In my third edition of Founder Insights back in March, I shared why I believed 2025 would mark the start of a golden era for startups. Looking at the Q2 2025 venture trends, the data doesn’t just validate that optimism – it exceeds it. We’re not just entering a golden age of company building; we’re accelerating into it, fueled by AI and powered by record capital deployment.

I’ll share why the Q2 numbers from NVCA and Pitchbook excite me even more about the rest of 2025 and beyond than any time in my three decades of building and investing in startups.

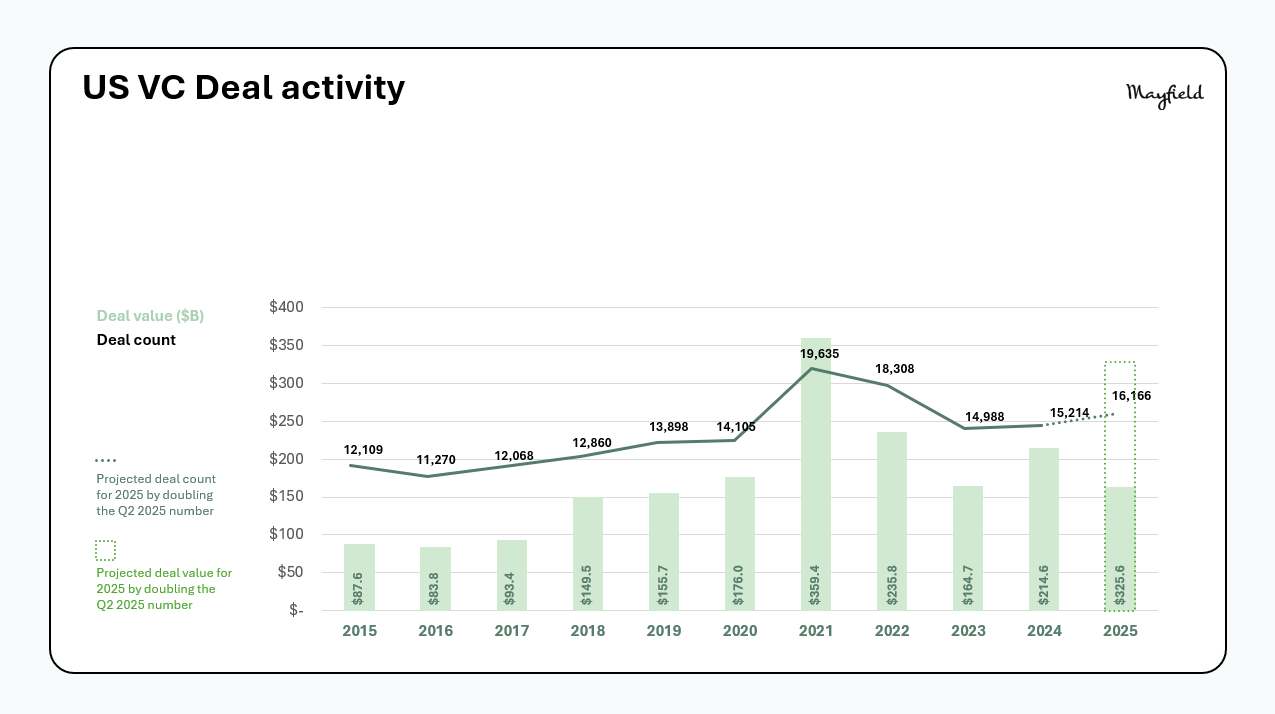

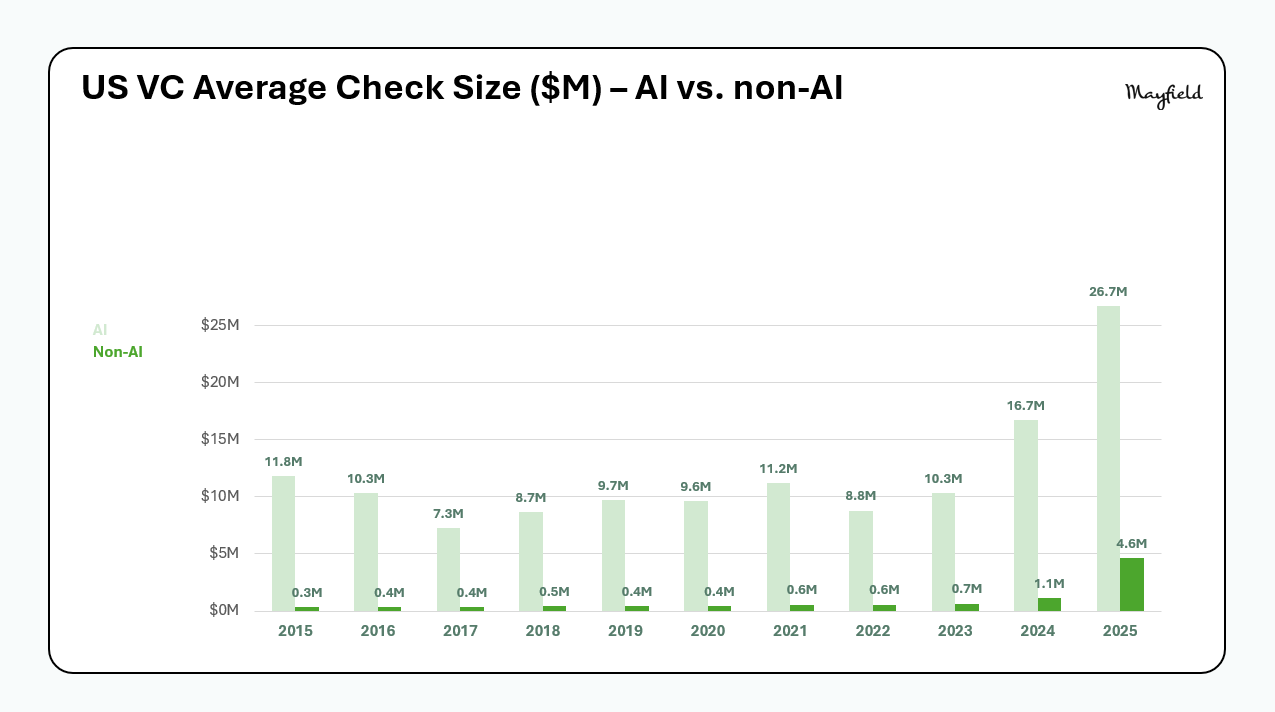

Based on Q2 data, we’re projecting strong momentum for the rest of 2025. The projected 2025 overall deal value of $325.6B is on pace to approach the historic 2021 peak. Deal count is trending slightly higher compared to 2024, but what’s even more notable is the sharp rise in average deal size. The average venture deal this year has reached $20.14M–up from $14.1M last year. For founders, that means investors are leaning in with bigger bets on companies they believe in with stellar teams or metrics and a clear path to scale sustainably. For AI companies, we’re seeing unprecedented mega-rounds even at the seed stage.

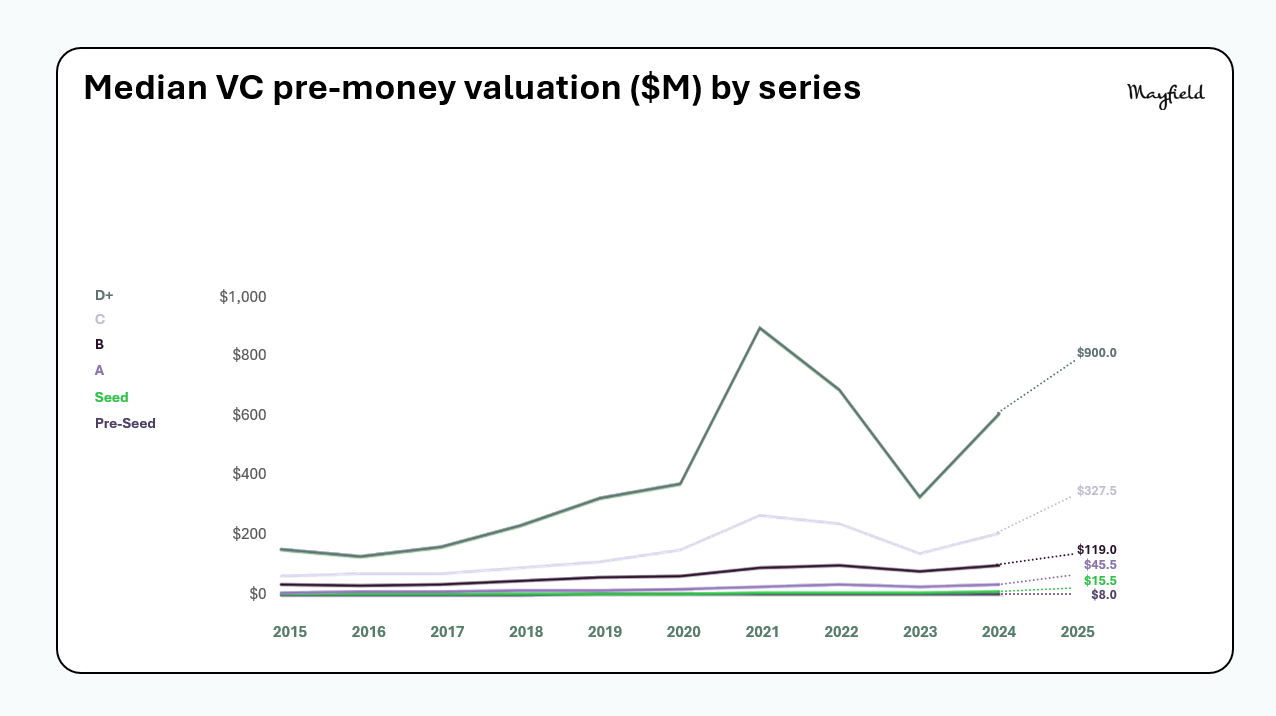

And yet – early-stage valuations remain relatively grounded. Pre-seed through Series B rounds are up only ~10% year-over-year, while Series C and beyond have jumped 40%. For early-stage founders, think rationally and capitalize your company based on where you are today. The market is rewarding staged, milestone-appropriate fundraising: raise what you need to build, prove, and grow, and let your execution earn the next step up in valuation. This approach creates a win-win: founders retain more long-term upside without the pressure of inflated expectations, and early-stage investors gain the right ownership, setting the foundation for a strong, aligned partnership.

Bottom line: If you’re an early-stage founder, there’s a lot of capital for smart builders — especially if you show traction, exceptional talent, and vision with a clear path to grow sustainably.

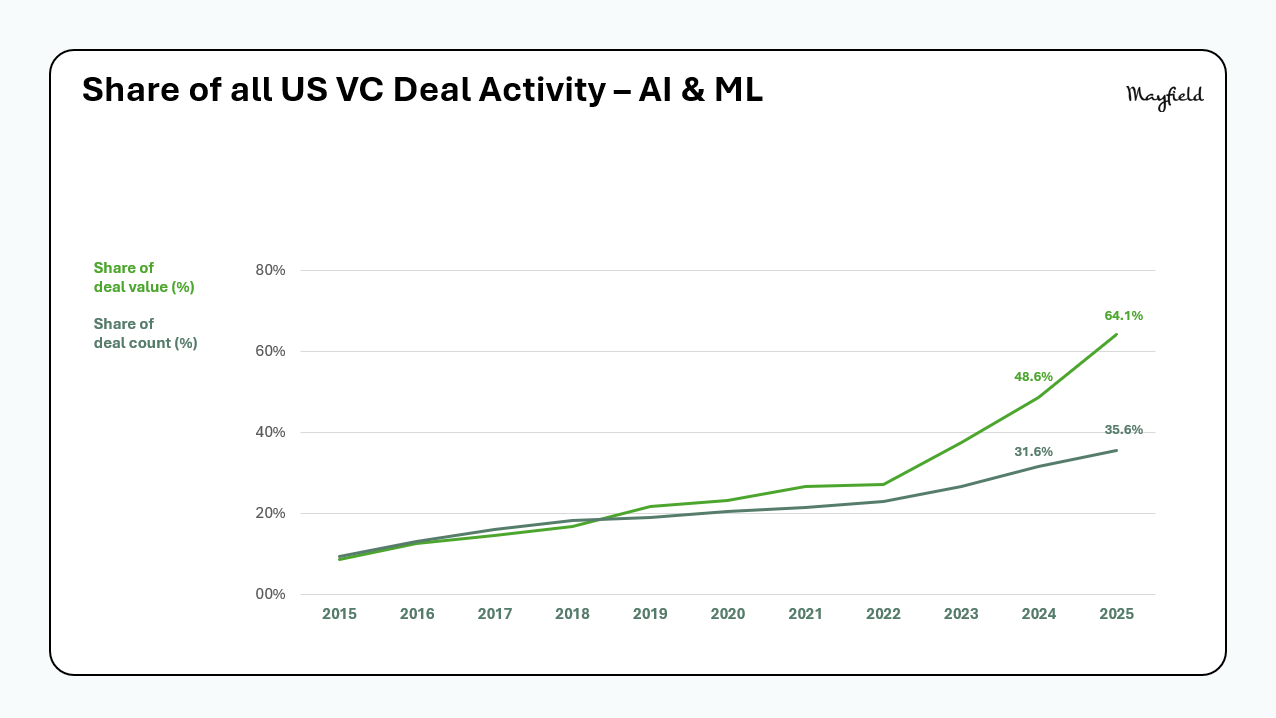

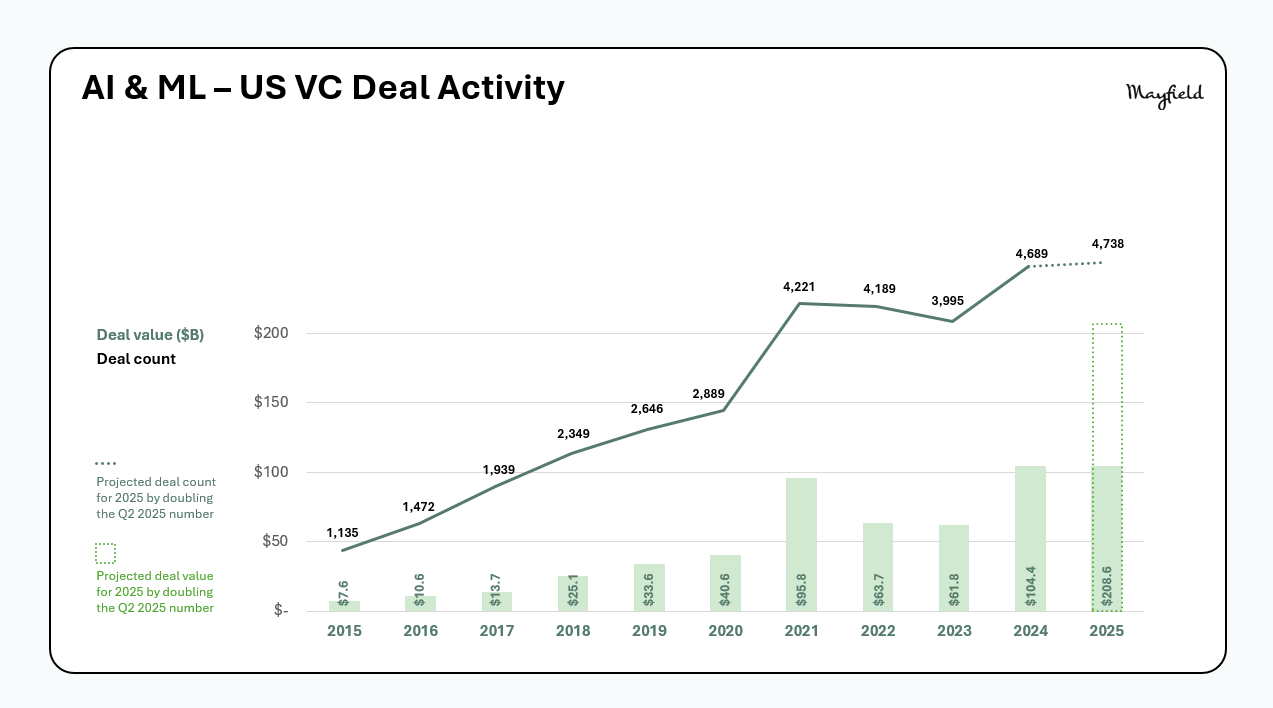

The numbers are staggering. AI companies now account for 64% of all VC deal value in 2025, up from 48% in 2024. VCs have already deployed $104.3B to AI deals in the first half of 2025 – matching the entire year of 2024 with six months still to go.

This isn’t just about foundation models anymore. We’re seeing AI transform every sector:

Bottom line: AI isn’t just hot – it’s becoming the entire venture market.

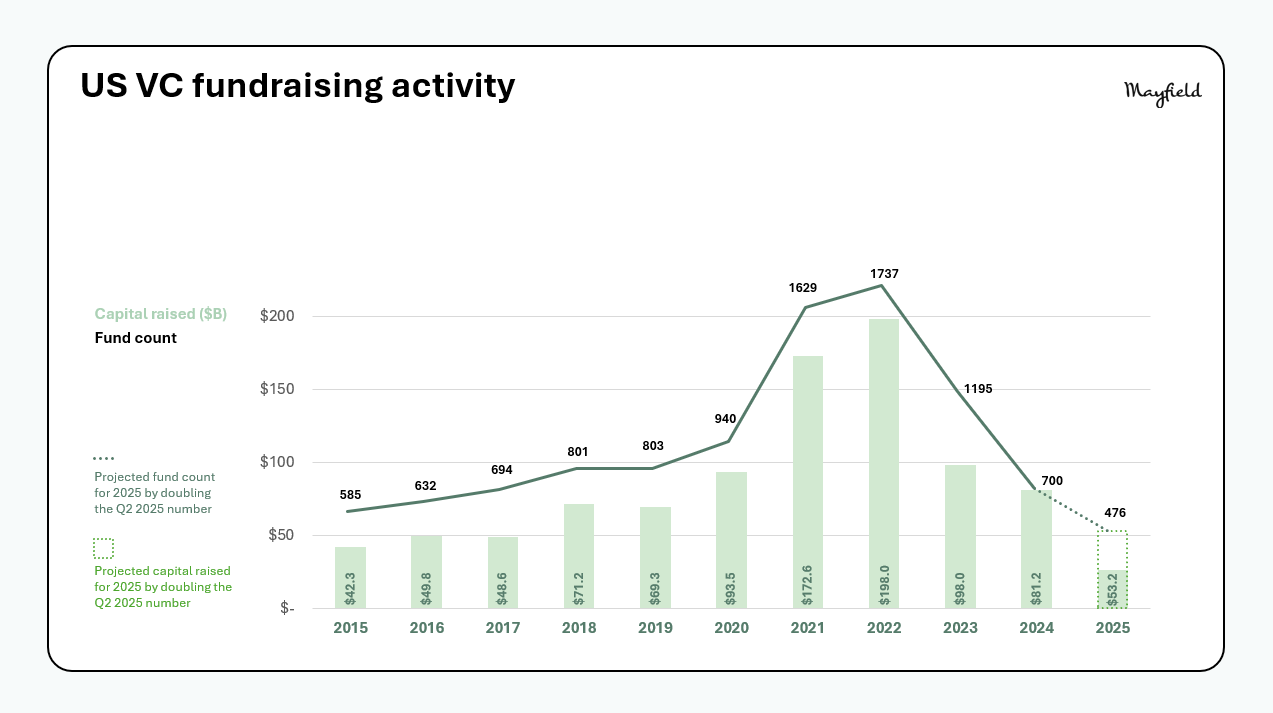

Let’s reframe the narrative around VC fundraising. While we’ve seen a pullback to $53.2B total projected to raise in 2025, this represents a recalibration towards disciplined investing. VCs were sitting on $278.1B in dry powder at the end of 2024 – money already committed by limited partners but not yet deployed as a lot of funds were raised in the past few years and most investors are returning to a 3-year investment period.

Capital is still flowing, but more selectively. Investors in venture funds are applying more scrutiny, with first-time funds facing fundraising headwinds.

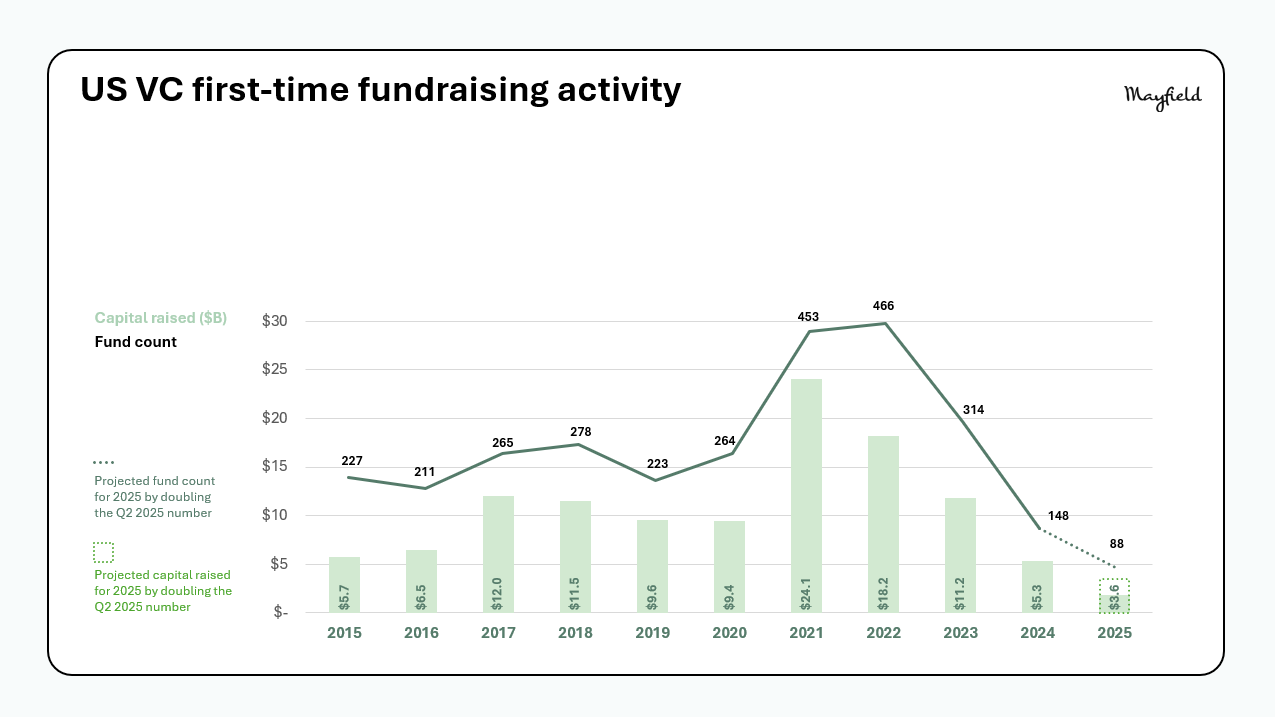

First-time fundraising has fallen from $24.1B (453 funds) in 2021 to just $3.6B (88 funds) projected for 2025. That’s an 85% decline in capital flowing to first-time funds. The flight to experience makes sense – capital is going to established fund managers.

Bottom line: The VC fundraising “winter” is concentrating capital with proven managers more than ever before. Choose a partner who’s weathered multiple cycles and puts people first – they’re the ones with dry powder to deploy.

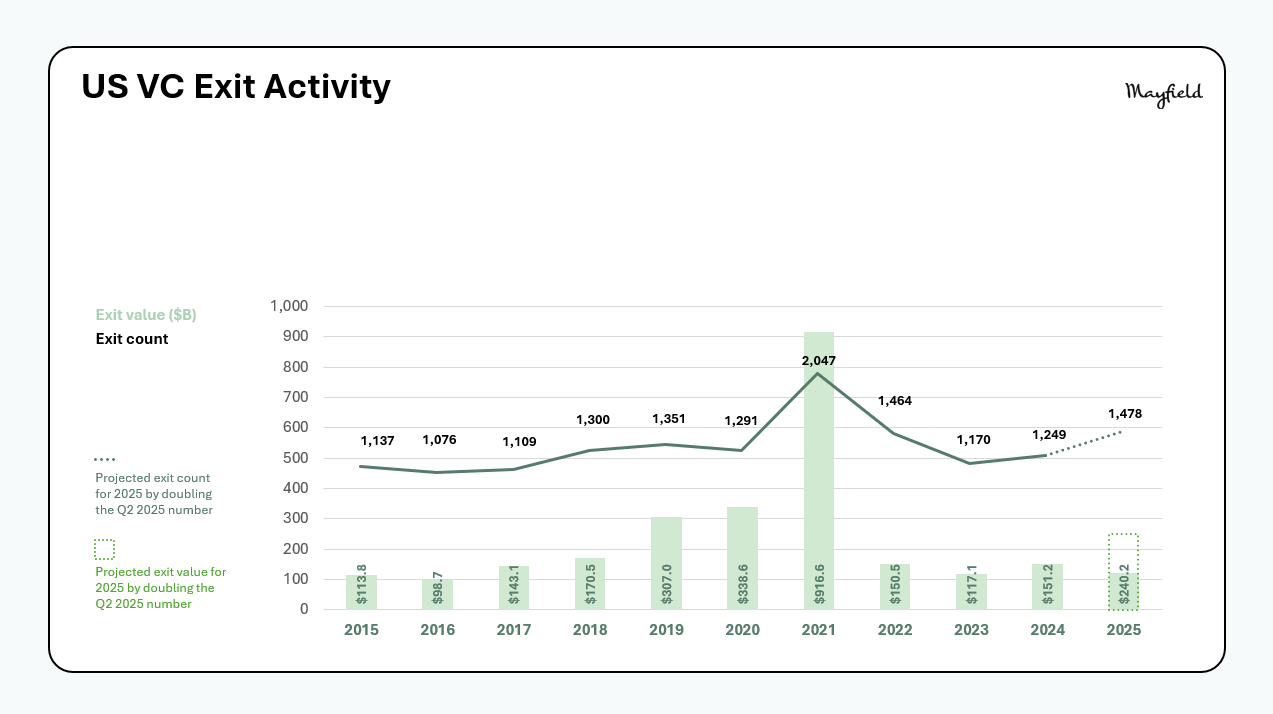

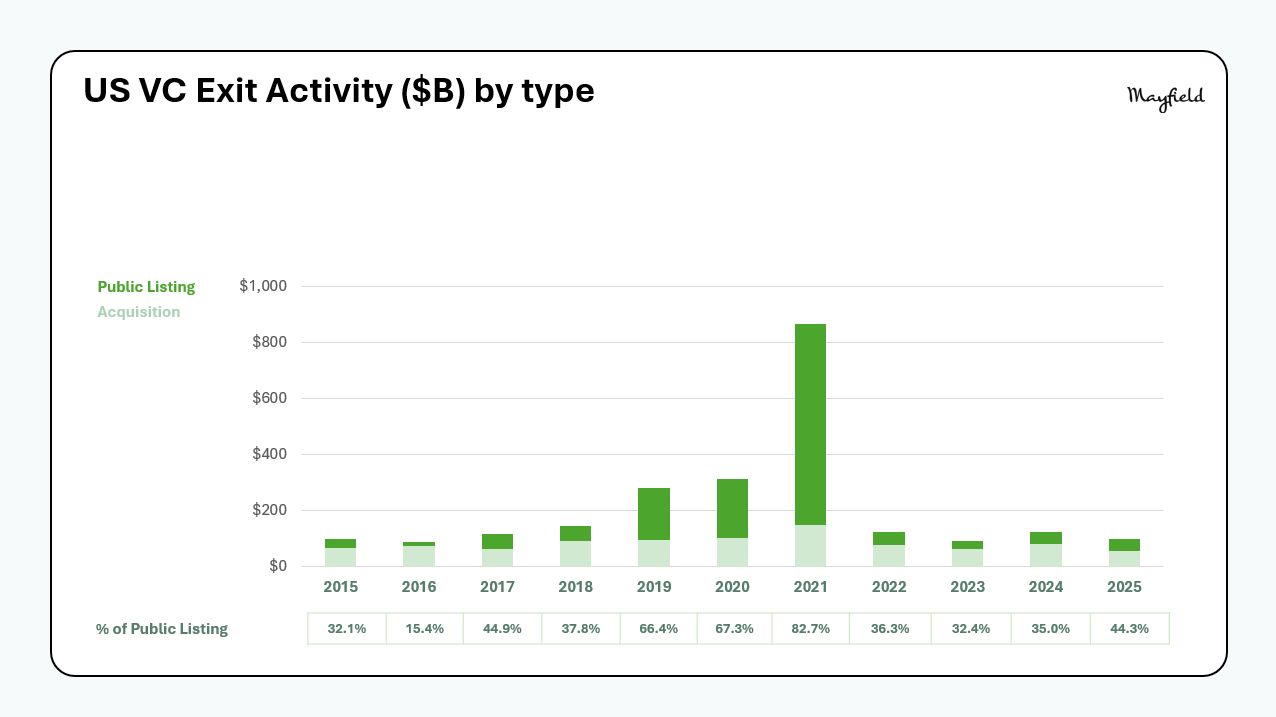

The exit market tells an encouraging story. While exit activity remains modest compared to peak years, 2025’s total exit value is on pace to exceed that of 2022-2024. Confidence in IPOs is gradually returning; however, only the elite companies with the right metrics are listing for now.

The exit data above shows an important shift in liquidity strategy. While 2021 saw 82.7% of exit value come from IPOs, 2025 is projecting a more balanced 44.3% IPO/55.7% M&A split. This suggests that until public markets fully reopen for venture-backed companies, M&A will likely gain strength as a viable path for startups.

Bottom line: Build with durability. IPOs may take time, but solid growth and execution can open up paths for strategic acquisitions.

The Q2 data reinforces every trend we identified earlier this year:

✓ Record capital deployment: $325.6B projected deal value for 2025

✓ AI market dominance: 64.1% of all VC deal value

✓ Larger checks, fewer rounds: $20.1M average deal sizes up from $14.1M last year

✓ Experienced investor preference: $49.6B expected to established vs $3.6B to first-time funds

✓ Exit landscape is coming back slowly: Exit activity improving from 2022-2024 lows

The next decade will produce the most valuable companies ever created. The companies getting funded today will have real revenue, real customers, and real paths to profitability – they’re building must-have “painkillers,” not “nice-to-have” vitamins.

For AI founders: You’re building in the fastest-growing, best-funded sector in venture history. The question isn’t whether there’s opportunity – it’s whether you can move fast enough to capture it.

Looking at the decade-long trends, it’s clear that we’re not just entering a golden era for startups – we’re accelerating deeper into it. The next Amazon, Apple, Google, Meta, Microsoft, NVIDIA, or Tesla will be built in this decade.