Early-stage fintech venture investing continued to explode throughout 2017, with 635 global investments totaling $8.4Bn in capital completed through Q3. It’s no surprise the fintech sector continues to be catnip to entrepreneurs: multi-trillion dollar markets, monolithic and increasingly faceless financial institutions, and bad consumer experiences are rich fodder for disruption.

This year, we’ve also seen what great success in fintech looks like: many companies achieved record valuations, with Square and Stripe leading the pack. Square in particular had a banner year as investors began to understand the depth of innovation built into the company’s product ecosystem for small businesses around the world, driving Square’s value to over $15Bn in the public markets, nearly 5X over its initial offering value in 2015.

I believe the next crop of winners will have much in common with the core tenets of Square’s success, as the fundamental drivers are broadly applicable (if exceptionally difficult to execute well). Here are the challenges the next fintech kings and queens will overcome in their ascendance:

Solving a truly challenging and meaningful problem

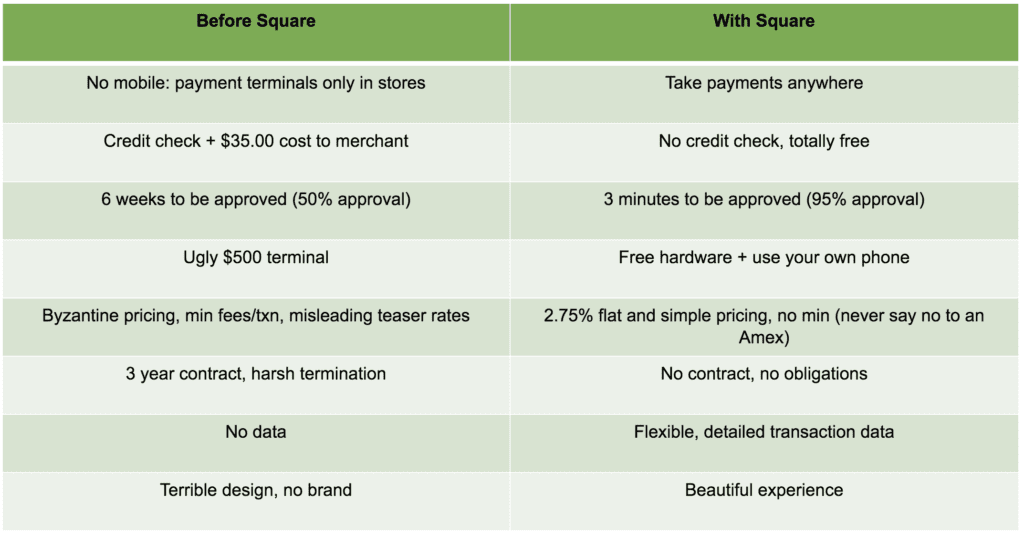

Intractability may sound like a high bar for a startup to hurdle, but when you consider how crowded and well-funded the consumer fintech space is, only the companies that seem to make the impossible possible actually break through. When Square was founded, the concept of mobile, seamless, beautiful payments for small merchants was almost too difficult to imagine, given the status quo:

Signing up to accept payments was so bad that hardly anyone imagined it could be seamless, easy, mobile, and beautiful. But that’s exactly why Square was able to make such an impact and ultimately drive runaway word-of-mouth adoption. It was the tremendous challenge inherent in reconceiving the whole experience that made the project worthwhile and ultimately successful.

Crafting a hyper-clear value proposition that drives word of mouth

Picking a hard enough and meaningful enough problem to solve is the first step. The second is distilling the solution into a single impactful sentence that customers can use to evangelize the product. This statement clarity is critical to break through the noise of thousands of fintech apps (not to mention the incumbents). No matter the strength of a company’s growth tactics, in the end winning companies declare victory primarily on the battlefield of product.Products must be explained in a sentence, where the magic value is obvious. “Accept all major credit cards with your smartphone and free hardware” was universally understandable to Square’s customers and easy to talk about. So once just a few merchants at a craft fair or taxi line began using Square, soon enough everyone else was too. Earny, a recent investment of ours, also reflects this: “Automate price protection (and reimbursement) on all your purchases when you use the right credit card.” Easy to understand, and clear value described. The coupling of a powerful solution and a simple description drives word-of-mouth, and therefore tremendous operating leverage.

Communicating trust in product design

Money is intimate, so trust matters a lot. For all of our society’s obsession with money, it’s still a largely taboo topic when it comes to personal disclosure. Plus, it’s a topic that sparks anxiety for many if not most consumers.Products that seek to provide value in the financial services must plan their approach accordingly. It’s largely why pixel-perfect product choices matter, as does tightly scripting the user experience: both efforts showcase the product focus that generates user trust.When Square first came to market, its three-minute, beautifully designed onboarding flow presented every step with tight clarity, displaying that every detail had been considered. Customers, in turn, tacitly decided to trust the app with their money and bank account numbers.

Picking a core customer

One of the hardest things to do on the pathway to world domination is deciding to serve a single customer. Are you trying to pick off college kids as they transition to adulthood? Recent immigrants who can’t get access to credit but are high income? Day-traders? The temptation to be everything to everyone often insidiously penetrates even the most self-aware product teams. At Square, the best execution often came when focus was tight on small businesses, leading to the unique ecosystem combining payments, point-of-sale, capital, and SMB software.It’s a Silicon Valley cliché, yet so many companies get lost by failing to make a firm decision about who the core customer is. To wit, consider the wave of personal financial management companies that have been founded in the last 5 years (we’ve counted at least 20). The problem is clear: most Americans do a poor job of money management, and need help and guidance to save, invest, and plan effectively for their futures. But often such products have attempted to solve every need for customers, watering down what exactly they mean and what problems they solve for a select group of customers for whom they can be essential.

Leveraging emerging technologies

Most significant fintech winners make use of a key emerging trend or technology to gain an edge in acquiring users. Square famously capitalized on the power of smartphones in every merchant’s pocket to deliver an unusually compelling capability. In 2018 we’re likely to see three key trends:

- Unprecedented access to consumer data between banking APIs and consumer willingness to provide logins and signup details for credit cards, bank accounts, and even email;

- Advances in machine learning capabilities to create new insights about credit risk, fraud, and underwriting;

- At least one successful implementation of the blockchain for a general consumer use case at scale.

While these five factors are no secret to intrepid fintech entrepreneurs, the ability to manifest them within a single offering represents an incredibly high degree of difficulty. In a 2018 that looks to be no less crowded or robust for fintech startups, we believe that only by meeting such exacting standards will the next breakout fintech company emerge from the pack.