We are living in interesting times. For multinational corporations, the risk of failure has never been higher, but the opportunities for growth have never been greater.

How can global enterprises capitalize on these opportunities to beat startups at their own game? For the answer to that question, we were joined on this month’s CIO Insight call by Linda Yates, Founder and CEO of Mach49, a network of Silicon Valley veterans who specialize in helping businesses disrupt themselves, and Paul Holland, Mach49’s VC in residence. We also welcomed Sukhjinder Singh, CEO of energy intelligence company Pear.ai, who provided the practitioner perspective on what it means to accelerate a new corporate venture.

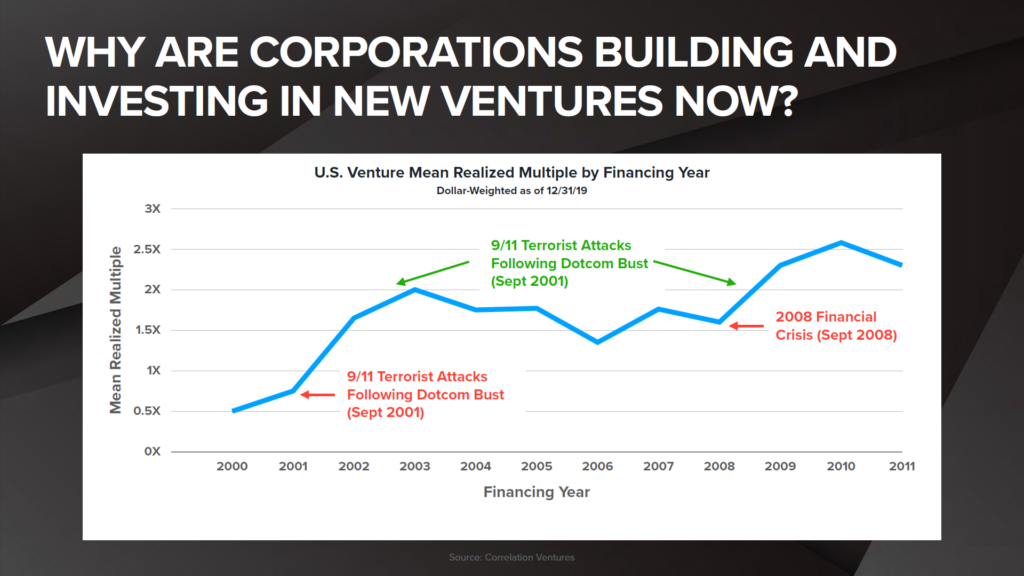

With the economy shredded by the COVID-19 crisis, the natural inclination is to be cautious and conservative with your capital investments. But that’s exactly the wrong approach. As we’ve seen from previous dramatic downturns, the current economic climate presents an extraordinary opportunity for new venture growth. Warren Buffett’s signature advice is now more true than ever.

Enterprises that are serious about innovation are developing rich portfolios with a solid pipeline spanning each phase of development, from ideation to growth at scale.

There are four ways to build a growth engine. The first two are from the inside out: You can launch ventures or build your own incubator to do it on a repeatable and scalable basis. Or you can go outside in, either by setting up a corporate venture fund or bringing Silicon Valley inside by developing venture advocacy within your business and creating partnerships with startups.

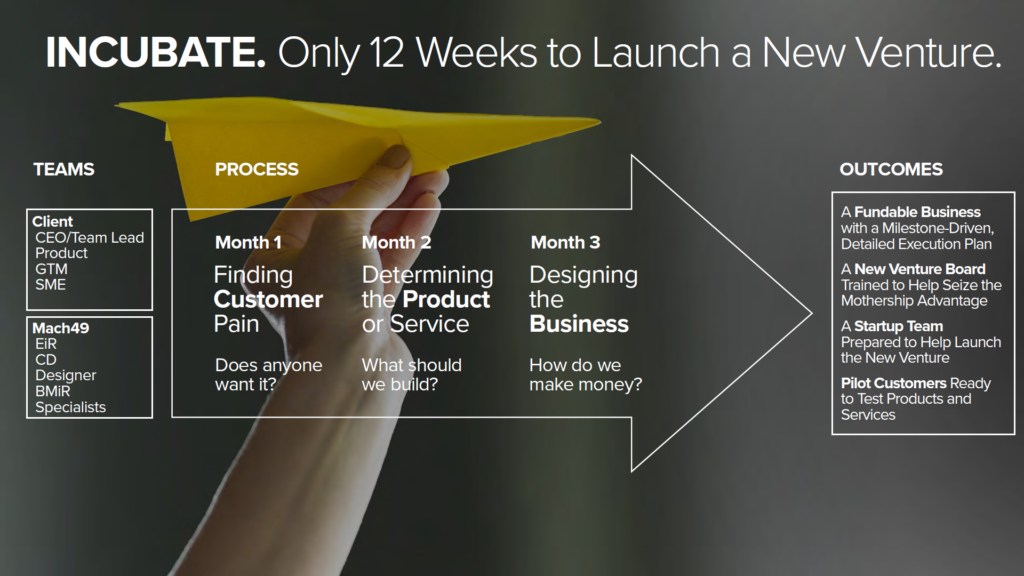

To launch a new venture you need to identify two things: the pain you’re trying to solve and the stakeholders who are suffering. If there’s no pain, there’s no venture. But the technology to alleviate this pain must be possible. If you’ve identified a large pain point but the only solution is time travel, there’s no venture. Finally, how big is the market? Can you build a viable business from this solution? If so, is your company the right one to build it?

Once you’ve answered the questions about customer desirability, product feasibility, and business viability, incubation looks very similar to what you see from the Y Combinators and 500 Startups of the world. After three months of incubation you should have a robust business and execution plan. But coming up with a venture idea isn’t what matters. What matters is getting into the market, running pilots, finding the right market fit, and generating revenue. From day one you should be looking to accelerate.

Acceleration comes in three phases: Build to learn, build to automate, and build to scale. You may end up throwing away everything you’ve done, but you’ll have learned a lot along the way. Once you’ve ironed out the kinks you can figure out how to automate and then scale. Big companies are great at the last two parts; where they get stuck is in incubation and early acceleration.

The first step toward building a growth engine from within is to optimize your current business. Become leaner, faster, more innovative. The second step is to explore opportunities in adjacent marketplaces, which may be larger and growing more quickly than your core marketplaces. And the third is to plug into what’s happening around you so you can stay current on the art of the possible.

Many global businesses have launched their own corporate venture capital funds, often utilizing the expertise of top-tier Silicon Valley VCs. Others are investing directly off their balance sheets, forming executive investment committees to bring discipline, metrics, and best practices to their portfolios. Again, many bring in experienced VCs to optimize their investments and bring more growth energy. The third option is to leverage partnerships with external startups.

Take time to focus on the design of your CVC and investment board. Clearly define why you’re launching the fund, determine your strategy, and agree on metrics. It’s important to establish a small, focused, fast-moving investment committee with clearly defined roles. Three or four people located in the same time zone, turning around decisions in 48 hours or less, is the ideal.

Large companies have huge advantages over startups when it comes to customer access, market knowledge, brand validation, and operating expertise. But they also have a lot of orthodoxies, antibodies, and inertia. Having executives who can access these advantages while avoiding friction is vital.

Who in legal will write the one-page term sheet? Who in procurement can get a new vendor approved quickly? Who in marketing can outrun the brand police? You need to create new venture advocates across every function.

Making this happen requires three types of people, who can usually be found inside large organizations or easily hired. You need internal entrepreneurs who are constantly generating ideas. You need people who don’t want to be entrepreneurs but know how to grow the business. And you need people who are running your core legacy business who can drive efficiencies and spin off the cash that makes all of this possible.

By disrupting your organization, either from inside or outside, you’ll end up with a portfolio of promising new ventures. You’ll avoid missing opportunities in adjacent markets and leaving potentially billions of dollars on the table. Along the way, you’ll discover new talent and uncover new leaders.

To learn more about Mach49, visit its website or its LinkedIn page.

Gamiel & Shelby run a CXO Innovation Network at Mayfield, focused specifically on helping CIOs & CTOs access innovation strategically. The group is made up of a curated set of global CIOs and CTOs who partner with Mayfield for their own needs to access the top innovative technologies.

Mayfield is a venture capital firm with a people-first philosophy and $2.5 billion under management. Mayfield invests primarily in early-stage consumer, enterprise and engineering biology companies. Since its founding 50 years ago, the firm has invested in more than 500 companies, resulting in 117 IPOs and more than 200 acquisitions. Some notable investments in recent years include CloudSimple, Elastica, Grove Collaborative, HashiCorp, Lyft, Mammoth Biosciences, Marketo, Moat, Outreach, Poshmark, ServiceMax and SolarCity. For more information, go to https://www.mayfield.com or follow @MayfieldFund