. So let’s just say your price to sales or price to revenue multiple in your sector is usually, I don’t know, three. I’ll make up something. Consumer packaged good is usually lower than that, 1.5 to 2.5. Let’s just say it’s three. You could still get to a multi-billion dollar valuation, $10 billion on 3 to $5 billion of revenue. Now, it takes a long time to get there. It takes longer… So you have to figure out how you’re going to fit within your time horizon, investment horizon, which is 10 years typically for venture funds. You have to figure all that out, but if you can know your destination, you can design your way there. And I’m a big fan of destination analysis; where where am I going? What does it look like? Paint that picture and now draw your map and you have your assumptions and go test your assumptions on the way to victory. So I think that’s the way to think about it.

Michael Lepech: One of the things that we like to call that in our book is future back planning, draw out your future and then back plan.

Arvind Gupta: Great phrase. But is that venture? There’s private equity, there’s other pools of capital, there’s debt financing that have different return requirements, that might be better suited for different types of businesses. So I think that’s something that great founders can do, or even different times. Seed stage can be venture, but later on you can go find alternative non-equity forms of financing.

Michael Lepech: Yeah. Well, I guess that connects me to my next question is that you talk about the returns for venture being very high, but of course that’s necessary to offset the extreme risk associated with most venture investments and the Power Law of returns. If you’re only going to get a small fraction of companies that do provide returns, then they have to offset everything else. And so, do you think there is a model in this space where maybe the risk, because the TAMs are so large, because these problems are so fundamental, that maybe the risk of failure is lower and therefore you don’t need to get those high returns on the winners that you do pick? Or is the risk of a failed startup, in your experience, equally as high, and so therefore that Power Law that is the fundamental, underlying principle of venture portfolio theory, does that still hold in this space, or can it be broken?

Arvind Gupta: It’s a good question. I think in the end it goes back to what are your goals? So, our goal at Mayfield is to be a top fund, consistent top fund, which it is. And so, that means having consistent top returns. Top returns are always driven by outliers. And so, you can get more consistent. Let’s just say we’re going to do CPG. You can do something where you’re doing 200 to $500 million exits by building a certain revenue that then gets flipped at Nestle. But one, you’re not going to solve climate change when you sell to Nestle, generally, because they have different goals. And two, you’re not going to generate the world-changing types of returns either. So I think that goes back to the goals. For me, I want to invest in companies that can make history, and that means reinventing or reshaping sectors. And Tesla is a great example of a sustainability company in my mind that is a better car, and cars are a $1.5 trillion TAM, and it’s one of the great successes of Silicon Valley. And it’s an example of the number of sectors that are going to be reshaped by entrepreneurs in planetary health and the types of returns that are going to happen in doing so.

Michael Lepech: I think that’s a great example. If you were going to advise a startup founder in this space of just one or two things that you would make sure are right in order to talk to, whether it’s somebody at IndieBio to get some of that initial funding, or to go on to pitch to a general partner at Mayfield and say, “Look, I’m in the climate and sustainability space, but this is why I’m a great investment,” what are those couple things that you would advise them to make sure are right?

Arvind Gupta: Yeah. Well, one, I think they have to be uncompromising. What I look for is uncompromising founders. It’s the one key trait that I see that’s been common to all the great founders that I’ve backed in my own personal experience. And the one common trait when I look out to the entrepreneurs that I admire, people like Elon Musk and Steve Jobs, Yvon Chouinard of Patagonia, all of them are uncompromising, 100% uncompromising, and that leads to controversies at times. Steve Jobs was not an easy person to work with. Elon Musk certainly not an easy person or personality. I don’t know Yvon Chouinard as well, but they were all uncompromising in their values and what they were trying to accomplish. So I think if you go in to pitch, show how you’re uncompromising in what you’re building and how you’re going to use the market forces to solve the problem that you’re setting out to solve.

Second, I think you need to have an amazing team. No one person can build a company. And I think there’s a lot of founders that think about the product they’re building versus the company they’re building. And founders that think about the company they’re building invariably go much further. Finally, the physics of what you’re doing. If there’s only one thing to think about in terms of business physics, it’s the product. How are you 10 times better than your closest substitute? Now, that also determines your very specific total addressable market. So Beyond Meat was 10 times better, arguably, than a Boca Burger, a veggie burger, the frozen… It was not 10 times better, it still is not 10 times better, in most people’s opinion, to a ground beef from a cow that you could buy at Whole Foods or whatever. And so meat eaters don’t switch to Beyond as fast as everyone hoped, because it’s just not better yet, it’s not better health-wise, it’s not better taste-wise. So the market size of Beyond is actually a lot smaller than the market size of meat. It’s the market size of veggie burgers. So that’s how you get to think about what your actual TAM is.

Michael Lepech: Yeah, I often get questions of when I say, “You must be 10x better than your next closest substitute.” Folks will often ask me, “Well, what does that mean? Does that mean 10x cheaper? Does that mean 10x faster?” And what I tell them is you have to understand your customer. What does your customer value and what their most important value proposition is, you have to be 10x on that metric. And if you’re asking the question, “How do I need to be 10x better?”, you don’t know your customer well enough.

Arvind Gupta: Yeah, that’s a good way to say it. I think for me, there’s two parts to it. One is a simple definition of 10x is once I use the product, I can never imagine going back to the old way. So once you use an iPhone, you can’t imagine going back to a Blackberry. Once I use a Tesla, I can’t imagine going back to a gas car. These are 10x products. Now, can you be 10x cheaper? Can you be… Absolutely. So the whole idea to me, so the second part is understanding the dimension in which you’re 10 times better than anyone else. So, does a 10 times cheaper car have a place? Yeah, it definitely has a place in the world. So, that’s what I mean by then you’ll understand what your true addressable market size is, because how many people want a 10x cheaper car? That’s your actual TAM, not $1.5 trillion. So, when you get very specific, it’s very helpful. And that’s what new market creation does, is it takes from the total TAM into where you’re going. So, I think that’s the most important way, that’s why it’s a simple idea, but when you take it very seriously, it becomes a very powerful tool.

Michael Lepech: Yeah. I like that a great deal. So one of the things you had said a little bit earlier really caught my attention, “When you combine design thinking with scientific method, you can accelerate R&D.” And I really like that, because to me what that says is that the first couple stages of design thinking always focus on customer empathy and the definition of a problem. Whereas in the scientific method, we start with asking a hypothesis. And we’ve seen a lot of interesting work come out around hypothesis-driven innovation at startups, and it’s always an interesting mix, but you have a background in design and creative thinking and shaping solutions. How do you see all of this coming together as it relates to planetary health?

Arvind Gupta: Yeah, so for me, the simple way to think about it is scientific method does not presuppose a destination. Design thinking starts with a destination and comes backwards to today. So when you blend the two, you actually get a very powerful tool to accelerate research and develop to solve a problem. So that’s the high level takeaway. And so when it comes to planetary health, every single sector that we have has carbon flowing through it. So when you think about… A simple way to stratify the world is all the carbon humanity creates flows through three general buckets; one is feeding the world, the second is building the world, and the third is powering the world. And that is $100 trillion of market value in terms of global GDP. It’s an incredible amount of opportunity.

So when you think about it, let’s just take energy, I’m just making stuff up really quickly now, let’s just take airline travel, how do we decarbonize airline travel? You get to really start thinking about, “Okay, we have a range of advancements in biology, physics, AI, all of these in pure science.” You’ve got these problems out there, and you’re basically taking from this toolbox of scientific advancement and applying those advancements to that end problem of, say, airline emissions. And then you work forwards using the business of physics to understand how you can create a sustainable company that lasts 20 years and reshapes the sector.

It’s that simple, and great entrepreneurs do this implicitly. So what I’m saying is, it shouldn’t be a shock to anyone, it’s pretty obvious when I say it out loud, but that’s how I believe every single sector we have is going to get reshaped. And I’m very positive and hopeful about the future, because I’m starting to see market forces start to ramp up and start to reward companies that are thinking this way. Oil and gas really is paying for solutions. Now, call it greenwashing or not, they’re paying for solutions. If you look at the fashion industry, they’re paying for solutions. MycoWorks is alternative leather made from mushrooms that was funded by IndieBio, and they’re doing great. So food and ag, enterprises are paying for alternative protein. So, I think that’s where I see how all of these scientific advancements are going to be funneled into products, delivered through capitalism to fulfill the unlimited desires of people. But in doing so, we create a sustainable capitalism.

Michael Lepech: Yeah. I would agree with you that the opportunity is not just large, but unparalleled in human history to some extent. But that opportunity will take time and capitalism and markets take time. And so how do you think about balancing the need for urgency to treat a planet, that is not the healthiest it’s ever been, with the patience and resilience that’s required for building really big solutions? Those two things, how do you square them?

Arvind Gupta: Well, historically, private sector has started the big ideas, and then the public sector has scaled them. So, it’s interesting, fission reactors started privately, and then the government helped figure out funding, how to scale them into actual workable reactors. I don’t think this going to be any different, because as the problem becomes bigger and bigger… Unfortunately, we as a society focus on problems that are very short term. We don’t tend to give stock to problems that are smaller and further out, because we just don’t think it warrants our attention.

Michael Lepech: Going back to your economics analogy, we have a very different way of discounting future value in our minds than things that are valid today.

Arvind Gupta: Yes, absolutely. And so I think what’s going to happen is as climate change gets worse and crops start getting lost, people’s economic livelihoods start to get lost, migration becomes… Well, yeah, the governments are going to step in. There’s going to be a lot more money flowing through. IRA has already fueled a lot of innovation around hydrogen, for instance. I’ve seen more hydrogen companies in the last year get formed than all the prior years combined. So, the government does have a large role to play, and it will have a large role to play. And even in our more divided political system, it’s going to be a topic that does get attention, and it does get attention worldwide. Europe is leading right now in climate funding and getting initiatives through governments in Europe. So, I think that’s where… It’s going to take all capital to solve this enormous problem, and it will take time, but I believe in humanity. I’m a big believer in people and the power of ingenuity and the power of what we can do when we put our minds to it. I have a front row seat to it.

Michael Lepech: Yeah. I guess the analogy I would make is then when we were all locked in our homes, your field of genetic engineering was able to solve a global problem, because there was a global pressing need in a timeframe that we have never witnessed before.

Arvind Gupta: Exactly. And the pace of acceleration of these technologies is just increasing with AI. It is an amazing time to be alive in that sense. The pace of innovation is going to continue exceeding every year, the year prior by a lot.

Michael Lepech: It is a fascinating time, and this has been a fascinating discussion. Before we finish, we like to do a little segment on our show called Four to Fix the Planet. And so it’s a series of questions that we ask every guest. You ready?

Arvind Gupta: Okay, let’s go.

Michael Lepech: All right. What’s on your bookshelf, playlist or feed right now?

Arvind Gupta: Let me see. I’m listening to a book called “What It Takes” by Steve Schwarzman, “Lessons in the Pursuit of Excellence.”

Michael Lepech: Wow. Sounds pretty good.

Arvind Gupta: Yeah.

Michael Lepech: What’s keeping you up at night?

Arvind Gupta: So far?

Michael Lepech: Yeah, so far. What’s keeping you up at night?

Arvind Gupta: I think just making sure that we can design planetary health businesses in a way that creates resilience in this high interest rate environment, and that we’re able to find the enterprise customers and business customers for these companies that really do pay the premiums that are required to create venture returns for everyone. And I think, I wouldn’t say it’s keeping me up at night, because I’m seeing wins in that direction.

Michael Lepech: You talked about it being a great time to be alive.

Arvind Gupta: Yeah.

Michael Lepech: What’s giving you hope?

Arvind Gupta: A lot of stuff. How much innovation and how… We don’t innovate until there’s pressure to innovate. Problems don’t get solved, because they exist. Problems get solved, because there’s a reason to solve it, and it’s Darwinistic in that way, requires a pressure. And so now there is pressure to solve problems that we haven’t really bothered to try to solve. And we’re seeing new technologies that are able to solve it with great unit economics that is not philanthropies, that they’re actually businesses. And so, what gives me hope is I do believe capitalism, the greatest system for innovation humanity has ever produced, is going to be able to solve climate change and reverse climate change for humanity.

Michael Lepech: That is hopeful. What’s your favorite sustainability hack? Something that people could do to add to their day-to-say lives that you like?

Arvind Gupta: Gosh, I don’t know if I have anything super clever here. Yeah, for me, I am an athlete, and so I require high amounts of protein. I eat very well and healthy. And so being vegetarian has been hard for me in the sense that it comes with a lot of carbs in general. The protein that I get from whole legumes and things like that doesn’t have the same balance. So, for me, you probably saw it earlier, I drink these protein shakes as a way of getting the protein that I need and it’s milk-based, but that’s okay for me. And so that’s what I’m doing as my hack, I’d say, is from my own personal life, that was the way I found getting off meat to be the easiest and still maintain my competitive and fitness goals.

Michael Lepech: Very cool. One other thing that I’m wondering, because you brought it up, what’s your favorite classic?

Arvind Gupta: Oh, wow.

Michael Lepech: You spent all that time at Berkeley reading classics.

Arvind Gupta: I did. I did. That’s an interesting question. Jorge Luis Borges, I don’t know if it would be considered a classic, but he was probably one of my favorite authors. Also, Hermann Hesse influenced me a lot along with Albert Camus. The Myth of Sisyphus by Camus was probably the most influential book for me at that time. And this idea that loving toil… My takeaway from the book was if you’re rolling a ball up the hill every day, and that’s supposed to be be hell, because you never go anywhere, well, obviously it’s the absurdity of life is a metaphor for that. And so the only escape from hell is to love that toil, to love that rock, to love every rugosity, every divot, every crack in it, and to learn it. And then you’ve escaped hell and you’ve given yourself a way, a mechanism of really taking something from the toil and making it your own experience and reframing it in a positive way. And that goes a bit to Viktor Frankl’s thinking as well, Man’s Search for Meaning, another great not a classics, but I think important work. So, anyway.

Michael Lepech: Yeah. And I like that as an ending, because that actually connects well to being an entrepreneur.

Arvind Gupta: Yeah, absolutely.

Michael Lepech: You have to love the problem, not the solution.

Arvind Gupta: Yeah. You got to love the toil. I think work is… When you find what you love to do, the work is truly a vacation. It doesn’t mean it’s easy. It doesn’t mean it’s not stressful. It’s extremely stressful, because you have goals and those goals are hard, and building things and putting people together and leading, none of that’s simple. And so, yeah, I think loving it is what makes it all worthwhile, because there’s a good chance it’s not going to work anyway.

Michael Lepech: For sure. Well, thank you so much, Arvind, for taking time to talk with us today.

Arvind Gupta: It was my pleasure. I really enjoyed it. Great questions, Mike.

Michael Lepech: Today’s guest has been Arvind Gupta of Mayfield. If you enjoyed this show, be sure to subscribe to Move Fast and Fix the Planet wherever you get your podcasts, and help others find it by rating, reviewing, and sharing it. Learn more about this podcast and related work at stvp.stanford.edu/sustainability. Move Fast and Fix The Planet is hosted by me, Mike Lepech, and produced by STVP, the Stanford Engineering Entrepreneurship Center. This episode is supported by Stanford Ecopreneurship Programs. Our producers are Holly McCall and Anthony Ruth. Editing is by Stanford Video. For more podcasts, interviews, and articles, please visit stvp.stanford.edu/ecorner.

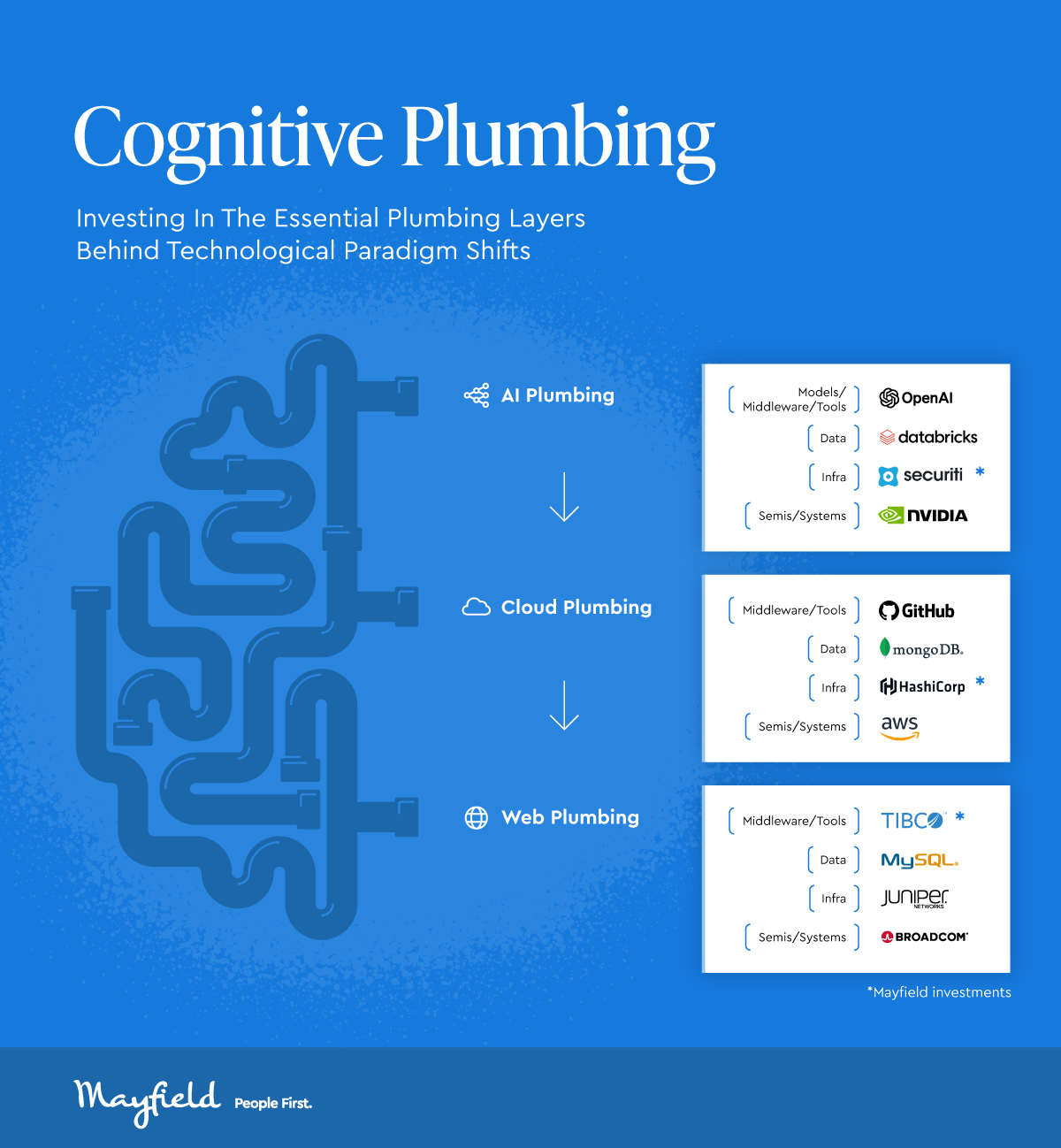

With the news of their $25 million inception round led by us, I am thrilled to welcome serial entrepreneur Allwyn Sequeira and the Highway 9 Networks founding team of Debashis Basak, Serge Maskalik, and Sachin Thakkar to the Mayfield family. Together, they have built several billion-dollar businesses and created multiple markets while at VMware, including software-defined networking (SDN) and private/hybrid clouds. As the first Mobile Cloud for the AI Enterprise, Highway 9 is an example of the infrastructure layer of Mayfield’s

With the news of their $25 million inception round led by us, I am thrilled to welcome serial entrepreneur Allwyn Sequeira and the Highway 9 Networks founding team of Debashis Basak, Serge Maskalik, and Sachin Thakkar to the Mayfield family. Together, they have built several billion-dollar businesses and created multiple markets while at VMware, including software-defined networking (SDN) and private/hybrid clouds. As the first Mobile Cloud for the AI Enterprise, Highway 9 is an example of the infrastructure layer of Mayfield’s

I just returned from an energizing weeklong visit to the World Economic Forum meeting in Davos, Switzerland. I have participated several times, starting in 2002, when I was named a Young Global Leader. This was my first post-Covid era visit, and I am happy to report that the magic that brings world and business leaders to this cold mountain town is alive and well.

I just returned from an energizing weeklong visit to the World Economic Forum meeting in Davos, Switzerland. I have participated several times, starting in 2002, when I was named a Young Global Leader. This was my first post-Covid era visit, and I am happy to report that the magic that brings world and business leaders to this cold mountain town is alive and well.