For the past 9 years I have been investing in companies reinventing our supply chain to become carbon negative. I founded IndieBio in 2014, have invested in over 150 companies and helped pioneer the new foods sector, being involved at the inception stages of food companies such as NotCo, Upside Foods, and Prime Roots. When I moved to Mayfield two years ago, I continued my mission to help founders by supporting them from inception to iconic. I thought I was done with cell based meats and food. Turns out, I was wrong. My Mayfield investment journey began by leading Prolific Machines’ $3.1 million seed round and I am excited to share the news of their $42 million total funding from fellow top-tier investors.

Here are five insights I gained from investing in Prolific Machines.

1. All revolutions have two waves

Every technological revolution in history occurs in two broad waves. First comes the innovation wave where the key features and capabilities to disrupt an industry are invented and demonstrated. The second and much larger wave is consolidation, where the innovations are made affordable and accessible to all (if we are to draw these waves to scale, the second wave looks more like a tsunami in terms of historical impact). Then, the cycle repeats, with innovation once again eroding away the advantages of the prior consolidation. We currently sit at the tail end of a 10,000 year consolidation of the food chain, where incremental innovations and consolidations have led to affordable beef, chicken, pork, corn, wheat and a handful of vegetables in every grocery store in the developed world.

A modern cow is a meat factory, producing ribeye and filet for low cost – and it’s remarkably successful. Over 350 million cows are killed every year to feed humanity. 72 billion chickens. 1.3 billion pigs. 345 million tons of meat are produced a year. Over one trillion dollars are earned by meat producers yearly. But this biological factory is outdated and destroying our planet. To feed all the livestock we consume, 20% of all greenhouse gas emissions on the planet is released.

This is remarkable. It’s also unsustainable. So a new class of alternative protein companies were born.

This first wave of revolutions, the innovation wave, has spawned hundreds of alternative protein companies over the past decade and have demonstrated market demand and product features. Plant based foods are ubiquitous but not the same as the real thing. Cell based meats have only been tasted by investors. Making everything harder, the cost of capital has recently risen, eliminating the ability to profitably scale by simply adding more capacity. We have to lower the cost of capacity to get to profitability.

The second wave of revolutions, the consolidation wave, is driven by innovation in production. For millennia, it has boiled down to reinventing the assembly line. Early in the industrial revolution, the spinning jenny enabled one person to do the labor of a hundred by reinventing the method of spinning cotton. Fifty years later, Henry Ford famously created the idea of an assembly line for automobile manufacturing, breaking down the labor into specialized roles while the car moved past them. He created a consolidation wave that collapsed the number of car companies at the time from hundreds to just a handful. Elon Musk took this a step further with casting the Tesla Y chassis in just a few parts. Assembly line innovations create powerful moats. The catch is, it’s hard to invent new assembly lines.

After meeting the Prolific Machines co-founders, Deniz Kent, Max Huisman and Declan Jones, I saw a company that could become the second wave forming on the horizon.

2. Great founders are radical

Great founders are radicalized by a perceived injustice in the world, and build their company to right it. Steve Jobs once remarked to his engineers that every second the computer took to boot up was wasting their users’ lives. As we were getting to know Deniz and his co-founders, we were listing the various applications and business models of their technology. Their eyes would glaze over whenever we strayed from food. Finally I asked, “Why do you keep coming back to cellular agriculture?” Deniz took a breath and began. “When I was a kid, I grew up in southeast Turkey near the border with Iraq, and when the war with Iraq erupted, thousands of refugees flooded our town. I saw the horrors of people on the move, the pain caused by fleeing a bad situation and the lives it upended. I realized that is what will happen globally during climate change and we want to stop that from happening.” He and his co-founders looked at me, steel-eyed.

I immediately realized that the refugees overrunning his town was the very face of climate change to Deniz, the event that radicalized him into action. Deniz told me he worked on vaccines at a large pharma company but realized his background in stem cell research could be used to fight climate change by eliminating animal agriculture and beyond. He then used his power of mission to recruit the top talent needed to execute his vision for the best tasting, lowest cost meat on the planet. The political refugee crisis of Turkey caused Prolific Machines to be born. The incredible talent drawn to the injustice of climate change will help Prolific achieve its goals.

3. Meat production and drug production are the same

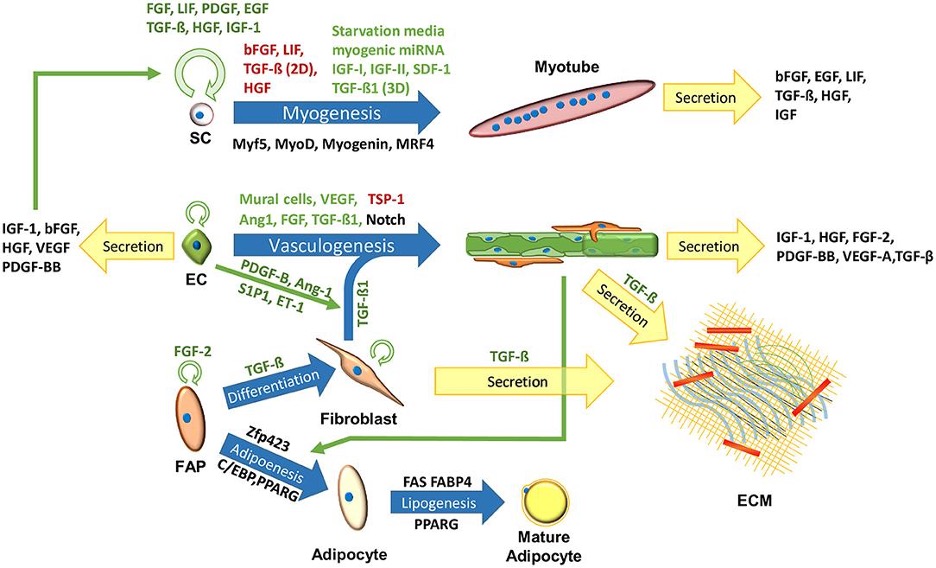

The heart of Prolific Machines’ approach to reinventing the assembly line for food is rooted in identifying the most expensive drivers of cell culture. Cost analysis shows that by weight, growth factors are by far the most expensive part of growing food – or anything really – in culture. So Deniz and his team had devised a novel way to eliminate the need for these growth factors in mammalian cell culture. What that means is it would theoretically enable cells to grow at the cost of electricity and basic nutrients like sugar.

There are many approaches to make growth factors cheaper. But none that I know of to eliminate their need in culture altogether. That is what Prolific was proposing to do (exactly how will be revealed after the final bricks in their patent wall are placed). But if eliminating growth factors is possible, the impact on humanity would be enormous. Meat production and biologic drug production would become the same thing, with different programs for the cells – the same inputs with different outputs. Biology programmed to produce what we need. Meat grown in culture at costs below factory farmed cows. Therapeutics like antibodies and cell therapies could become drastically cheaper, enabling life saving drugs to become affordable around the world. Human breast milk could be made in culture, eliminating baby formula shortages and replacing it with the real thing. Industry after industry, sector after sector could become supercharged with lower price, sustainable ingredients.

4. Thinking big and small

Translating a founder’s true vision and their radicalized self that they hide from the public, potential investors and even their parents, into a working business with milestones that represent the future well enough to create value inflection, is what I love to do. At the inception stage of companies, the seed or even pre-seed rounds, it is not about thinking fast and slow, but thinking big and small.

The big is as hard as the small. Not many VCs want to take risk – meaning career risk – by going after an audaciously large goal. Easier to sleep well at night by doing something achievable. I find the opposite to be true. Everything is hard, everything is risky and nothing is guaranteed. So going after something big enough to matter makes sense. So many founders I meet tell me they didn’t dare share what they really want to do because it scares investors. I am always surprised by that. It’s in the translation from a vastly big idea to the daily tasks where people lose their way.

Navin Chaddha, Mayfield Managing Director, gave me sage advice to be a great inception stage investor. He said, “first you are the management consultant (build the business model), then the recruiter (help hire great people), then the banker (help get them financed).”

With Prolific Machines, I work with the team weekly to help block and tackle the minutia (who is the best IP strategy team?, etc), while helping Deniz to make the big strategic decisions relative to the runway. We hired a phenomenal chief of staff to offload critical work from Deniz. We brought on the best engineers in their field. I had never spent my entire energy on just a few companies, and it was amazing. I realize that networks matter. The better the investors’ networks, the dollars go further, faster because calls get answered.

Our weekly board meetings flew by and the team made fast progress. We kept things very quiet. After a few months, when the first signs that their basic technology could potentially work were replicated, we decided to step on the gas. We needed a large Series A with a great investor who could help our mission. I knew who to call.

Cooper Rinzler, a partner at Breakthrough Energy Ventures, would come by IndieBio and we would imagine solving climate change with lasers and more, pushing the boundaries of what was possible. But the truth was we were bonding over our missions, coming from opposite angles – he from later stage and scaling, me from inception stage and shaping. We always looked for ways to work together. Now at Mayfield, we had the chance. I know Cooper and Breakthrough Energy Ventures have a tight scientific diligence process. They don’t fund vaporware, nor companies with no chance to move the needle. If it can’t truly dent climate change, they pass. As Cooper and BEV dove in I watched Deniz grow. Fast. At Mayfield, there is a saying, “No company can grow faster than its founder.” And it is so true. As we worked in direct mentoring sessions, Deniz absorbed everything, from how to handle a room full of investors to confidentiality and all the soft parts of building trust. The team worked long hours to create an 80 page diligence document. Humbird’s famous whitepaper (a paper that details the scalability problems with cell culture) was invoked and many assumptions tested. Countless hours of meetings and papers written. After a month or two, while Cooper was on a long-planned vacation in Italy, Prolific Machines signed the Series A term sheet. That was now a year ago.

Since then, the Prolific team has grown to over 20, with the world’s best in their subjects moving house and home from around the world to join the team. The company is moving to Emeryville into a 10,000 square foot facility that will include a demo assembly line with the ability to supply the first customer. And a cadre of restaurateurs and celebrities have become involved in the development of Prolific’s food, setting up the future by winning the heart and mind of the public.

5. Zen and the art of company building

The process of company building is repeatable, and over time leads to repeatable outcomes. I learned it out of necessity at IndieBio and Mayfield has refined it to an art form. While getting heavily involved in company building isn’t scalable, it makes my work meaningful.

I read Zen and the Art of Motorcycle Maintenance when I was at Van Nuys High. It profoundly affected me though I didn’t know it at the time. The book is about quality. I recently re-read it. I realized it encapsulated the way I approach investing, and my life. The book explains quality is found in deep participation in our activities. It argues we should understand how a motorcycle is built, runs and is maintained for a quality experience with motorcycles. The same is true for company building. I want to deeply understand the technology of the companies I invest in. I draw pictures and diagrams until I can explain it back to the founders in my own words. I do this because I want to spend a lot of time with these founders and their missions. If I cannot understand the depths of deep technology companies, I couldn’t really help with go-to-market strategy, building business models, or explain to others what they do and why it matters. Diving into each company and helping with hiring, financing and personal growth is where I find quality and joy. This extends to VCs I work with. Po Bronson is the managing director of IndieBio and my friend. He found Prolific Machines, recognizing their potential, and wrote the first check. By diving into the science, he and Cooper came to understand where Prolific could go.

Prolific Machines is an example of the companies I want to invest in. My tombstone I call it. If you etch the companies I invested in on my tombstone and nothing else, that is the legacy I leave. For me, tombstone companies are solving a very specific problem that is holding back progress in a sector that is critical to society to solve. Like food, water, disease, suicide, pain and climate change. I take this very seriously. There are probably only thirty to forty spots left on my tombstone. And every company I invest in I will spend up to 5% of my life with. I meet Deniz weekly and join the all-hands. It helps to see around corners and participate. So money is not the rate limiting resource, it is time. This level of commitment is the same I ask of founders, and a mission worthy of history.

I am honored to be able to spend my time and resources to help the Prolific Machines team on their journey to create the next generation of bio-manufacturing assembly lines, prevent climate change, and one day make history by providing ubiquitous meats people love.