2020 has left an enduring mark on the consumer landscape. Years of change have happened in weeks, and products rarely bought online are now ecommerce staples. Q2 2020 saw a 44% YoY growth of U.S. online sales, and eCommerce will be more than 19% of all retail for 2020, up from 14% in 2019. However, as traditional comes back online in 2021, its impact on eCommerce remains to be seen.

How did the 2020 holiday buying season shape up? How will consumer buying behaviors evolve from here? How are brands responding to these rapid shifts in consumer behavior? And what industry trends and new technologies will shape the future of eCommerce?

To answer these, and many other such questions, Mayfield hosted a panel of eCommerce brand and technology experts to discuss how the industry is evolving. I moderated the panel along with Aseem Chandra, EIR at Mayfield. It was a great opportunity for ecommerce providers and brands to share insights and perspectives on the path forward.

Key Takeaways

Ecommerce Providers Panel

Ecommerce’s Big Moment

The panel acknowledged that the COVID-19 crisis of 2020 created big opportunities for ecommerce, but also revealed a lot of vulnerabilities in the way people were doing business – ranging from supply chain, to marketing, to customer acquisition.

Nick Raushenbush’s company, Shogun, builds software that powers the storefront experience. Shogun has experienced significant growth in paying users.

“I think that everybody in the in the room that it’s a big moment that’s been brought on by these very unfortunate events and I think it’s really given rise to merchants becoming more sophisticated and starting to really crave solutions that are custom tailored to their exact needs.” -Nick Raushenbush, Co-Founder & COO, Shogun

What has helped businesses grow this past year and what are the priorities going forward?

Moritz Zimmermann, the co-founder of Hybris Software, and until recently the CTO of SAP Customer Experience, cautioned against complacency.

“If you’re setting up an eCommerce business with a beautiful website and a great assortment, you’re actually making a promise to the customer. It can be hard to keep that promise. There is a need for speed with changing customer demands. Customers course correct quickly.” -Moritz Zimmerman, Former CTO, SAP Customer Experience

Nick Raushenbush believes that interest in D2C has accelerated in 2020.

“When home quarantine was imposed and foot traffic was reduced at places like Sephora, Walmart and Target, we got a lot of calls from brands, especially CPG brands, saying: “My website, which was barely set up to be transactional, is entirely sold out!” So there is a really healthy organic focus on D2C, which was stagnant for a while, as a result of the pandemic. But D2C’s need their own channel. They can’t rely on brick and mortar and other distribution partners. They can’t rely on Amazon. They’ll eat into your AOV and recommend competing products..” -Nick Raushenbush, Co-Founder & COO, Shogun

Security

“Security is getting higher on the agenda. If you fight for survival, getting stuff into the hands of the customer is the priority. But once that is solved, security is important and only becoming more important. Ransomware is everywhere now and businesses are very vulnerable.” -Moritz Zimmermann, Former CTO, SAP Customer Experience

Customer Expectations

Harry Chemko, Cofounder and CEO of Elasticpath has seen a significant rise in consumer expectations around precision.

“Customers want to know that a package is arriving within a few hours, versus within a period of two or three days. When you order pizza, they tell you when the toppings are going on the pizza, when the pizza goes in the oven, and then when delivery guy is on his way. I think the level of precision that consumers have become accustomed to is going to continue.” -Harry Chemko, Co-Founder and CSO, Elasticpath

Flexibility and Agility

Dirk Hoerig, CEO of Commercetools believes that we’ve created too many dependencies that have in turn created unexpected vulnerabilities.

“The pandemic has highlighted our high dependency on supply. During the lockdown, I (and everyone else) got into mountain biking because there was not much that you could do in your free time. Now if you try to order a mountain bike or a part from a specialty store, they just don’t have it. Companies weren’t prepared and business models were not flexible enough. Now we need to focus on resilience in business models, supply chain and customer experience.” -Dirk Hoerig, CEO, Commerce Tools

The need for speed

“The CIO of one of the world’s largest consumer brand companies recently told me that the average consumer nowadays prefers brand B over brand A, even if they like it less, because they want to get it faster.” -Moritz Zimmermann, Former CTO, SAP Customer Experience

“Customers expect superior site performance and have little tolerance for load times on mobile. When you take a look at the bounce rate and how quickly shoppers are willing to abandon a shopping experience due to a second of page load, it’s pretty unreal.” -Nick Raushenbush, Co-Founder & CEO, Shogun

The Headless Revolution

Brands today need backend as a frontend or a platform as a service to keep up with customer demand and changing expectations.

“In the past we wanted to solve two things: 1) We wanted to give devs more flexibility for agility and speed and break out of the current analytics solutions, and 2) We wanted to make something resilient enough as a commerce platform. Looking into the future we need to differentiate. We have the SMB market and then we have the enterprise. On the enterprise, things are more complex regarding business processes, products, etc. – and everything will become a service for the next couple of years. This will grow and the challenge will be to combine those components to make a great, unique customer experience. This is where companies can excel. It’s not just the look and feel, but the quality of time.” -Dirk Hoerig, CEO, Commercetools

“Each new app we deployed to help serve our customers this last year had an effect on page load time. Headless commerce is the best solution going forward. It’s going to really explode.” -Brig Graff, Former COO Gear.com

The Shopify Factor

Many ecommerce brands count on Shopify for consistency and flexibility without being tied down to hefty costs. Brands want to know that their platform will be able to be resilient to change in the future. They wonder if there is a need or want for small brands to move off of the comfortable platform.

“The answer is probably not Shopify *or* custom, it’s really a number of services that you can plug together in the way you want. The more you’re on the lower end, the more you’re happy with out of the box from Shopify, but the more you have higher demands, you can change (with lower cost) these things in and out. Build or buy decision is grey not binary.” -Moritz Zimmermann, Former CTO, SAP Customer Experience

“Hyperlocal fulfillment and delivery will change the game. It will be harder for a lot of the larger brands because they have such established processes that need to be shifted, but it’s an opportunity for smaller D2C brands.” -Harry Chemko, Co-Founder and CSO, Elasticpath

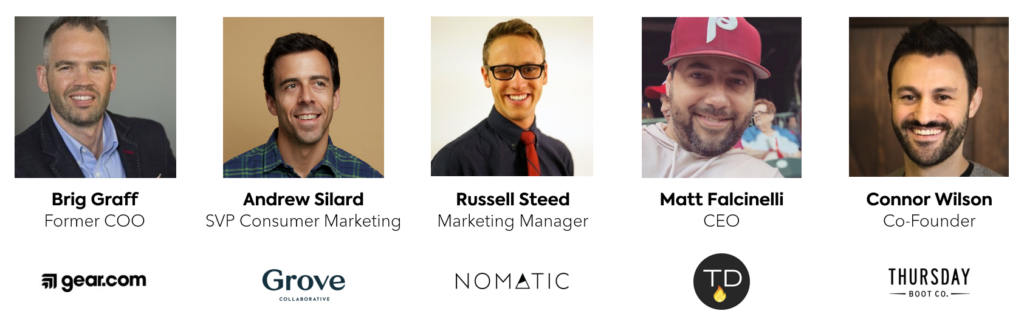

eCommerce Brands Panel

What did D2C brands have to do differently last year?

Brig Graff, former COO Gear.com always focused on highlighting really cool brands.

“Rock climbing was really doing well for a long time until all the of the rock-climbing gyms closed. But then there was an explosion in selling bikes and bike related items. People also bought sweatpants and flip flops and fire pits for the backyard and it was it was a lot of fun to and being able to move in a natural way like that. It made a big difference for us being able to deploy a number of key apps to the site to add functionality.” – Brig Graff, Former COO, Gear.com

Grove Collaborative is a popular manufacturer of household cleaning products and experienced an overflow of consumer demand starting in March of 2020.

“We had to turn off ordering on the website for a few days. We couldn’t deal with the surge in demand. Throughout the year we had to be really responsive to a lot of external factors linked to the pandemic like increased consumer demand for sanitizing and cleaning products, industry-wide supply chain disruption and other core SKUs we had to be in stock on. It was a strenuous time for the team. We came out with a really strong year from a growth standpoint, and supply chain disruption has snapped back. We were fearful of remote work but have now embraced it.” -Andrew Silard, SVP Consumer Marketing, Grove Collaborative

Nomatic, a seller of products and experiences related to travel, obviously hit quite a rut in 2020 with airports closed and everyone on lockdown.

“Pre-pandemic travel was hot and marketing was easy. Then from one week to the next sales just dropped, and consumer resistance was through the roof, so we had to pivot our marketing model and how we position ourselves. Do we reinvent the business or take a different marketing approach? We figured out that efficiency on the operational side would save our business. We cut our team in half by June and hit our same revenue milestones again by the end of the year. But it was very hard to be a travel brand during a travel ban. Efficiency and focusing on what’s important kept us going.” -Russell Steed, Online Revenue & Marketing Manager, Nomatic

The Drop sells the latest trends in designer streetwear.

“I’m student of the late Tony Hsieh. He said if you can consistently deliver selection and service, you can build loyalty and eventually profitability. That’s our focus. We definitely don’t have the cheapest products, but we try to consistently deliver new things and try to deliver stories around those new products and brands. We have a great selection and provide the service no matter what other obstacles come at us. Loyalty has continued to grow.” -Matt Falcinelli, Co-Founder & CEO, TheDrop

Thursday Boot Company produces high quality footwear.

“We were not in a selling season so it was good timing when this happened. We focused on flexibility and being quick to produce to keep capital efficient and flexible. In the spring we started producing masks instead of sneakers. The same folks that operated out of some of the factories really threw in the towel and freaked out: both smaller brands and big legacy guys. We were more steady with our ordering which led to more capacity. We did not get overwhelmed because we were focusing on the fall and the spring, but I am very excited about a return to normalcy because it bodes well for our business. Boots and footwear have done ok even though people aren’t going outside, but this next year will show who made the best decisions in 2020.” -Connor Wilson, Co-Founder, Thursday Boots

On Competing with Amazon

“Amazon sets the bar on experience, price selection and convenience, but there are other components. Real enthusiasts who know their stuff care about the brand they buy, they want specific things. Amazon can’t necessarily offer that. It’s really tough on Amazon for brands to tell their story.” -Brig Graff, Former COO, Gear.com

“The other argument against Amazon is the discovery story. The infinite shelf creates an overwhelming discovery experience. In our product category, consumer behavior has not developed around net new product discovery on Amazon. People go to amazon to save money on products they have already identified, but it’s rarely the place they start with net new discovery.” -Andrew Silard, SVP Consumer Marketing, Grove Collaborative

“Amazon is unavoidable, we use it and drive revenue through it. But we also have a big customer base that will wait 6-7 months for products (the other group is traveling in 4 days and needs an item now). So it’s a give and take with Amazon. We allow our product to be sold on there for convenience.”-Russell Steed, Online Revenue & Marketing Manager, Nomatic

What is the most effective customer acquisition strategy?

“Our business is built around drops and the newest things, and we have stories and emotional connections to the customer. It took time, building up that customer, and that customer database. After about 3 years we now have enough segments around brands, and we know that if we’re dropping something new around that brand: we can email and text the right people. We build sales, lower costs – then refine and optimize our marketing spend with this segmented approach.” -Matt Falcinelli, Co-Founder & CEO, TheDrop

Brands Collaborating with Customers

Amber Atherton, a good friend of Mayfield and the CEO and Co-Founder of Zyper, was hoping to join the roundtable but Zyper was just acquired by Discord. Congratulations Amber! She shared this video to describe how brands are collaborating with their customers and building community.

Contact Our Speakers:

Dirk Hoerig: linkedin.com/in/dirkhoerig

Harry Chemko: linkedin.com/in/harrychemko

Moritz Zimmermann: linkedin.com/in/moritzzimmermann

Nick Raushenbush: linkedin.com/in/nickraushenbush

Amber Atherton: linkedin.com/in/amber-atherton

Brig Graff: linkedin.com/in/briggraff

Andrew Silard: linkedin.com/in/andrewsilard

Russell Steed: linkedin.com/in/russell-steed-79921390

Matt Falcinelli: linkedin.com/in/falcinelli

Connor Wilson: linkedin.com/in/connor-wilson-cfa