In 2020, no one calls enterprise “boring.” Despite the challenges of a pandemic, economic uncertainty, and social unrest, it’s been a good year for enterprise technology companies. We have seen the market cap of public cloud companies cross $1 trillion, the rise of 86 privately held unicorns, and multiple recent IPO filings. Remote work has accelerated the pace of digital transformation. Many start-ups are having “Zoom moments”, posting record revenues and earning lasting customer loyalty.

This uptick is the result of a decade-long movement toward the digitization of every industry, as companies realized that the benefits of digital transformation brought imperatives for change. Businesses had to rethink how to build new products and services, develop new business models, hire different kinds of talent, and redefine their brand promise to customers.

While there is no single playbook for success, there are some patterns when it comes to building enterprise technology companies. As an early stage investment firm with a fifty-year history of partnering with entrepreneurs building iconic companies, Mayfield has picked up a few insights on the process of enterprise company building, and we have some thoughts on where the world of enterprise is headed.

In this post, we’ll take you through Mayfield’s perspective on how we have invested in the enterprise landscape and lessons learned from our breakout portfolio companies.

A History of Enterprise Tech Impact

Over fifty years, Mayfield has invested in hundreds of enterprise companies which have impacted the world in myriad ways. Some of the companies we were involved with during our first four decades include:

- Computer Systems pioneers such as Compaq, SGI and Tandem;

- Semiconductor leaders such as Cypress, LSI Logic, SanDisk and S3;

- Networking giants such as 3COM, Avanex, Qtera and Redback Networks;

- Software category creators such as Citrix, Concur, Nuance and TIBCO;

- Biotech and pharma visionaries such as Amgen, Genentech and Intuitive Surgical.

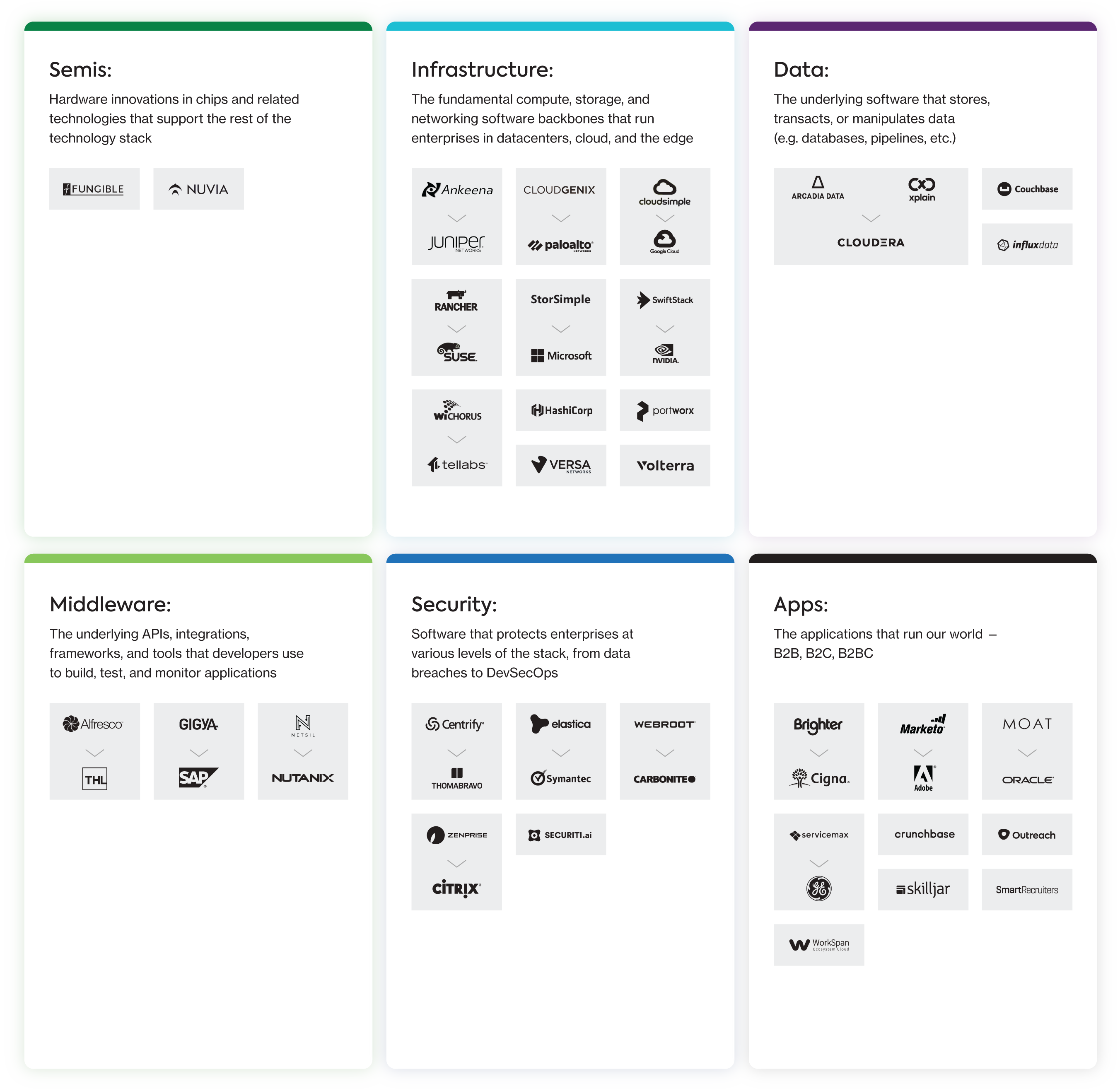

The Mayfield history of enterprise investing is best explained via the technology stack. While individual technologies have evolved, the stack has remained more or less the same over the years but with increasing specialization. During the last decade we’ve partnered with over 60 companies across the stack, from semis through infrastructure, data, middleware, security and apps.

Some of our breakout companies include:

Lessons Learned on Enterprise Tech Company Building

The work of a good investor doesn’t end once the term sheet is signed. As a firm composed of former founders and operators, we spend much of our time working closely with our portfolio companies on all aspects of company building – product strategy, go-to-market, hiring, operations and CEO development. In the process, we believe we’ve learned valuable lessons from partnering with the entrepreneurs of these enterprise companies, which could serve as guidance for other founders. Here are our top 5, along with stories from the breakout companies they came from.

Stay true to your founding mission and values.

HashiCorp was founded by open source developer legends Armon Dadgar and Mitchell Hashimoto and is led by CEO Dave McJannet to help practitioners deploy infrastructure in a multi-cloud world, a mission the company has stayed true to. Following the mantra of infrastructure enables innovation and a product philosophy codified in the Tao of HashiCorp, the company has grown into one of the most valuable infrastructure companies of the multi-cloud era with a recent round of financing valuing it at over $5 billion. But it devotes as much time to its dedicated community base of tens of thousands of developers as it does to powering leading enterprises such as global stock exchanges and much of the Fortune 500.

Make sure your product is seen as a painkiller vs. vitamin.

Marketo, whose founding team including CEO Phil Fernandez, had strong marketing DNA and the desire to elevate marketing professionals from cost centers to revenue accelerators. Their marketing automation tools became indispensable to marketing teams and the Marketing Nation community they created grew to thousands of members. Their software ended up elevating the CMO into having a seat at the leadership table and even into the boardroom. Marketo had a very successful public offering, followed by being acquired by Vista Equity Partners, and subsequently acquired by Adobe for over $5 billion.

Go beyond technology to deliver innovation in GTM, delivery and business model.

Rancher is the most widely adopted enterprise Kubernetes platform, with 100M downloads and 30K active deployments across 300 global enterprise customers from Disney to Fidelity Investments to Verizon and beyond. The company focused on developing a community-first, bottoms-up adoption strategy, a sustainable and scalable business model focused initially on usage over revenue, and a capital-efficient inside sales model. On top of that, they worked with an ecosystem of partners to build key components. Along the way, they took the pulse of the market to pivot from their original focus, switching from Docker to Kubernetes, from a services to a SaaS recurring revenue model, and from Kubernetes distribution to Kubernetes management. SUSE, the global open source leader, is in the process of joining forces with Rancher.

Build extreme focus as startups die of indigestion; not starvation.

Outreach, co-founded by CEO Manny Medina and his team, targets the sales professional, enabling them to close more deals with a sales engagement platform. The Outreach team was using the software to sell their recruiting services for their initial focus and pivoted from a near death experience, realizing that the sales software was their crown jewel and thus should become the focus of the company. Individual reps and teams have become vocal about their love for the product and are getting Outreach as the standard platform for sales at over 4500 companies as varied as Zoom and the Sacramento Kings basketball team. The company helped pioneer and is the leader of the Sales Engagement category and recently raised a round of financing which valued them at over $1.33 billion.

Instill patience into your DNA as company building is a marathon; not a sprint.

It is a long road from idea to iconic company, with milestones such as finding product/market fit, becoming a category leader, building a repeatable GTM engine, creating a strong business model, and ensuring that the founding culture continues to inspire new employees. We have invested in over 500 companies, of which 117 have gone public and over 200 have been acquired. We are patient investors who take the long view when partnering with entrepreneurs

Given what we have learned from working with our portfolio companies, what perspectives are driving our future investments? Learn about eight opportunities to build iconic enterprise tech companies here.

Great Companies are Often Created in Tough Times

As we said before, no one calls enterprise boring these days. The opportunity to build an iconic enterprise company has never been more exciting. In our experience, downturns can be catalysts for entrepreneurs to continue to dream big, attract the best talent, and build capital efficient models. We believe that entrepreneurs are already building the next Atlassian, Coupa, Okta, PagerDuty, ServiceNow, Shopify, Slack, Workday and Zoom. Our (virtual) doors are open to partner with you on your journey.