I’m excited to welcome Sri Pangulur, a proven enterprise infrastructure, developer tools, and SaaS investor and operating leader, to the team as our newest and eighth partner. Sri will be our first dedicated partner for Select/Spring Funds. He will be partnering with entrepreneurs focusing on enterprise infrastructure, AI, developer tools, and SaaS. These companies will be primarily at the Series B stage and we will invest in them out of our Select/Spring funds, which represent approximately $800 million of capital. To date, we have invested in 23 companies from our Select Funds across all layers of the technology stack, and announced our new $375M Select III/Spring Fund in May of this year.

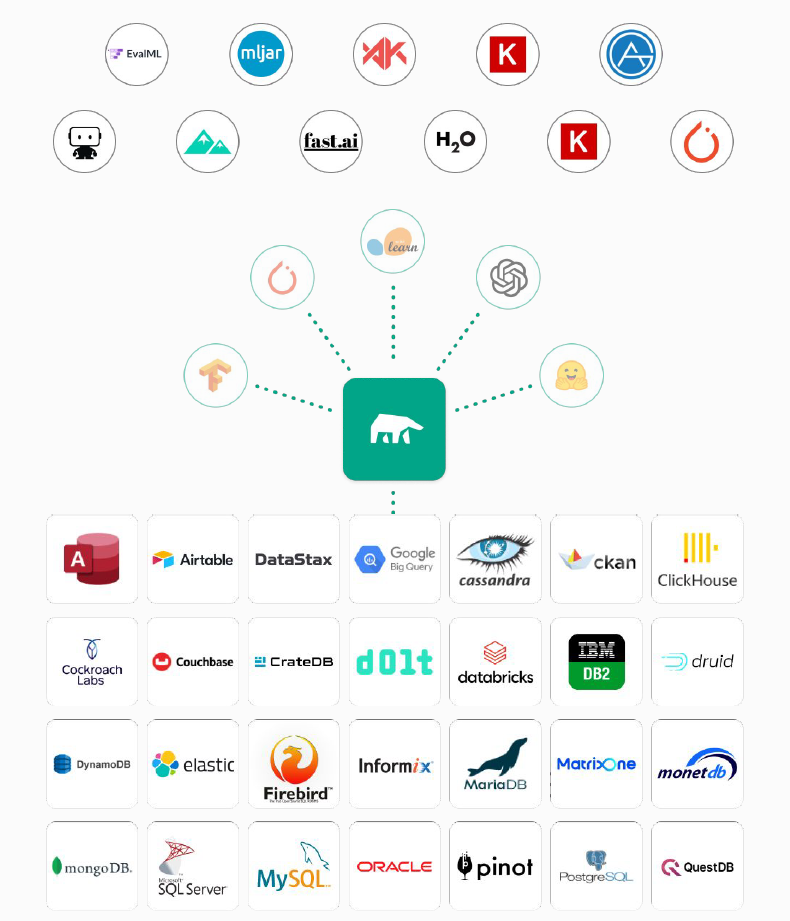

Prior to Mayfield, Sri led the enterprise software investing practice at Tribe Capital and was an active angel investor before that. Some entrepreneurs he has partnered with include the teams from Apollo.io, LinearB, Docker, JupiterOne, Orum, Instabase, MindsDB, Abnormal Security, Hasura, HYCU, Nylas, Airbyte, Hightouch, and Oort.

During his operating career, Sri held sales and business development leadership roles across multiple enterprise infrastructure and SaaS companies. Prior to his operating tenure, Sri was a member of the investment banking division of Barclays Capital.

The team at Mayfield is collaborative and focused, where every new member makes a significant impact toward our firm’s success. Sri embodies the Mayfield Way, a set of of operating principles that guide our firm, and is a perfect addition to our team for the following reasons:

- The founders he has worked with highlight his empathy for their journey, which is a key pillar of our People-First philosophy;

- His unique combination of recent operating and investing experience enables him to bring a both-sides-of-the-table mindset when guiding entrepreneurs;

- He complements our inception stage focus with expertise for companies a little further along. Key areas he has contributed to include rounding out executive teams for the next stage of growth, upleveling founder narratives for successful future financings, and leveraging his recent operating experience to build scalable go-to-market strategies, high-performance organization structures and business models;

- He is not a fan of the recent *steroid era of investing* and brings a craftsperson approach which is a signature of our firm.

Sri outlines some reasons for his excitement in joining our team including:

- Having known us personally and by reputation for a long time as a focused and high-performing team with a track record of success;

- Our People-First culture and willingness to follow our own North Star;

- The greenfield opportunity to further build our Select/Spring investment practice.

Sri joins us during a momentous year at Mayfield, one during which we raised $955 million in May across our oversubscribed Mayfield XVII and Mayfield Select III/Spring Funds in record time, and also announced our $250 million AI Start Seed Fund in July.

We look forward to partnering with bold entrepreneurs on their inception to iconic journeys.