Category Type: Mayfield News

Investing in Human and Planetary Evolution

Twenty years into the new millennium, we find ourselves in a bewildering time. Covid-19 has locked the world at home while systemic racism has lit our streets on fire. Millions of Americans are unemployed and many will not have a job to return to. Compassionate leadership is absent and social media sows confusion rather than clarity. All the while, climate change continues unabated, wreaking silent havoc on our marine and forest ecosystems. Progress seems inevitable. It is not. It is the outsiders, the dreamers and the visionaries that create progress. And we must support them now more than ever.

It is the outsiders, the dreamers and the visionaries that create progress. And we must support them now more than ever.

To support human and planetary evolution, we need to adapt as an industry to become conscious capitalists, building business for better rather than for business as usual.

This means creating opportunities for diversity, equity and inclusion. This means bringing an ethical lens to how leaders treat their employees. This means looking at how innovation can simultaneously re-invent trillion-dollar industries while improving our lives and the state of our planet.

With fifty years in business as one of the pioneers of the industry, Mayfield has participated in many technological revolutions. We have pattern recognition. And we see a new revolution emerging.

To support human and planetary evolution, we need to adapt as an industry to become conscious capitalists, building business for better rather than for business as usual.

From the 1970’s to the 1980s’s computer technology was fringe, filled with CMOS, transistors and ethernets, and few who understood it. A computer was something only outcasts bought. Then advances like the PC, GUI, world wide web and cloud services changed everything. The technology became invisible, reinventing shopping, communication, education, transportation and life.

At the same time, biology was biotechnology and fringe, filled with plasmids, proteases, FDA clinical trials, and white lab coats. Biology was only for a small group of PhDs whom the world did not understand. Now with workhorses like bacteria, yeast and bioinformatics, biology is also becoming invisible, reinventing food, materials, health, energy and life.

Technology disappeared in both these cases because the code creating the products (whether 1’s and 0’s, or A’s C’s T’s and G’s) eventually became a commodity, enabling full focus on the customer experience.

Five years ago, we saw that the ability to marry the engineering approaches of information technology with advances in biology creates a big opportunity for a whole new class of companies. We see a mutually reinforcing engineering biology innovation loop coming together that enables these companies.

The Engineering Biology Innovation Loop:

The innovation loop starts with innovations in digitizing biology that quantify the living state and create data that allow for IT innovations like cloud computing and machine learning to be applied to life sciences. There have been some groundbreaking advances in this space such as the cost of whole genome sequencing for a person falling from $1B to about $100 in 20 years, advances that allow for finding sequence differences between individual cells of a person, very low cost and accurate diagnostics enabled with emerging CRISPR toolkits and continuous data streams from wearables.

Concurrently we have also seen the emergence of platforms to precisely engineer biology with very low costs such as gene editing, DNA synthesis, bioprinting, cell engineering and neuromodulation.

These platforms in turn enable faster development of new applications, including new diagnostics and therapeutics, new materials, new foods, and environmental engineering. These new applications create demand for more enabling tech in digitizing biology and bio engineering platforms, completing the innovation loop. This loop is hitting critical mass for super-fast iteration because the cost for digitizing biology is trending to zero.

Solving the current twin challenges of human and planetary evolution presents the greatest entrepreneurial opportunity in history. Our mission at Mayfield is to partner with entrepreneurs leading this movement.

Solving the current twin challenges of human and planetary evolution presents the greatest entrepreneurial opportunity in history. Our mission at Mayfield is to partner with entrepreneurs leading this movement.

In order to achieve this mission, we are announcing two actions today:

- Adding a New Partner: We are adding Arvind Gupta as Partner. As founder of IndieBio, the world’s leading biotech accelerator, Arvind brings a deep track record of partnering with early stage scientists and helping them build biology-based businesses addressing world scale problems. Over the last six years, he has nurtured hundreds of entrepreneurs, with some of his industry-defining investments including Memphis Meats (redefining meat), Geltor (redefining collagen), Synthex (redefining peptide therapeutics), Endless West (redefining alcohol), Prellis (redefining organ transplantation), NotCo (redefining plant based food), Catalog (redefining data storage), Tinctorium (redefining blue jeans), Mycoworks (redefining leather) and more. He is a thought leader and author with his book Decoding the World, set to be released in October by Twelve Books, a division of Hachette Book Group. Most importantly, Arvind is a people-first investor, deeply committed to helping entrepreneurs realize their dreams. Arvind joins us to expand our engineering biology focus. Together, we are excited to partner with entrepreneurs building industry redefining consumer and enterprise companies, with biology under the hood.

Most importantly, Arvind is a people-first investor, deeply committed to helping entrepreneurs realize their dreams.

- Creating a New Alliance: We have invested in and joined forces with SOSV, the parent firm behind IndieBio, to co-found the Genesis Consortium, an alliance of funds and corporations to promote human and planetary evolution. Arvind will continue as founder and Venture Advisor at IndieBio and advise cohort selection as well as mentoring of new IndieBio startups for both SF and NY. Mayfield will also invest alongside IndieBio in their SF batches every 6 months, cementing the partnership with SOSV.

We have been here before.

Over our 50 year history as a firm, we have been fortunate to partner with many bold entrepreneurs who leveraged inflection points to build iconic companies. They include:

- The first biotech revolution led by:

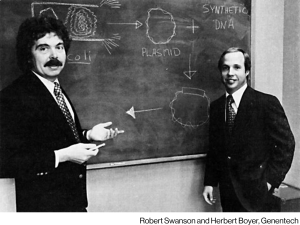

Genentech (biotech)

Amgen (biopharma)

Applied Biosystems (protein sequencing)

Millennium Pharmaceuticals (drug discovery); - The medical device era with portable defibrillator Heartstream and surgical robotics provider Intuitive Surgical;

- The IT revolution with game changing companies such as:

Atari (digital gaming)

Compaq (personal computing)

3Com (computer networking)

SGI (graphics computing)

Nuance (speech recognition) — which transformed the way humans live, work and play; - Sustainable products and services including alternative energy:

SolarCity (solar energy)

Lyft (ridesharing)

Poshmark (social commerce)

Grove Collaborative (eco-friendly CPG); - The first wave of digital health:

Brighter (transparent healthcare)

Basis (quantified self)

Tonal (precision fitness); - The Rise of the Individual B2B communities which enabled humans to become superhumans:

Marketo (marketing automation; elevating marketeers)

ServiceMax (field service automation; elevating field service workers)

HashiCorp (multi cloud; elevating developers and DevOps professionals)

Outreach (sales engagement; elevating sales professionals)

Rancher Labs (cloud native; elevating ITOps professionals); - Healthcare and Engineering Biology innovation:

Mammoth Biosciences (CRISPR)

Mission Bio (single-cell sequencing)

Qventus (healthcare AI)

Endpoint Health (precision medicine), and additional stealth companies in neuromodulation therapeutics and precision diagnostics.

As we enter the summer of 2020, we believe now is the time for biology to rebuild the world and ourselves one cell at a time. With tremendous excitement, we are joining forces to partner with the world’s best scientists and entrepreneurs to accelerate human and planetary evolution, a noble effort that will enable us to do well while doing good.

As we enter the summer of 2020, we believe now is the time for biology to rebuild the world and ourselves one cell at a time. With tremendous excitement, we are joining forces to partner with the world’s best scientists and entrepreneurs to accelerate human and planetary evolution, a noble effort that will enable us to do well while doing good.

If you are excited by this purpose and want to partner with us, drop us a line. We look forward to hearing from you.

Human & Planetary Evolution:

Engineering Biology Trends: Insights from Jennifer Doudna, Stephane Bancel and Ursheet Parikh

Announcing New Funds & Leading in Tough Times

Mayfield Announces $750 Million Across Two New Venture Capital Funds

Mayfield, a venture capital firm with a 50 year history of people first investing, today announced that it has closed on $750 million in new capital across two venture capital funds, the $475 million Mayfield XVI and the $275 million Mayfield Select II, bringing the firm’s current assets under management to over $2.5 billion.

Mayfield XVI will continue the firm’s early-stage focus, primarily investing in companies at the ideation or early product/customers stage. Mayfield Select II follows the strategy of Mayfield Select I, to invest in later-stage rounds of Mayfield breakout portfolio companies. The firm is expanding the charter of Mayfield Select II to invest in companies outside its portfolio which are at early-growth stages with product-market fit and are demonstrating inflection in their business.

“We appreciate the vote of confidence of our limited partners, especially in these unprecedented and difficult times,” said Navin Chaddha, Mayfield Managing Director. “At the same time, we want to recognize the hard work and sacrifice of our entrepreneurs, who inspire us every day and help us achieve top-tier returns. While we are all navigating choppy waters right now, we go into the future feeling confident about their imagination and resilience. We believe it’s time to lean forward, as fear is the only thing that limits one’s potential.”

About Mayfield

Mayfield is a venture capital firm with a people-first philosophy and $2.5 billion under management. Mayfield invests primarily in early-stage consumer, enterprise and engineering biology companies. Since its founding 50 years ago, the firm has invested in more than 500 companies, resulting in 117 IPOs and more than 200 acquisitions. Some notable investments in recent years include CloudSimple, Elastica, Grove Collaborative, HashiCorp, Lyft, Mammoth Biosciences, Marketo, Moat, Outreach, Poshmark, ServiceMax and SolarCity. For more information, go to https://www.mayfield.com or follow @MayfieldFund.

Looking Back, Looking Forward

Today we are announcing $750 million across two new venture capital funds – the $475 million Mayfield XVI and the $275 million Mayfield Select II – making these the latest funds in our 50 year history and bringing our current assets under management to over $2.5 billion. We want to thank two important groups – limited partners and entrepreneurs – who made this possible.

Raising a new fund, especially in these unprecedented and difficult times, required the unwavering support of our limited partners who recognized our team-based approach, disciplined strategy and top-tier returns. We believe our success as venture capitalists is always the result of the hard work and sacrifice of entrepreneurs who choose to partner with us.

Through our two new funds, we are in a strong position to invest in the entrepreneurs of tomorrow and continue to support our current entrepreneurs with both venture and mentor capital. Mayfield XVI will continue the firm’s early-stage focus, primarily investing in companies at the ideation or early product/customers stage. Mayfield Select II follows the strategy of Mayfield Select I, to invest in later-stage rounds of our breakout portfolio companies. The firm is expanding the charter of Mayfield Select II to invest in companies outside its portfolio which are at early-growth stages with product-market fit and are demonstrating inflection in their business.

While the current climate is uniquely challenging, our firm has lived through many industry ups and downs, and over the last decade, we navigated some tough times. We were called upon to demonstrate our core beliefs again and again. Here are some reflections from our journey over the last decade that illustrate how we became a stronger firm committed to stand by our entrepreneurs through victorious and challenging times.

Company building is a marathon, not a sprint.

This is true of Mayfield’s journey over the last decade as well. The period following the 2008 financial crisis was hard for the venture capital industry. Like so many other firms, we too were impacted by the downturn. With the support of limited partners (and good timing), we raised Mayfield XIII, in September 2008 right after the financial market crash. Looking back, it is clear that it took grit, patience and a long-term perspective to get to where we are today. Similar to how we are guiding our founders and CEOs today, we had to quickly adopt a wartime leader mindset. We made moves to get back to the basics and focus on what matters. We stuck to our conviction of staying as an early-stage venture investor over four subsequent funds even as the venture industry was shifting. We went deeper into domains we were already experts in vs. following shiny new objects. We raised funds at a measured pace of every four years and built a team of investors who were company builders. Today, we are fortunate to be a top choice for entrepreneurs, a top performing venture capital firm for limited partners, and a great place to work. But we never forget that it took time for us to get to where we are today.

Crisis is an opportunity for the bold.

The 2008 financial market crash was a tough time to feel optimistic about the future. However, we were inspired by historical examples of founders who created great companies in difficult times – such as General Electric after the Great Depression, Hewlett Packard after the Second World War, Amgen after the 1980 recession, Cisco after the 1987 stock market crash, and Google after the 2000 Internet bust. So we did what we know to do best – we found and funded bold entrepreneurs. There were some great ones who chose us at that time – Rehan of Elastica; Logan and John of Lyft; Phil, Jon and Dave of Marketo; Jonah and Noah of Moat; Manish, Tracy, Chetan and Gautam of Poshmark; Hari, Athani and Dave of ServiceMax; and Lyndon and Peter of SolarCity. We are eternal believers in the power of the entrepreneur and are convinced the next wave of great companies are being formed by them as we speak.

We are eternal believers in the power of the entrepreneur and are convinced the next wave of great companies are being formed by them as we speak.

Follow your true North.

As we went into the post-2008 era, the venture industry was being transformed. The craftsman model of an investor working closely with a handful of entrepreneurs was becoming rarer. The industry moved to an assets under management model where big teams made lots of investments every year. As many of our peers raised mega-funds, it took courage and discipline for us to stay focused rather than follow the crowd. We raised a similar size fund every four years and invested in thirty companies per fund. We primarily led Series A investments and were comfortable with the fact that the companies we invested in will evolve. We worked hard to help the founding teams scale their business and kept our eye on the long term. This consistency in our strategy enabled us to deliver top-tier returns on our last four funds and put us in a strong position to raise our most recent ones. It also helped us attract and retain the right kind of people to our team – former entrepreneurs and operators who are passionate about company building. We have found that the clarity gained in tough times serves you well in good times. We are confident that the hard decisions founders are making today will help them build enduring companies.

We have found that the clarity gained in tough times serves you well in good times. We are confident that the hard decisions founders are making today will help them build enduring companies.

Have a prepared mind and a beginner’s mind.

Over the last decade, we all benefited from the impact of industry inflection points such as mobile, cloud, social, and big data. Going forward, we are excited about innovation trends such as the future of work, biology as technology, human-centered AI, the renaissance of silicon, the rise of the developer, user-centric privacy & security, next gen consumer brands, and many more that will emerge. We will continue to invest in companies serving the enterprise, consumer and engineering biology sectors. Even though we have a prepared mind on future trends, we always make sure to treat every new entrepreneur as an adventurer who will help us climb a new hill. We believe having a prepared mind coupled with an open mind is essential.

It’s always about the people.

Our motto is people first. We live by it everyday. This means combining radical candor with being loyal to a fault when we interact with entrepreneurs. This means prioritizing teamwork in making investment decisions. This means valuing everyone at our firm from the receptionist who greets guests, to the administrative staff who support us, to the finance team who provide the financial infrastructure, to our portfolio services team who amplify the impact of our companies, and most importantly, the entrepreneurs who (physically and virtually) walk through our offices and make us excited to come to work every day.

Being people first also means being a responsible member of the community, which has never been more important than today. We have a long tradition of philanthropy through our Mayfield Fund Foundation which supports local and global organizations that address health issues such as Lucile Packard Children’s Hospital and Stanford Medicine, food & literacy programs such as Second Harvest and Akshayapatra, and diversity-focused groups such as the Anita Borg Institute. We are especially proud of our Mayfield Fellows program at Stanford University which is entering its 25th year and has fostered entrepreneurship among hundreds of students. We are continuing this tradition for needy organizations today such as those assembling medical supplies for healthcare workers in New York and local community organizations for children.

Our motto is people first. We live by it every day.

It’s time to lean forward.

We realize that we are in the midst of unforeseen challenges. Reality is changing every day. We believe it’s time to lean forward, as fear is the only thing that limits one’s potential. Economic crises can have a Darwinian effect — the fittest companies will adapt, survive and emerge dominant into a world with less competition.

We believe it’s time to lean forward, as fear is the only thing that limits one’s potential.

So if you are an entrepreneur who is looking for a committed and experienced venture investor who has partnered with successful entrepreneurs that have achieved 117 IPOs and more than 200 acquisitions and learned some life lessons over their 50 year history, our doors are open. Looking forward to our journey onward to a People-First future together.

— Navin Chaddha

Mayfield 2019 Year in Review

Announcing the Second Female Founders Competition

Mayfield Turns 50: Insights from 5 Decades of People First Investing

In 1969, Tommy Davis, a lawyer and businessman with an entrepreneurial streak and a gregarious spirit, decided to start a firm that would invest in promising young companies. Tommy loved Stanford University—he’d worked closely with the school earlier in his career—and so he called his new firm Mayfield, after a once-thriving, but now-forgotten town that was annexed by Palo Alto, Stanford’s home, decades earlier.The name, for us, has become a reminder that lasting success requires vision, long-term thinking, and people determined to change the status quo. As our venture firm enters its 50th year, this is the lesson from Mayfield’s original investments like Atari, Tandem, and Genentech, recent milestone companies like SolarCity, Marketo, Moat, and ServiceMax, our current breakout investments like Lyft, Poshmark and HashiCorp, and the 115-plus IPOs and 200-plus M&As along the way.

There wasn’t much of a roadmap for venture capital when Tommy and his co-founder Wally Davis (no relation) started out. So they invented one: Mayfield was among the earliest investors to recognize the need for partners with a deep understanding of the computer industry; among the first to incubate companies at its office; and even put in place some of the structural mechanisms of modern venture capital.

In the process, they created a set of core values that are still in place today. Chief among them: an investment philosophy that focuses primarily on the entrepreneur. Tommy’s motto was, “People make products, products don’t make people,” which is a saying we still use to anchor our investment decisions.

Mayfield, then as it is now, was an early stage investor, finding great founders with big ideas, and getting involved during or soon after the company formed. The early team learned quickly that finding smart, talented people with a passion for what they were doing—even if it was just an idea on a napkin—was the path with the highest likelihood of success.

Fault-tolerant computing sounded important, but there was only so much technical diligence they could do. But it was obvious that Jimmy Treybig, Tandem Computers’ founder, was a world-class entrepreneur. Recombinant DNA was still an emerging science concept when Genentech was founded, but the Mayfield team knew Bob Swanson well and believed in him.

From the beginning, Mayfield took a team-based approach to investing. The entrepreneurs the original team backed worked closely with any partner that could help. We still take a team-based approach to investments, assigning more than one partner to each portfolio company.

As the pace of innovation increased in the 90s, the team added partners with deep knowledge in software, networking, and other areas. We believed so much in the power of software that we even started a side fund, Mayfield Software Partners, which allowed industry luminaries to serve as high-level advisors and benefit as individual investors. Mayfield learned how to groom multiple generations of firm leaders. Through the leadership of Gib Myers, the partners in the 80s inherited Tommy’s desire to win, but never at all costs.

They learned it was critical to offer entrepreneurs more than capital and to be patient. This was passed on to the next generation of leaders in the 90s and early 2000s who offered a portfolio of services to startups before it became fashionable. The partners in the 90s also formalized another key Mayfield value: giving back to the community. They launched the Mayfield Fund Foundation which supports university programs, hospitals, and non-profit institutions of all types; they helped start the Entrepreneurs’ Foundation, an organization that solicited money from startups and VCs and gave it to promising nonprofits; and they endowed the prestigious Mayfield Fellows program at Stanford, and later UC Berkeley, which gives 12 students each year the opportunity to learn about entrepreneurship and intern at a fast-growing startup. We still sponsor the program, which has had more than 200 participants, including the founders of Instagram and Gusto.

Today, as the fourth generation of stewards of Mayfield, our focus on people remains constant. Our motto, People First, is meant as a reminder. We still filter out founders who are just looking for a check, and take pride in developing deep relationships with our entrepreneurs, built on mutual trust. We limit our fund sizes so we can keep our focus on early stage companies and actively engage with the companies we invest in.

We do some things differently today. We’re more likely to dress casually than wear a suit, for instance. And our current investment team is all ex-founders or operational execs with startup experience. But our values remain the same.

As we enter our 50th year, Mayfield stands strong. We’ve raised 15 U.S. early stage institutional funds, a later-stage select fund, two India funds, a partner firm for investing in China, and have $2.7 billion under management today. We’ve distributed billions of dollars in cash and stock to our limited partners since our founding.

Our gallery of legendary entrepreneurs keeps growing and we come to work every day excited to help them achieve their vision. Most importantly, we’re proud that the core beliefs driving us today still draw from our roots—adopt a people-first mentality, embody a team spirit, and do right while doing well.

After all, people make products, but they also make VC firms.

Regards,

Navin Chaddha & the Mayfield Team