In 1969, Tommy Davis, a lawyer and businessman with an entrepreneurial streak and a gregarious spirit, decided to start a firm that would invest in promising young companies. Tommy loved Stanford University—he’d worked closely with the school earlier in his career—and so he called his new firm Mayfield, after a once-thriving, but now-forgotten town that was annexed by Palo Alto, Stanford’s home, decades earlier.The name, for us, has become a reminder that lasting success requires vision, long-term thinking, and people determined to change the status quo. As our venture firm enters its 50th year, this is the lesson from Mayfield’s original investments like Atari, Tandem, and Genentech, recent milestone companies like SolarCity, Marketo, Moat, and ServiceMax, our current breakout investments like Lyft, Poshmark and HashiCorp, and the 115-plus IPOs and 200-plus M&As along the way.

There wasn’t much of a roadmap for venture capital when Tommy and his co-founder Wally Davis (no relation) started out. So they invented one: Mayfield was among the earliest investors to recognize the need for partners with a deep understanding of the computer industry; among the first to incubate companies at its office; and even put in place some of the structural mechanisms of modern venture capital.

In the process, they created a set of core values that are still in place today. Chief among them: an investment philosophy that focuses primarily on the entrepreneur. Tommy’s motto was, “People make products, products don’t make people,” which is a saying we still use to anchor our investment decisions.

Mayfield, then as it is now, was an early stage investor, finding great founders with big ideas, and getting involved during or soon after the company formed. The early team learned quickly that finding smart, talented people with a passion for what they were doing—even if it was just an idea on a napkin—was the path with the highest likelihood of success.

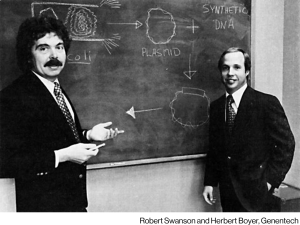

Fault-tolerant computing sounded important, but there was only so much technical diligence they could do. But it was obvious that Jimmy Treybig, Tandem Computers’ founder, was a world-class entrepreneur. Recombinant DNA was still an emerging science concept when Genentech was founded, but the Mayfield team knew Bob Swanson well and believed in him.

From the beginning, Mayfield took a team-based approach to investing. The entrepreneurs the original team backed worked closely with any partner that could help. We still take a team-based approach to investments, assigning more than one partner to each portfolio company.

As the pace of innovation increased in the 90s, the team added partners with deep knowledge in software, networking, and other areas. We believed so much in the power of software that we even started a side fund, Mayfield Software Partners, which allowed industry luminaries to serve as high-level advisors and benefit as individual investors. Mayfield learned how to groom multiple generations of firm leaders. Through the leadership of Gib Myers, the partners in the 80s inherited Tommy’s desire to win, but never at all costs.

They learned it was critical to offer entrepreneurs more than capital and to be patient. This was passed on to the next generation of leaders in the 90s and early 2000s who offered a portfolio of services to startups before it became fashionable. The partners in the 90s also formalized another key Mayfield value: giving back to the community. They launched the Mayfield Fund Foundation which supports university programs, hospitals, and non-profit institutions of all types; they helped start the Entrepreneurs’ Foundation, an organization that solicited money from startups and VCs and gave it to promising nonprofits; and they endowed the prestigious Mayfield Fellows program at Stanford, and later UC Berkeley, which gives 12 students each year the opportunity to learn about entrepreneurship and intern at a fast-growing startup. We still sponsor the program, which has had more than 200 participants, including the founders of Instagram and Gusto.

Today, as the fourth generation of stewards of Mayfield, our focus on people remains constant. Our motto, People First, is meant as a reminder. We still filter out founders who are just looking for a check, and take pride in developing deep relationships with our entrepreneurs, built on mutual trust. We limit our fund sizes so we can keep our focus on early stage companies and actively engage with the companies we invest in.

We do some things differently today. We’re more likely to dress casually than wear a suit, for instance. And our current investment team is all ex-founders or operational execs with startup experience. But our values remain the same.

As we enter our 50th year, Mayfield stands strong. We’ve raised 15 U.S. early stage institutional funds, a later-stage select fund, two India funds, a partner firm for investing in China, and have $2.7 billion under management today. We’ve distributed billions of dollars in cash and stock to our limited partners since our founding.

Our gallery of legendary entrepreneurs keeps growing and we come to work every day excited to help them achieve their vision. Most importantly, we’re proud that the core beliefs driving us today still draw from our roots—adopt a people-first mentality, embody a team spirit, and do right while doing well.

After all, people make products, but they also make VC firms.

Regards,

Navin Chaddha & the Mayfield Team