Your AI startup just raised a round of financing. Revenue is growing 20% month-over-month. Everything looks promising. But here’s what might be hiding beneath the surface: your gross margins could be masking underlying business fragility.

In AI, gross margin isn’t just a metric. It’s a control signal that reveals the sustainability of your business model. Companies relying heavily on third-party models without infrastructure leverage often scale costs faster than revenue.

Most AI founders focus intensely on growth while paying less attention to unit economics. Today, I’ll share:

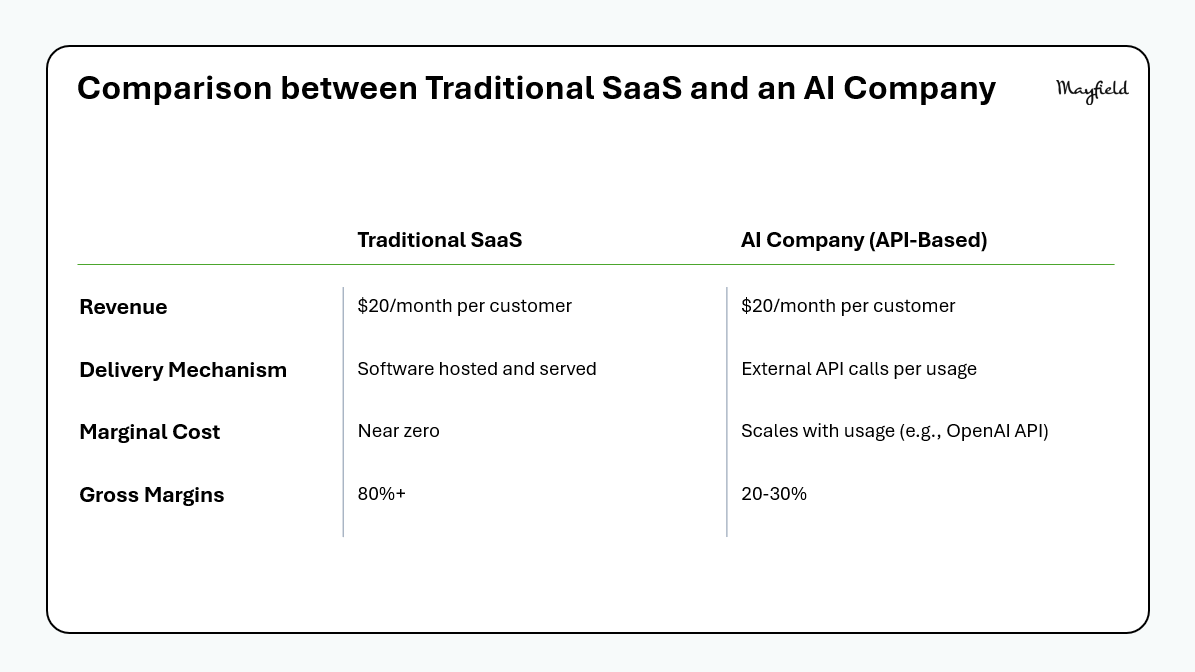

AI companies face a unique challenge compared to traditional SaaS businesses. Every new customer who actively uses your product increases your infrastructure costs proportionally.

This creates different dynamics than traditional SaaS, where increased usage typically improves margins over time. Understanding this difference is crucial for building sustainable AI businesses.

Here’s the comparison:

Let’s examine the specific dynamics that can impact AI business sustainability:

1. Your costs eat up most of your revenue

Many AI companies incur significant costs per interaction when using external APIs like OpenAI or Claude, handling long context windows, or lacking model optimization infrastructure. This leaves limited room to invest in growth, R&D, or go-to-market activities compared to traditional SaaS businesses.

Bottom line: Prioritize infrastructure leverage to improve unit economics over time.

2. Platform dependency means you don’t control your own pricing

When your costs are tied to third-party model providers, you’re exposed to pricing changes, rate limiting, and API policy shifts. You have limited control over latency, reliability, or update cycles. Additionally, product differentiation can be challenging if competitors use the same underlying models. External factors beyond your control influence your margin structure and product roadmap.

Bottom line: Build optionality in your model stack to maintain pricing flexibility.

3. Growth doesn’t automatically improve unit economics

In traditional SaaS, increased usage typically scales revenue without proportional cost increases. In AI companies with high variable costs, more usage often means more tokens and higher expenses. Delivering additional value doesn’t always translate to improved gross margins. This creates pressure on pricing strategies and requires creative approaches to monetization.

Bottom line: Design pricing models that align revenue growth with cost increases.

4. Advanced features can cost you more money

AI agents are getting more sophisticated, which means they’re taking on increasingly complex tasks that require more computation. At the same time, token costs from providers like OpenAI and Anthropic have remained relatively flat. This creates a squeeze: your product gets better and more valuable to users, but your costs increase faster than your pricing can capture that value. Companies are discovering that power users can consume orders of magnitude more resources than anticipated, making flat pricing models unsustainable.

Bottom line: Implement usage-based pricing for compute-intensive features.

5. Building defensible moats requires additional considerations

If your AI product doesn’t solve high-value vertical problems, accumulate proprietary data, or integrate deeply with customer workflows, it may face commoditization pressure as model costs decline and open-source alternatives improve. Sustainable differentiation requires building beyond basic model access.

Bottom line: Focus on vertical differentiation and proprietary data advantages.

6. Investment expectations may need recalibration

Early-stage investors typically expect high gross margins (80%+), scalable go-to-market strategies, and clear paths to capital-efficient growth. AI infrastructure-heavy or agentic companies with persistent 20-30% gross margins may need to set different expectations around multiples, capital requirements, and profitability timelines.

Bottom line: Set realistic expectations on multiples, capital needs, and cash flow timelines with investors from the start.

The encouraging news is that these challenges can be addressed with thoughtful design from the beginning. Here’s how successful AI companies approach unit economics:

1. Start with cost modeling before product design

Many AI startups design user experiences and pricing before understanding interaction costs.

Model your costs per interaction early. Understand token expenses, inference latency, and memory usage. Track cost profiles for different types of operations and external integrations.

Identify which features are margin-positive versus margin-negative to inform product prioritization.

2. Design growth with cost control in mind

To maintain healthy margins as usage scales, consider tiered pricing for high-cost operations, credit-based systems that bundle usage into manageable units, and task offloading using background processing or batch inference for non-critical operations.

3. Reduce dependency on external APIs where feasible

Heavy reliance on third-party providers means inheriting their cost structure and margin limitations. You’re also subject to their operational constraints. Consider using open-source models where fine-tuning and hosting are viable, building model abstraction layers for flexibility, and fine-tuning smaller models for specific use cases to optimize costs.

4. Align pricing with actual costs

Traditional per-seat pricing becomes problematic when compute costs vary dramatically across users and tasks.

We’re seeing this play out in real time. Replit switched from flat 25-cent pricing per coding task to “effort-based pricing” that can reach $2 per complex task. Cursor moved from unlimited per-seat models to consumption-based pricing. Even Anthropic started charging power users more after some consumed tens of thousands of dollars on $200/month plans.

The shift is creating growth pains as companies figure out sustainable monetization. According to Orb’s State of AI Agent report, 92% of AI software companies now use mixed pricing models — some features for flat fees, advanced features based on consumption.

Better approaches include pricing based on task complexity rather than simple usage, implementing mixed models that separate basic from compute-intensive features, and building transparency into cost estimation so users can predict their bills.

5. Implement cost visibility from day one

Without real-time tracking of usage patterns, per-user costs, and model performance, it’s difficult to optimize economics effectively. Early investments should include cost monitoring dashboards, performance tracking for inference and latency, and safeguards against runaway usage.

6. Build differentiation beyond model access

If your primary value proposition centers on accessing foundation models, competitive differentiation can be challenging. Consider building moats through vertical specialization, proprietary data advantages, and deep workflow integration that creates switching costs.

Sustainable AI companies will likely own more of their inference stack, price against business outcomes, have proprietary data, and embed deeply into customer workflows. Your gross margin structure reflects your level of control over the business fundamentals. Heavy reliance on external APIs without usage optimization or pricing alignment can create economic constraints over time.

While this post focuses on the cost of goods and gross margins, there’s another economic pressure worth noting: people costs are rising significantly, especially for AI talent. High turnover among top AI talent compounds this issue. The constant competition for engineers and researchers drives up compensation while creating knowledge retention risks that can derail progress and disrupt company culture.

Here’s a different approach: while everyone competes for “central casting” talent at the top companies and universities, focus on mission-driven, values-oriented people over paper credentials. Broaden your search to other universities and less-hyped companies and find these highly capable talent pools. Tapping these overlooked candidates isn’t just smart hiring, it’s a powerful equalizer that expands opportunity and brings different perspectives into your company.

The companies that address both infrastructure economics and talent economics thoughtfully from the beginning will be better positioned as the AI market continues to mature. Understanding these dynamics early allows you to make informed architectural, business model, and hiring decisions that support long-term sustainability.