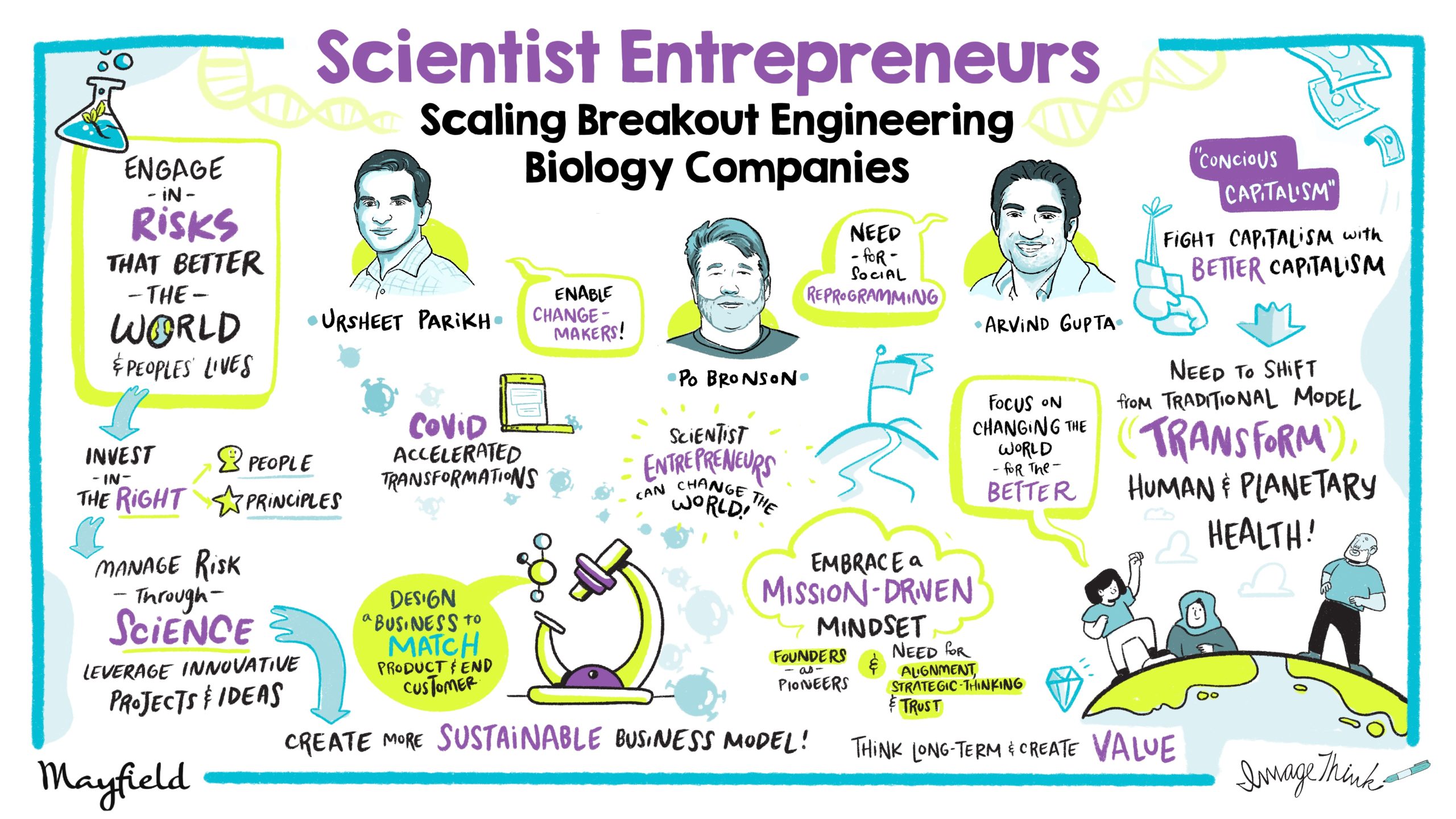

Biology as technology will re-invent trillion dollar industries and enhance human and planetary evolution. In this session at TechCrunch Early Stage 2021, two early-stage investors and company builders, Arvind Gupta and Ursheet Parikh, connect with leading author and seed investor, Po Bronson, Managing Director of IndieBio. They share their playbook on scaling start-ups touching upon three seminal areas which influence trajectory — fundraising, hiring, and product design. Their insights draw on their experience with companies including ingredients-as-service leader Geltor, which raised a $91 million Series B in 2020, CRISPR platform Mammoth Biosciences whose dream team includes co-founder Nobel Laureate Jennifer Doudna, and Endpoint Health, started by the founding team of GeneWEAVE (acquired by Roche) and former YC Bio Partner Diego Rey, which is designing a new class of therapeutic products that focus on hospital conditions that kill as many people as cancer.

Transcript

Po Bronson:

Hi, welcome. I’m Po Bronson. I’m the managing director of IndieBio, and a general partner at SOSV. And in this hour, I’ve got two wonderful VCs from Mayfield, Ursheet Parikh and Arvind Gupta, who lead their engineering biology practice. And today, we’re going to talk about something dear to everyone’s heart, building companies to make an impact on human and planetary health, which this year has really reached a crisis stage. Hi, Arvind. Hi, Ursheet.

First question to you Ursheet, and then to Arvind, just introduce yourself to our audience, but I want you to finish with a quick lightning round. Drop in no more than five companies you’ve done that exhibit your work in this space.

Ursheet Parikh:

Sure. Well, good to see everyone. I am a former entrepreneur. Actually, a Mayfield entrepreneur who joined Mayfield in 2013. I invest in enterprise technology, and then with Arvind, co-lead our engineering biology practice. It’s great to be in this particular practice because whether we are investors in a company or not, we really want everybody we meet, every company in the domain to be successful because it makes all of our lives better.

And to your lightening round question, Mammoth Biosciences, Endpoint Health, Nesos, Mission Bio, and Qventus are some of the publicly known companies where I’ve had the opportunity to champion founders and leaders.

Po Bronson:

Thanks, Ursheet. Arvind, follow up as well to you.

Arvind Gupta:

Gosh. So my background is genetic engineering. I’m also a designer. And blending those two background together, had the idea to start IndieBio, which I founded in 2015. And the whole premise is that scientists can become entrepreneurs and build product driven companies that can change the world. And that could extend beyond just therapeutics, into worlds that people hadn’t previously imagined from food to fashion and beyond.

Recently, as Ursheet and you’ve mentioned, I joined Mayfield. I’m very proud of that. I’m very proud to work alongside Ursheet and Navin and others to extend that mission and to drive more capital and more resources into that purpose.

Po Bronson:

Okay. Lightning round, remember five companies.

Arvind Gupta:

Five companies. There are so many. I’ve invested in over 150 companies. Five off the top of my head. Let’s see. Memphis Meats is really well known. Michael works, Geltor, Prelis, and NotCo.

Po Bronson:

Awesome. So it’s fascinating, because to both of you, when you describe these companies, we all know you are both taking a lot of risk. You’re going into areas the world thinks it was risky. Ursheet, sepsis, the brain, CRISPR. Arvind, barely know where to start with you, but human immune system, outside the body, leather without the cow, first VC into cultured meat. Tell me a little bit about your feelings about risk, how much you like it, how you manage it.

Ursheet Parikh:

Go ahead, Arvind.

Arvind Gupta:

So my whole life has been about managing risks. And not many people know this, but I was a base jumper and I don’t base jump anymore, but a rock climber. I’ve climbed El Cap. And it’s really not about getting away with it, but it’s about figuring out how to do it safely. And that’s carried over into my venture career and in doing improbable things. I oftentimes see founders that say or show what they’re doing and you’ll be like, “Well, why tackle that problem when the much bigger problem is right next to it and you can easily do with your technology and your mind?”

And they say, “Well, most VCs tell us that’s more risky.” Well, what’s riskier, going after the smaller idea that isn’t going to go very far, even if you’re successful, or changing the world with what you can make and what you could produce with your own mind and creativity? I fully go for the latter. I think that is where the right risk is. And it allows everyone to align. It’s not about trying to make some money. It’s actually providing value to people that could change our lives. And in doing so, using capitalism to fight the old capitalism that has led us down to the path we are, which is ruinous destruction and climate change, which is upon us.

Po Bronson:

Ursheet, what do you think of that, and how do you think about risk? Same way?

Ursheet Parikh:

Actually, I think it’s a little bit of a mirror image, but very consistent. We personally look at a lot of these problems. And when I look at the problems we have with regards to global health or the health of our planet, they are the biggest entrepreneurial opportunities of all time. There’s no fixed formula around on it, but two things really stand out for us in the way we look at it. The first is it does start with people, and it doesn’t matter how awesome the starting technology is. People are the ones who build the companies. So really understanding them, their mission, how they operate, how they learn.

Two of the most important attributes in entrepreneurs that probably are not spoken about enough is intellectual honesty along with continuous learning and the ability to learn. Because entrepreneurs just go on to do amazing things. To do that, they end up having to learn a lot in a very, very fast time period. The second thing is it often requires some really good first-principles thinking. It does require understanding why the world is broken the way it is. You cannot necessarily ignore it. You want to make new mistakes, not the same ones that people have made before, but it does require first-principles thinking.

And so when we were partnering with Jason, Diego, and Leo Teixeira worked for Endpoint Health, they had been on a mission to save lives for the top killer in hospitals, which is sepsis. And it really started with understanding why that was happening. And besides the core understanding of the disease, the business model of that category of therapeutics was broken and so it required a new way to look at it. When we saw CRISPR, it felt like a core bioengineering technology. And rather than our company trying to keep a monopoly on that technology, it became much more about enabling an ecosystem to build many new applications with such a platform. You get a similar bioengineering platform.

When we were looking at Nesos, it was the realization that therapies for the brain diseases are so far behind say other areas. And it’s maybe because we might be looking at the brain all wrong. Think about it. The brain is reshaped every time you sleep, train, hear, talk. And at the same time, it’s designed to be different from animals, so the classic drug development may not work. And it’s also designed to not take a lot of new drugs. And so maybe there is a new version of therapy that is actually understanding the communication language of a nervous system, which is electrical signals, and using that to unleash the power of the brain to control the immune system.

And so as crazy as it sounds, these were some of these first-principles starting points with amazing people and partners. And then as Arvind said, fundamentally, it’s about managing risk. So where do you take something from science, which is not what the entrepreneurial ecosystem is set up well to find. It’s not science, but it’s like taking that science into a product that actually really can then become the basis for a business. And then building a platform company. Those are the things that we love to partner with people on. But yeah-

Po Bronson:

So I want both of you to apply to this, but stick with science just for a sec, because we are going to get to scaling business. But Ursheet, you said something fascinating to me last week. A lot of VCs, we talk about programmable biology, but you took it to another level. You were like, it’s programmable, but it’s programmable and far more than genetic code. It’s programmable with any form of energy. And I think you were just speaking to that. I thought it was brilliant. What are some other examples of how we can program biology, not just with the genetic code itself?

Ursheet Parikh:

Correct. So I think if we look at biology, biology as it exists on the planet is responding to many, many different forms of energy. I was just talking about how electrical signals end up being that you can have the same thing happening with light. You can have the same thing with materials. And then if we go back and look at traditional cultures, they’ve had different attributes of how just wellness and other things play out.

I think the key is if you have to take ideas or concepts which are not mainstream accepted and make them real, the onus does end up becoming on the company to actually create the evidence and create business models that can sustain the companies through leading that change and really creating a movement and then getting everybody to board and join that movement, but … Sorry. Go ahead. I really wanted-

Po Bronson:

Well, no, that’s good. But Arvind, I’m going to push you now. Let’s talk about scaling a bit. It starts with the fact that a platform isn’t a product. Everyone wants a platform, but it’s not a product. And you said to me the other day, there are no biotech companies. There are only consumer companies and enterprise companies, which that was a hot tick, and I want you to unpack it for people.

Arvind Gupta:

It’s less of a hot tick and more obvious. So when you really think of … Biotech is simply a foundational technology. It doesn’t imply any value creation. Consumer companies focus on products that end people use and buy, whether it’s in stores or wherever. That requires a full value stack. That requires communication of what the product is. It requires all of the things that are necessary for a solution to a problem that a person has, getting into their lives.

And likewise, I can ask you, is … The same thing for an enterprise company that’s doing ingredients into … Is it a biotech company? No, that’s just their technology. That type of company just has a different sales channel. It has a different end customer. That end customer is a business with different margin structures. So how you design the business from the very beginning is completely different.

And if you don’t design the business from the very beginning to match the product and the end customer, you’re hosed, because you’re going to run out of runway, you’re going to have to pivot around. It’s going to cause all sorts of heartache and real issues. I learned this from Ursheet, and I learned this from Mayfield really. As I was going through all the IndieBio companies, as they were scaling, it was a real opening eyeopening experience for me. As they started to hit the market realizing, oh, actually, distribution channels, putting chemicals on trains and the volume it takes directly affects your margins. Because how many train cars do you need to lease?

So it gets mind blowing. And so if you don’t think about all of these specific things in a margin structure that makes sense for your business, you don’t have a business anymore, and therefore you don’t have the change you can create. We’re using capitalism. One of the reasons I joined Mayfield is Navin coined this phrase, conscious capitalism. And you and I, Po, wrote about it in our book as fighting capitalism with capitalism.

Po Bronson:

With better capitalism.

Arvind Gupta:

With better capitalism. And that’s it. And so it’s about building these businesses in the right way. And going back to the programming biology with anything, Ursheet talked about making movements right at the end. And I want to make sure we put a pin in that, because if you abstract it all the way out, to create movements, you’re actually reprogramming biology with culture. So you could extend all the way, and-

Po Bronson:

I like that. You’re reprogramming biology with culture by collective mass movement that’s inspired by the companies and the founders voting with their dollars-

Arvind Gupta:

That’s exactly-

Po Bronson:

… and their culture is literally reprogramming the sustainability of the planet. That’s fascinating.

Arvind Gupta:

That’s what we’re doing. And whether we recognize it or not, everyone in our industry, that’s what we’re doing. And when you see news articles and industry reports about making weather without the cow or whatever product you’re reading about, that’s what’s happening. It’s a reprogramming of society. And-

Po Bronson:

I’m going to interrupt you. Because I’m the host, so I get to do that to keep us on track. Because I want to establish how much this contrast is there or not. Obviously, where engineering biology has taken biology is into lots and lots of markets, but you’re still firmly rooted in human health. And so let me ask you how different the engineering biology practice at Mayfield is than traditional biotech. So one might say you’re reinventing the economics, reinventing the nature of the risk, or one might say, “Hey, it’s biology. There’s always huge upside and fundamental risk there.” So in your minds, do you feel like you’re doing biotech, or life sciences, or do you feel like you’re doing something different? How unique is it?

Ursheet Parikh:

So I think we have the benefit of being at a firm which has been in business for over 50 years, has had a chance to create profound companies in biotech itself, the Amgen and the Genentechs, and the Intuitive Surgicals of the world. But in the current incarnation, the genesis of what we are, we really started with the mission of transforming human and planetary health. And that has been a big thing. So in the clean tech era, one of the best companies at the clean tech era, before Tesla or SolarCity, and that was an example of a company that had happened.

But if we are thinking about it, we think about just as you can program biology with many things, ranging from drugs, to electricity, to light, or any of that. To transform human and planetary health, there have been other technologies that have existed. There’s been Silicon, there’s been software, there’s consumer companies that we have like Grove. There’s companies like [inaudible 00:15:27], which are of cycling. There’s companies like Tonal, which are really about transforming consumer health and that sort of things as well.

And so one thing I ended up learning from Arvind five years ago is to really start thinking about biology as a technology that can be used to solve this full set of problems. And then as we start looking at this as a additional technology to solve these problems, fundamentally how we think about company building differs from traditional biotech as follows. In traditional biotech … And it wasn’t like that. So if you look at the startup biotech, when Amgen and Genentech were funded, they were not funded to create an asset and then sell the company.

So traditionally, biotech was also like tech to go build companies. Then in the ’90s, as the tech and the bio innovation space changed, a lot of bio-investing and the entrepreneurial and venture ecosystem really became about taking a project off and coming out of academia. Funding some additional clinical research on it, taking the data and then selling the asset. Now, one thing that we’re really passionate about at Mayfield is if we are going to have the solutions for human and planetary health, they’re not going to come from a lot of the large companies who’s watched these problems have emerged in the first place.

So we’re going to have to have a set of entrepreneurs that build the next generation of lasting companies. So now, if we have to do that with engineering biology, it can’t happen in a traditional biotech model, because as soon as you flip your asset, your mission’s lost. It’s become a cog in the wheel of a different entity. And they just are not going to be able to really make the automation their own. And so then this starts with the very foundation of the company.

How do you get the stakeholders aligned for the long haul? How do you design your business? How do you set up that culture? How do you think of your technology as not a project, but a product? How do you get it to market? How do you then show commercial scalability? How do you raise the capital, run the industry conversation out on that? And how do you build a commercial org to get success with your first product? Then you take that footprint and get a lot more product in the pipeline and partnerships with the ecosystem to really create a platform and a company.

And none of the success is accidental. So it’s great to be in this time where despite COVID in the last 24 months, we’ve seen several of these platform companies make it in both planetary health, as well as human health and collective consciousness. And it is to try and see how we can go ahead and engineer company building. And-

Po Bronson:

We’ll come back to COVID in just a second, but let me stick with what you’re describing about alignment. And let me ask this question in the form of just two words. Lightning round question. I’m going to say two words, and then Arvind, you can start. I just want you to react. Alrighty? Two words. Mission driven.

Arvind Gupta:

Founders.

Po Bronson:

No. You don’t get one word. You got to react. This isn’t a therapy, man. Expound. Mission driven. How do you think about mission driven? Every wants to be mission … How do you think about it?

Arvind Gupta:

So mission driven. First of all, the first thing that comes to you is founders, because it’s the founders’ mission in the end. It can’t be mine. And so I think often times, venture capitalists will project what they want onto others, “Arvind, you can do that.” So first of all, I’m excited to meet founders that are mission driven, that have the ability to start movements, to program culture, and reprogram society through their actions.

I’ve seen it many, many times in companies I’ve founded. And so there’s a obsession with those types of founders about the end consumer or customer that they’re reaching. They have to feel like that is their goal. Not the gizmo necessarily that’s going to get them there. The gizmo could change, but the end customer or consumer, and giving them a better life that results in a better society or better future, those two things, that Venn diagram that’s in between, that is the sweet spot when I think of mission driven.

Po Bronson:

Ursheet, how do you think about mission driven?

Ursheet Parikh:

I think it’s mission ahead of everything else. It also means that it literally translates to entrepreneurship because there are a few things out there, few constructs that can allow for the change that is needed to realize the mission the way entrepreneurship can. No amount of publishing papers, no amount of nonprofit boards and conversations will go out and do that. And then that moves to this built to last. Because realizing that mission just cannot happen in a short time, and so it does require great tactical execution, but amazing strategic thinking and just always doing the right thing.

Po Bronson:

Let’s use an example. So I want to give you one. It’s quite an interesting story, so with Mammoth Biosciences. You all became the first CRISPR product to market, which is amazing. And with COVID testing, an incredible pipeline of partners there for Mammoth. But not that long ago, when you started with Trevor it was going to do STD testing and it was going to be 2024 before it reached the market. So how did you get from that plan to what you incredibly have done today? That’s scaling in a way that we often don’t hear in this industry.

Ursheet Parikh:

So when we met with Trevor for the first time, his mission was where he saw that CRISPR was a technology to program life in one way. To read and write and edit the code of life. And his mission was that the long-term company would be something that powers the whole ecosystem, like Intel Inside. In fact, they literally had a version of that Intel Inside logo that they had in that first step. And then as they were given feedback by the entrepreneurial ecosystem, it was something that had to be put away, maybe in the appendix and not early on. And so they took that feedback and figured what would be the first insertion product and came up with what would be an STD test that would be in the consumer self pay model that could come to market faster?

So that is how they were … The opportunity we had was to really understand what they wanted. We participated in their seed round and then spent a good amount of time trying to peel the onion on the core vision. And then it became pretty clear that what we needed was a CRISPR platform company. And to that effect, while the company had licensed something out of UC Berkeley, they needed a core innovation engine, and they needed a lot of the heft on the IP side.

And so we got into a conversation with Jennifer Doudna and shared our vision. She had a certain direction and vision back then. And there was another company that was coming out of her lab. Two of the best graduate students she had out in her career. And you could see that these founders were quite aligned in their mission and direction. They wanted to get it to market. While CRISPR was coming with therapeutics everywhere, they wanted to see the impact in patients. They felt diagnostics was going to be a fast way of doing it.

But the core thing, the conventional wisdom was to a diagnostics company or a therapeutics company. And it wasn’t recognizing that this technology was starting with a CRISPR innovation engine that would find new CRISPR systems, develop new CRISPR systems for different applications. And then diagnostics and therapeutics were just two applications. There are other applications in ag and then bio-defense and a range of other places. And so we were able to go ahead and align on that mission, and then design the company and the business and all the stakeholders on that journey, form very deep trust relationships.

One thing that people … It’s like when you have very deep trust between the early stakeholders, founders, investors and other advisors and mentors, it really allows for an exponential speed up. It’s one of those slow down to speed up things. And so the whole process to figure this thing out, this business design, we weren’t doing a lot of science at that time, but it took us three to six months to figure it all out. But when that happened, you can see three years since, the company has accelerated so much. And about a year ago when COVID was happening, they were so well poised to actually go ahead and bring the first CRISPR based products to market with the COVID test.

And the recently launched COVID CRISPR test from them increase the actual capacity of our country to do COVID testing by an order of magnitude with the existing labs. So I think it’s a privilege to have been in those conversations and to have enabled in our way the pharma’s vision. And there’s a lot that goes into this. And as I said, it takes a village to-

Po Bronson:

Well, let me give Arvind a chance here to add some of this. Because Ursheet, you talk about essentially being on a team with the founder. Arvind and Ursheet, you guys are on a team. And Navin and Tim is on your team in this space. Arvind, you’ve known the guys at Mayfield for at least six years, but nine months of working together. Ursheet earlier mentioned stuff he learned from you and what you’re doing at IndieBio. Tell us a little bit about you’ve been learning from them at Mayfield since you’ve been there.

Arvind Gupta:

Man, it’s been a massive learning curve, as you could imagine. That was the goal of working with Mayfield, and that goal is being accomplished. I think one of the biggest things is really understanding how to topple incumbents. Truly thinking all the way through. Not just getting these companies started, but all the way when it gets me into the nitty gritty, how do you keep … You’re getting the success, the incumbents want you out of there. How do you keep going and not become part of the problem and get shuttered? How do you go around that and make it all the way to IPO and then continue in the public markets and continue to create value dependably?

That’s the timeframes we’re talking about. That’s the timeframes that Ursheet, Tim, and Navin have built value in companies, literally. That’s something that’s rare and something that I’m excited about continuing to learn. And it’s different for different companies, it’s different for different founders, different industries. And so it really requires this long-term thinking and this ability to build, not just in, “Okay, we got to get a series A company funded,” or, “It’s series B, we got to get it funded.”

A, funding is not success. It just allows you to play a little bit longer and achieve your goals. And so if you don’t have clear goals and ways to achieve that long-term thinking, you’re getting sloshed around by turbulent seas and you end up drowning usually. But with that long range purpose North Star, you could chart your own course and make it all the way through. That to me is really exciting. And that’s what I’ve been learning in spades and I could write a book about it.

Ursheet Parikh:

Decoding the World is a nice book. That was a fun book.

Po Bronson:

Thank you, Ursheet. Really appreciate it. So you’re describing the challenge of knocking off incumbents. Do you have a framework? You guys just get to know you’re coming one at a time? Do you have a playbook here? Boy, who wouldn’t love to know how to knock off incumbents?

Arvind Gupta:

It is a playbook. I’m not sure. Some of it can’t be shared here obviously, because these are the learnings of the past 20 years. Navin was one of the very, very few venture capitalists that made money in the clean tech 1.0 wipe out. And there’s some very distilled learnings and a playbook that’s come out of that. And that’s directly being used right now in some of the companies we’re using. And so it’s good.

Po Bronson:

I don’t want to push too much. Let’s go with as you mentioned, because you just mentioned clean tech and making money in clean tech. One of the only people. A few. You’ve been doing human and planetary health for quite a long time. A lot of people are just jumping on to it today. Recently. We say, how many carbon funds have we seen in the last year? You guys have been doing this a long time. So I’m curious what’s your newest evolution of your thinking here around doing companies to make an impact on planetary health?

Arvind Gupta:

Specifically on the planetary health side? I think really making sure the latest evolution first to market, understanding that there are more markets than just food. I think that people are just starting to wake up to that. Michael Works is a great example of the first breakout. There’s going to be many, many more. Think of it this way. If a lot of this behavioral change, social reprogramming that we’re talking about is occurring because of climate change, what you eat immediately goes in your stomach. What you wear doesn’t. That is a billboard for what you stand for all day long. So I’m going to leave it at that, and you can imagine where these things go.

Ursheet Parikh:

I’ll definitely say the one thing, and we’re beginning to see more and more examples of that. I have a teenage daughter and she often … And it’s amazing how much she really worries about what’s happening out with the world. And really what is more worrying is that majority of the world doesn’t care. But guess what, there is a subset that does. And so if you can enable them to vote with their dollars on your innovation, then they become the people who program the culture and make that change happen.

And so the business design, often a lot of companies are made by scientists and entrepreneurs, and the right engineers. And so there’s a strong desire to just go and build a set of things. But I think if you could get the business design right, so those constraints bring focus and that helps actually make the problem narrower. Sometimes it can expand. You have to do a set of things more, but then you think about what all can you leverage. But the point being those constraints bring so much focus that it actually creates for a lot less trashing data and a more successful company.

So I think in the newer incarnation, we definitely encourage entrepreneurs to think about how, just because we are doing the right thing, people will buy it or will follow versus who really cares about this and how do we enable them to vote with their dollars. And people, organizations, whoever that may be.

Arvind Gupta:

That’s right. That’s a real focus for us. I could say for all the founders out there, they’re building product-driven companies that have an angle into impacting climate change or planetary health. That’s what we do.

Po Bronson:

Ursheet, you mentioned this earlier, that time of the pandemic altered things, is often called the great accelerator. Certainly pushing people online and watching more Netflix and the like. How has it impacted the human and planetary health sectors?

Ursheet Parikh:

I like to call them the silver linings from the COVID era. I think the first is we’ve had the e-commerce moment in healthcare. It had been building up for a while, and the technology was all largely available in there, but it just required COVID to get people to break out of the habit of always asking to see patients in person. It never made sense from a first-principles perspective to take an infectious disease patient and get them in to the clinic rather than seeing them on the telephone.

But not only that, it makes a case for making health equity happen much more easily. It’s a luxury to be able to take two or three hours off from your weekday to go see your doctor for a preventative care thing versus the … And there’s a lot of people who are working hard to make ends meet, who just don’t have that time. And so the convenience that comes along with the ability to get your medication quickly. So I think it’s going to be a big factor in changing practices to make our care system better and lower cost.

But the other thing that also it did is it changed processes everywhere, not just … Even at the FDA, for example. We had two fundamental platform technologies to get their first products to market during COVID. mRNA vaccines, they’ve been trying to get the cancer vaccines to market for seven, eight, 10 years, and we were able to get a vaccine to market in a year or less, to hundreds of millions of people within a year. And then CRISPR’s first clinical products as we’ve seen come in with diagnostics.

So I think these things happened not because the scientists were working as hard, but a lot of the large company ecosystems that you depend on to build the products or the government processes and practices. They evolved as well. The other thing it did is it also accelerated transformation in other industries. For example, wellness in the home. A company like Tonal and Peloton. You saw that break out. But as people spent more time in the home, they started caring about what products they’re using.

And there’s a company called Grove which actually gives you cleaning products that are better for you and better for the planet. And that’s an example of a company that really broke out. Initially it was because people couldn’t go out shopping as much or they were afraid, but then the other part is even as COVID is coming more and more in control and business continues to grow. Because people can see, why do you need to take so many petrochemicals and have them in such proximity when there are better other alternatives that could work as well? Why do you need packaging, which is this big versus you could have something this small and just add water to it and things like that.

Po Bronson:

It’s interesting. I love how you’re elucidating all this. And I like the framing of silver linings very much. But I want to acknowledge that we probably have a lot of founders interviewing audience. These are spirited people who the world probably hasn’t heard of at least yet. So for both of you, let’s imagine … Arvind, you’ll start with this one. Let’s imagine they get in a room with you. All right. So give me some red flags, some no-nos. And what gets them a second meeting with you?

Arvind Gupta:

Oh, gosh. Well, one, you have to be mission-driven. And that’s hard to fake. I think really, really focused on the customer, really care about your innovation making into the world rather than proving your innovation can work. Those are two very different things. And I’m looking for founders that are talking more about how they see it getting to people and changing their lives and what that world will look like. Then let’s go talk for an hour and a half on how brilliant I am. I know you’re brilliant. I know you’re brilliant, but I want to see the world change.

Po Bronson:

Little less prove me it works, and a little more prove me people care.

Arvind Gupta:

There’s plenty of time to prove that it works. You asked for the first meeting, the first thing that matters is if it did work, whose life changes, and does that sum up to a world changing? Does history change?

Po Bronson:

Ursheet, for you, red flags, turn-offs, or other things that you particularly love to hear?

Ursheet Parikh:

So I really don’t have a set … So I don’t have a set formula. I can share a wishlist. But I’ve had the great fortune of working with founders who’ve come right out of college to founders that have gone on to take products to market, to commercial scale, and companies that are billions of dollars. Constantinos, Nesos, or several other folks like that. I think on my wishlist is in that first meeting rather than tell me what you think VCs want to hear, telling us what’s really in your mind, what you want to do, why you want to do it. Recognizing that of anything that anybody can choose to do, entrepreneurship is probably the hardest thing to do.

There is just easier ways of making money than entrepreneurship. So it does start with a certain degree of authenticity and then a certain willingness to engage in conversation and learn. And not everybody is everybody’s going to be great at everything, but we clearly want to walk out of that thing feeling really healthy, respect for something that you are doing, or something that’s new or novel or something that I learned in conversation that I probably wasn’t aware of.

And given that one of the best privileges of our jobs is we get to learn from the smartest people every day, which are the entrepreneurs changing the world, if we try and say something, it’s really coming with the intent of enabling their success. I think that Arvind, you know there is a promise that you don’t have to worry about what we say versus what we mean. And it’s coming right … As what I said at the beginning of this session, anything that is said is coming really with the intent of whether we are investors in the company or not. We want the company to succeed. The entrepreneurs really are the ones who change the world, make our lives better.

Po Bronson:

So I think you identified something. And we have less left, but I just want to hang here for a second. Is the founder ready really for the life of an entrepreneur? Now, that’s an internal state. How does an entrepreneur themselves know whether they’re really built for this or not? Is there any way that you’ve found to work with them to help them understand whether they’re right for this, Arvind? You’ve got less than 30 seconds.

Arvind Gupta:

I think don’t think, do. You’ll find out along the way. It’s like saying, “Am I ready to take a grappling match?” Go, find out-

Po Bronson:

I love that answer. So thank you Ursheet and Arvind and the engineering biology team of Mayfield. Thank you for spending time with me today. Really appreciate your insights in this event for TechCrunch. Thank you very much.

Arvind Gupta:

Thanks, Po very much.

Ursheet Parikh:

Thank you everyone for listening.